Still waiting for your piece of Idaho’s $500m rebate? Here’s how to check for your money

Earlier this year, Idahoans found out they’d be in line for at least $300 in tax rebates straight into their bank accounts to help relieve consumers from inflation.

Idaho lawmakers approved a bill proposed by Idaho Gov. Brad Little during a special session in September that would direct $500 million, a quarter of the state’s $2 billion tax surplus, back toward Idahoans via a nontaxable rebate.

The Idaho State Tax Commission began processing payments in late September, commission spokesperson Renee Eymann previously told the Idaho Statesman. Approximately 75,000 refunds were to be issued weekly, according to the commission’s website, and that would continue through early 2023 as taxpayers became eligible.

If you’ve yet to receive your rebate — or if you’re wondering whether you qualify — here’s how you can check how much you’ll receive and when you can expect to get it.

Who qualifies for the tax rebate?

Before you get too excited about additional spending money heading into Christmas, the rebate is only eligible to full-year residents in Idaho in 2020 and 2021 who filed a tax return or Form 24 for both years.

The Form 24 is a grocery credit reform fund for residents over the age of 65.

Nonresidents and part-year residents of Idaho during those two years are not eligible. To qualify, eligible residents must also file their tax return forms for 2021 by Dec. 31, 2022.

Active military members stationed in Idaho for 2020 and 2021 are also eligible for the rebate.

How much will I get?

Every eligible resident will get at least $300. Individual filers will be guaranteed $300 and joint filers $600.

Alternatively, some residents may qualify for a more significant rebate, depending on how much they paid on their 2020 tax return. Eligible residents will receive either 10% of the tax amount reported on their 2020 return or the flat $300 or $600, whichever number is greater.

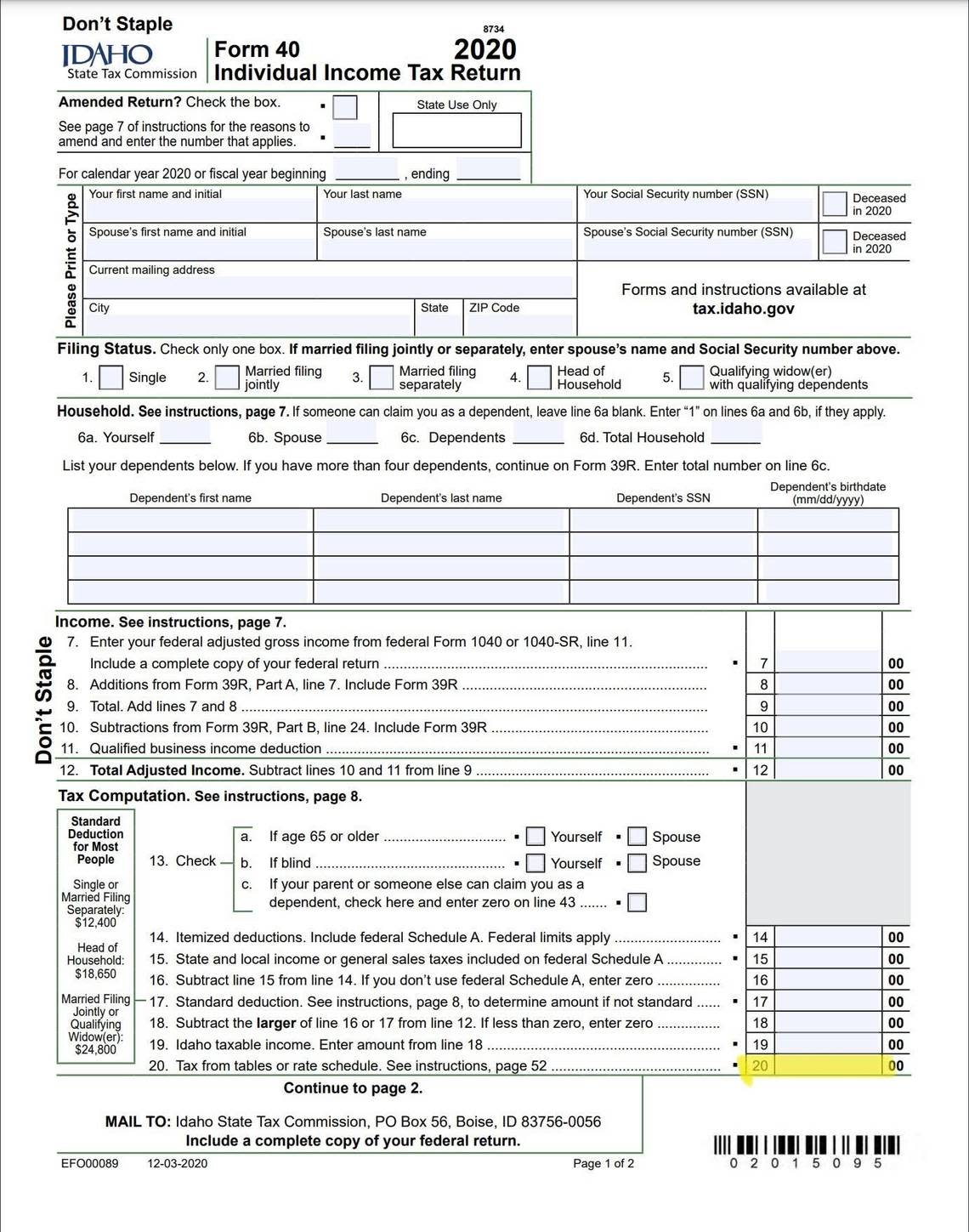

You can check the tax amount you reported on line 20 of your 2020 tax return, also called a Form 40. Service members will find their total on line 42 of their 2020 Form 43, which is for nonresidents with income sources from Idaho.

You can calculate 10% of 2020 taxes paid by taking the number on line 20 and multiplying it by 0.1. Alternatively, you can determine how much money you’ll get back on the online percentage calculator.

The state’s Tax Commission will also automatically deduct money from your rebate if you have any outstanding tax obligations, such as unpaid child support, unemployment overpayments and federal tax debts.

How can I check the status of my rebate?

You can check the status of your rebate using the State Tax Commission’s Where’s My Rebate tool. You can also call the commission at (208) 334-7660 or the toll-free number (800) 972-7660 to check your status with a representative.

In both instances, you will need to provide your Social Security number or Individual Taxpayer Identification Number and one of the following three pieces of identification: your Idaho driver’s license number, state-issued ID number, or 2021 Idaho income tax return.

Taxpayers who provided bank account information when filing their 2021 tax return will receive a direct deposit into their bank account. All other taxpayers will receive a check in the mail at their most recent address on file.

If you have moved since filing your 2021 tax return, you can request an update to your address at RebateAddressUpdate@tax.idaho.gov.

If you’ve filed your 2020 and 2021 tax returns and are yet to receive your rebate, Idaho’s Tax Commission says on its website that all income tax returns go through fraud detection reviews and accuracy checks.

The commission may send letters requesting more information from individuals or verifying their identity. The commission can only issue a rebate payment once these letters are responded to.