'My son makes over $100K/year and still lives at home': TikToker runs the math, finds college grads now spend the same percentage of income on rent as workers earning $3.10/hour did in 1980

Orlando Realtor Freddie Smith is tired of hearing older Americans compare the challenges they once faced to the dual cost-of-living and housing crises today’s young adults are now contending with.

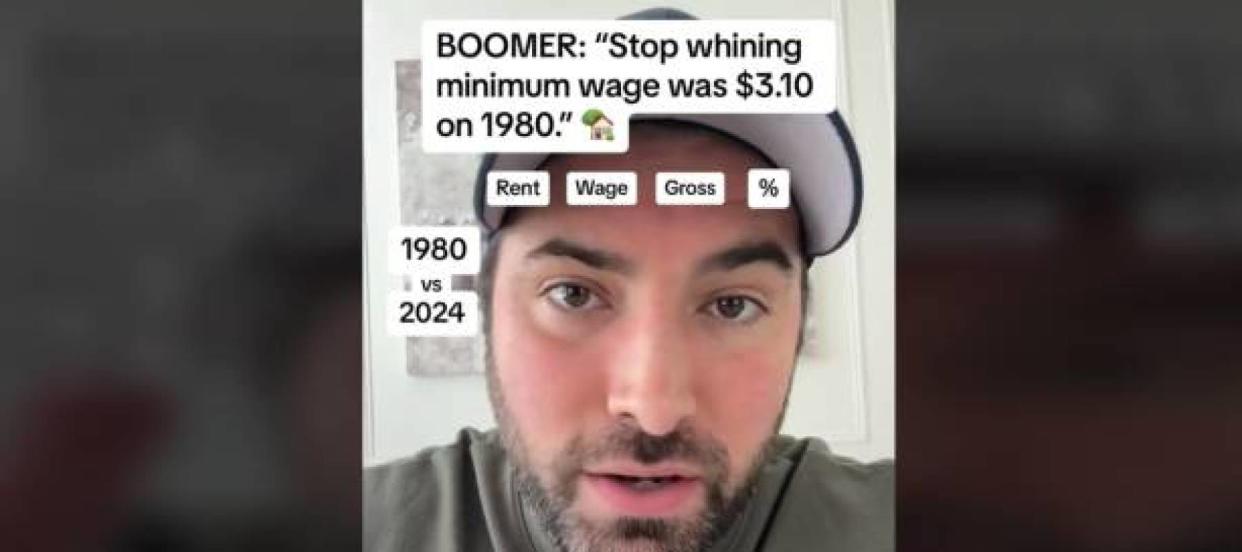

Smith informs viewers that anyone who accuses millennials of “whining” about how hard it is to get ahead in 2024 by suggesting that even workers earning $3.10/hour back in the 1980s were able to buy homes and live “comfortably” is simply comparing apples to oranges. What they fail to factor in, he argues, is how much the cost of living has skyrocketed in the decades since.

Don’t miss

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

Don't let high car insurance rates drain your bank account — find how you can pay as little as $29 a month

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

“The millennials and Gen Zers who are complaining that they can’t buy a house are not working minimum wage,” he says. “These are people making $60,000, $70,000, $80,000 … $90,000 a year who can no longer afford a house.”

In fact, many young Americans continue to lean on their parents — even as they’re earning those once-respectable salaries and the older generation is either winding down their careers or already settling into retirement. A Pew Centre survey from earlier this year revealed that 44% of young adults say their parents had given them financial help in the past year. As for the parents who helped their kids with money, 36% of those Pew surveyed say doing so hurt their own financial situation — especially for parents with lower incomes.

So what’s really going on? In a viral TikTok video, Smith did some math to figure out why that seemingly decent salary doesn’t seem to afford a comfortable lifestyle — and he came across some thought-provoking results.

Smith’s findings

Smith did some quick math and calculated that college graduates in 2024 spend the same percentage of their earnings on rent as minimum wage workers did back in 1980 — despite seemingly having a much greater earning potential with their college degree.

In the video, he runs through his math for viewers. The median monthly rent in 1980 was $243, while minimum wage workers made $3.10/hour. Assuming they worked a 40-hour week, their monthly earnings would come in at $496. This means that 48.9% of a minimum wage worker’s income would go toward rent.

As for now, Smith puts the current median monthly rent at $1,747 (he’s not far off, but it’s closer to $1,712, according to Realtor.com’s most recent numbers). A college grad makes an average of $24 per hour, meaning they earn $3,840 per month, according to statistics from the job site ZipRecruiter. This means that a typical college grad today must use up 45.4% of their salary on rent.

Read more: Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Parents feel the pain

On the surface, you might think that those who came of age back in the days of big hair and neon would be unsympathetic to the younger generation’s financial woes. Though millennials have seen three recessions in their lifetime, young adults in the 1980s had their share of trouble, living through two recessions in a three-year period.

And if you think 2022’s inflation rate 40-year high of 9.1% was steep, imagine a trip to the grocery store in 1980 when inflation was 14%. Meanwhile, interest rates hit an all-time high of 19.10% in June 1981, according to the historical numbers from the Federal Reserve.

But, in fact, many parents empathize with the challenge their kids face in making their way in the world. One Gen X mom even took to TikTok to voice how hard it is for her to watch her adult children struggle.

As she watches her kids struggle to buy homes and set themselves up financially, this mom can’t help but think back to her 20s, when she says she could support herself by working for less than $10 per hour.

“We struggled but we knew there was light at the end of the tunnel,” she says. “Now, you need to be making a six-figure salary to get a decent, tiny place to live.”

The irony that the people who were working minimum wage jobs in the ‘80s are now the ones housing the college-educated youngsters who can’t afford to rent wasn’t lost on commenters on Smith’s video.

As one commenter put it: “My son makes over 100k a year and still lives at home. It’s wild.”

At the end of the day, a lot may have changed from the ‘80s, but what’s abundantly clear is that financial struggles never seem to go out of fashion.

What to read next

Can I collect my dead spouse's Social Security and my own at the same time? Here are 5 secrets of 'survivors benefits' you need to know

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Millions of Americans are in massive debt in the face of rising costs. Here's how to get your head above water ASAP

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.