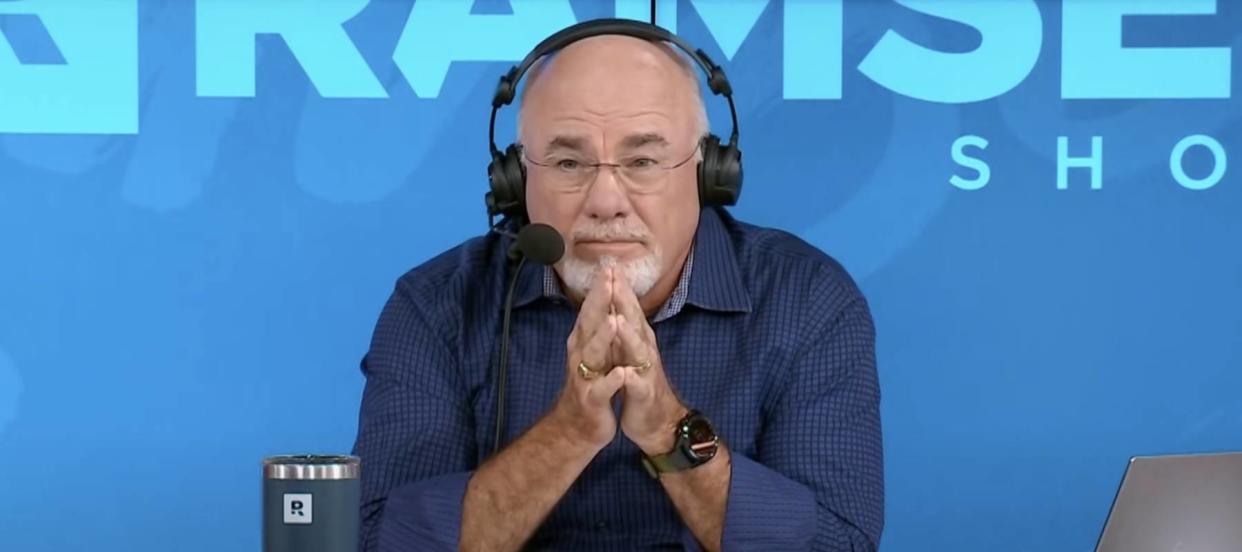

‘Are you smarter than Warren Buffett?’: LA man attacks David Ramsey for recommending actively managed funds, forcing him to explain his 'arrogant' stance

A debate of active versus passive investing arose on an episode of “The Ramsey Show” when a caller accused host David Ramsey of misguiding investors. Chris from Los Angeles, California wasn’t pleased with Ramsey recommending actively managed mutual funds.

Seemingly uninterested in being civil, the 35-year-old began the conversation by saying he finds the financial expert “stupid and arrogant” in some ways.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

He said, “My first question would be, ‘Are you smarter than Warren Buffett?' You push people into actively managed funds when over time if you push people into an index fund they would have about 50% more money when they [retire].”

Regardless of his tone, Chris’ thesis is backed up by some data.

Active versus passive

Billioknaire investor Warren Buffett has been a vocal advocate for passive investment strategies. He has previously recommended low-cost index funds for average investors and said that 90% of his wife’s inheritance will be deployed in such funds when he passes.

Studies indicate that over long periods, actively managed funds tend to underperform low-cost passive funds that simply track broad indexes. According to the S&P Dow Jones Indices’ scorecard, only 12.02% of all U.S. large-cap actively managed funds outperformed the S&P 500 benchmark index over the 15 years up to the end of 2023.

Read more: 'Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

However, many investors believe they can spot those rare mutual funds that will outperform the index over extended timelines. Ramsey apparently counts himself as one of them.

He conceded that index funds are "wonderful" but rejected Chris' claim that an investor would earn 50% more in an index fund than actively managed funds, "unless you're an absolute idiot" in picking active funds.

Chris argued that even when actively managed funds outperform index funds, the higher costs associated with active management lower your returns by 2%.

“The actively-managed mutual funds that I personally have picked have outperformed the indexes by more than 2% as a portfolio,” Ramsey responded to this. “Because it’s fairly easy to study mutual funds and pick [ones] that outperform. But if you're not going to study them, and you're not going to have a good advisor in your corner, then using the index funds is a great idea.”

Ramsey pointed to his team’s survey of wealthy individuals, which he claims is the “largest study of millionaires.” He said it showed that the large majority became wealthy without large inheritances and "almost all" did it with actively-managed funds in their 401(k)s. He also pointed out that Buffett himself made his enormous fortune through active investing.

Buffett himself is active

Buffett has been actively investing in stocks and private companies for several decades through his investment vehicle, Berkshire Hathaway. In fact, he purchased his first stock at age 11.

Ramsey says Buffett doesn’t practice what he teaches.

However, the key argument for passive investing is based on skill and fees. Unlike Ramsey, Buffett doesn’t invest in mutual funds but buys stocks directly, which circumvents the expensive fees of money managers. “As Gordon Gekko might have put it: ‘Fees never sleep.’” Buffett once wrote. "When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds."

Even a tiny 2% fee can significantly impact the amount of money an average investor accumulates over time. Buffett’s direct approach avoids this cost. But Buffett is a professional investor with decades devoted solely to investing. His chances of beating the market are dramatically higher than that of amateur investors.

This is why passive investing has become more popular in recent years. In 2023, assets managed by passive index funds officially overtook active funds, according to data published by Morningstar.

What to read next

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.