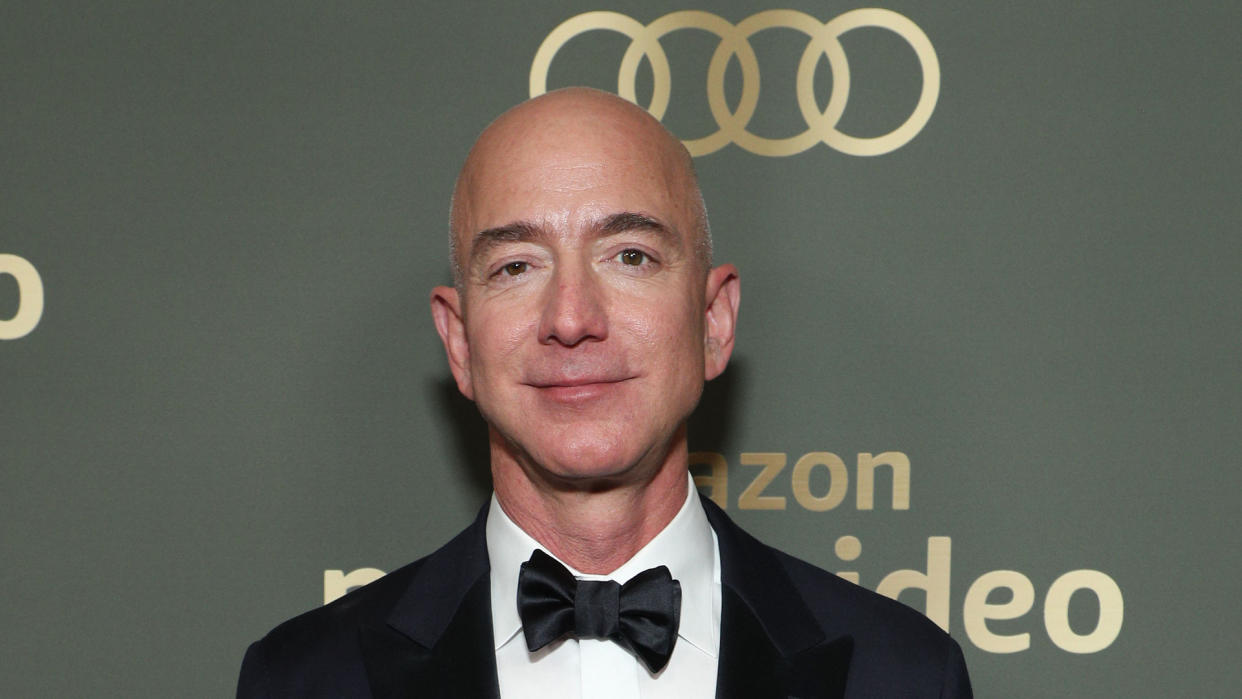

States Where Billionaires like Jeff Bezos Pay the Least Taxes

Jeff Bezos — the Amazon founder who is worth nearly $200 billion — recently moved from Seattle, Washington to Miami, Florida, and while Bezos said it was not about money, it just so happens that the move could save him $610 million in state taxes over the next few years, as reported by CNBC.

This is because in 2022 Washington State imposed a new 7% tax on the sale of more than $250,000 worth of stocks or bonds. That would cost Bezos millions in new taxes annually due to his longtime practice of selling billions of dollars of Amazon shares annually. But, when the new tax took effect, Bezos stopped selling shares and fled to Florida, which, coincidence or not, has no capital gains tax. And lo and behold, Bezos then filed a pre-scheduled stock-selling plan to sell 50 million shares before 2025, according to CNBC.

Florida is not unique in its catering to the very wealthy with a rich-friendly tax code, however it does have one of the most regressive tax policies in the nation, according to a recent study by Institute on Taxation and Economic Policy (ITEP). A regressive tax is one that is applied uniformly, regardless of income. The result is that the very wealthy will pay less, percentage-wise, than the very poor. According to ITEP’s analysis, “most states require low- and middle-income families to pay higher effective tax rates than the wealthy.”

In fact, their research shows that nationally, the lowest-income 20% of residents pay an 11.4% effective rate, while the wealthiest 1% enjoy an effective rate of just 7.2%. In this way, the report says, 44 of the nation’s tax systems actually exacerbate income inequality, which has been on the rise in recent years.

Based on this, here are five states where billionaires enjoy a better total tax burden than the poor, according to ITEP. This is based on total taxes paid as a percentage of income, which includes state and local sales and excise taxes, property taxes, personal income taxes, and other taxes.

South Dakota

Featuring open plains, Mount Rushmore, and no sales, inheritance or corporate taxes, South Dakota is a nice haven for billionaires.

Poorest 20% ($14,600 average annual income): 11.4%

Wealthiest 1% ($1,860,100 average annual income): 2.6%

Florida

Jeff Bezos’s new home tops the list of states with regressive tax policy. Perhaps that’s why billionaires like Donald Trump, Citadel hedge fund founder Kevin Griffin and many other billionaires call the sunshine state home.

Poorest 20% ($11,400 average annual income): 13.2%

Wealthiest 1% ($3,267,400 average annual income): 2.7%

Nevada

With no tax on estates or inheritances, no personal income tax, along with other perks for the uber-rich, the country’s gambling capital is a winner for billionaires.

Poorest 20% ($14,700 average annual income): 11.9%

Wealthiest 1% ($2,434,500 average annual income): 2.8%

Tennessee

While Tennessee is better known as the home of Elvis’s Graceland and country music’s capitol Nashville, the state’s regressive tax system is a serenade to the mega-rich.

Poorest 20% ($12,600 average annual income): 12.8%

Wealthiest 1% ($2,018,200 average annual income): 3.8%

Texas

Everything’s bigger in Texas, right? Wrong. Billionaires will enjoy much smaller total tax burdens thanks to the nation’s seventh most regressive tax policy.

Poorest 20% ($12,600 average annual income): 12.8%

Wealthiest 1% ($2,658,800 average annual income): 4.6%

More From GOBankingRates

Why Florida's Retirees Are Fleeing -- And Where They're Going Instead

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

This article originally appeared on GOBankingRates.com: States Where Billionaires like Jeff Bezos Pay the Least Taxes