This State Has Zero Estate Taxes — How Bezos and 77 Other Billionaires Game the System

There’s no crime in moving to a state with a lower tax rate to avoid giving up more of your hard-earned income to the government. For instance, many retirees relocate to Tennessee because of the state’s moderate climate and no state income taxes.

Check Out: A Look at Tax Filing Options and Costs

Read Next: 5 Genius Things All Wealthy People Do With Their Money

Billionaires in the U.S. also use this tactic.

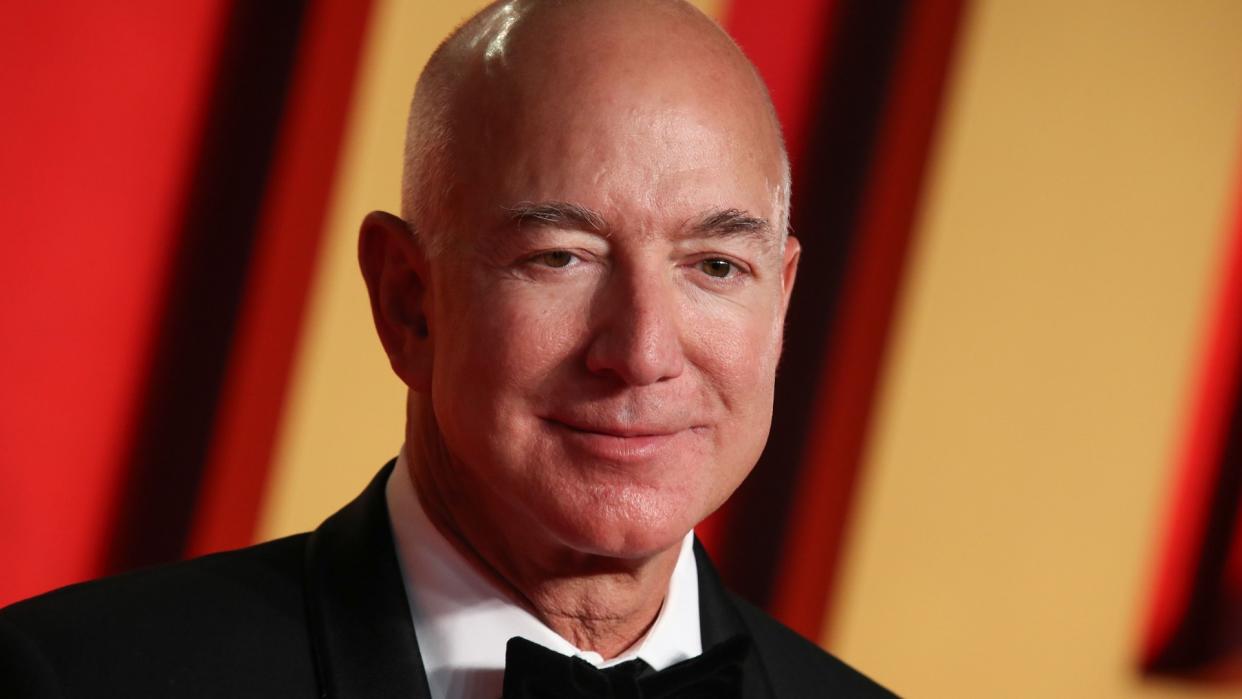

In fall of 2023, Jeff Bezos purchased two side-by-side mansions, with a total value of $147 million, on Florida’s Indian Creek Island, also known as Billionaire Bunker island, according to the NYPost.com. Bezos is one of 78 billionaires in the U.S. who reside in Florida, according to WorldPopulationReview.com.

Florida ranks third for billionaires behind California and New York, according to the website. But, apart from beautiful beaches and year-round sun, what attracts so many wealthy elites to The Sunshine State?

For Bezos, the answer seemed obvious. When he announced his decision on Instagram, the Amazon founder cited a love for Miami and, like many people of Bezos’ age, a desire to be closer to his aging parents.

Additionally, Bezos owns the aerospace company Blue Origins. Moving from Seattle to Miami puts him closer to the Space Coast, Cape Canaveral and Kennedy Space Center, where many launches take place.

The move kicked off speculation that the second richest man in the world, currently with a net worth of $197.7 billion, according to Forbes’ Real Time Billionaires list, had other motives for moving.

Florida has no estate tax and no capital gains tax. By comparison, Bezos’ former home of Seattle, Washington, enforces an estate tax ranging from 10% to 20% for estates worth $2.19 million or more. Plus, it has a 7% capital gains tax on earnings that exceed $250,000.

Most working class and middle-class Americans don’t have to worry about avoiding taxes on income over $2.19 million or $250,000. For millionaires and billionaires, Florida is obviously a better financial move than Washington or other high-tax states.

In a Bloomberg opinion piece, columnist Jonathan Levin pointed out that Bezos has sold down billions in Amazon stock. “Bezos didn’t mention taxes explicitly, but the math must have crossed his mind,” Levin wrote.

Are U.S. billionaires really moving to preserve generational wealth and avoid capital gains tax? It’s possible. Levin also argued in his column, “I think this focus on taxes and billionaire ‘tax flight’ is often misguided and dangerous.”

Levin pointed out that personal factors and local networks frequently come into play when wealthy people decide where to live. “The uber-rich have far more money than they could ever spend, so they can afford to simply live in the places that make them happiest,” he wrote.

Learn More: Stimulus 2024: IRS Commits To Sending Child Tax Credit Refunds ‘Promptly’ — What To Know

It’s entirely possible that Bezos and other billionaires are flocking to Florida for the same reason as many older adults — for the sun, sand and crystal-clear waters, golf courses and plenty of activities. But the tax breaks for America’s wealthiest definitely won’t hurt their bottom line.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: This State Has Zero Estate Taxes — How Bezos and 77 Other Billionaires Game the System