Single Parents’ Best Tips on How to Stretch a Dollar

Single parents have a hefty lift when it comes to caring for children, responsible not only for their emotional and physical well-being, but often for their financial needs too. And there are more single-parent homes than ever before: In 2020, 19 million children, a quarter of children in the U.S., lived in single-parent households, the highest rate in the world. Being a sole provider takes planning and savvy spending, so we asked a few single parents to share their best tips on how to stretch a dollar — remembering that when it comes down to it, “kids need healthy food, a safe home, love, and relatively clean clothes,” says Emma Johnson, a Richmond, Virginia–based mother of two who blogs at Wealthy Single Mommy. “Don't get sucked into the cultural and marketing mania that encourages parents to spend beyond their means.”

Related: Great Gifts for New Parents

Single parents may get or pay child or spousal support. These payments may be a help — or may become a hindrance. “Be careful about putting energy into how much money you can get from your ex in terms of child support — or being angry about how much you have to pay,” Johnson says. “Instead, focus on what you can control: your own financial independence and growing your own career and income.”

Related: Strategies from Experts on How to Make Divorce Work

Planning how you’re going to spend will help you live within your means. Before you impose a budget, though, it’s important to understand where your money is going now. Track your real-world spending, from mortgage or rent payment to that $5 you sent with your youngest to buy a snack on field trip day. “Budgets are not bad. They help you give each dollar a job,” says Kim Williams, an Arizona-based mom of one daughter who blogs at Single Black Motherhood.

Related:22 Ways to Get Help Paying or Lowering Your Monthly Bills

Make sure you stay in a position where you can keep helping everyone. “Pay yourself first and make it non-negotiable. No matter how much you make, you have to commit to saving for the future,” says Nakisha Wynn, a Florida entrepreneur and mother of four. Saving can be easier when you make automatic payments to a designated account. “Have that amount taken directly from your payroll check and deposited into a separate high-yield savings account,” Wynn says. “When you don't see the money, you won't touch it. Many banks occasionally offer bonuses to open an account. Take the bonus and save that, too.”

For more great money-saving tips, please sign up for our free newsletters.

There are programs out there to help single parents. Many have been gathered on the Financial Help for Single Mothers website and on the Single Mother Guide, which both include grants that can help on everything from education to child care support.

Many cities and states have a child care assistance program run by a local department of health or human services, usually specifically for lower-income working people with young children. Start your research at childcare.gov.

For one-off child-care needs, whether it’s a self-care night away or a parent night at school, recruit family or friends to provide free child care. If need be, trade a chore — such as yard work or cleaning for the help. Or find other parents who also need this type of help and trade off child care sessions.

Experts recommend creating an emergency fund to insulate yourself and your kids against unexpected expenses. The usual recommendation to keep enough money to cover three to six months of expenses might seem daunting to single parents, though. Williams suggests starting small. “Even if you can only save $5 every time you get paid, it is something. Small steps matter,” she says.

Related: Painless Ways to Grow Your Emergency Fund

Many single parents are coupon aficionados; they clip and scan their ways into saving a buck or big bucks. Johnson advises to focus instead on shopping less. “A house full of discounted food, clothes, and products is still money spent. Instead, just stop shopping for anything but the necessities,” she says.

Low-cost items may be tempting but, for some things, buying cheap can cost more in the long run as you replace quickly worn-out items. Wynn suggests buying quality items that can be handed down, but buying them off-season when they’re on sale.

If you have jewelry you don’t wear or enjoy, sell it, Johnson says. (Your wedding and engagement rings could be included for consideration.) “Diamond and gold prices are high, and money in hand is the best economic strategy!” she says. She recommends finding an online gold buyer with an A-plus rating from the Better Business Bureau — in her experience, they pay more than other buyers.

Related: Easy Money: Secrets for Selling Stuff on Craigslist, eBay, and Facebook

Single parents agree the keys to saving on grocery bills are taking stock of what you already have in the pantry and fridge, and meal planning. With this preparation, your grocery list will include only necessities. Williams also recommends ordering items online for pickup, so you’re not tempted to buy extra items while browsing inside. “It helps you stick to your grocery budget, save time you would've spent shopping in store, and some stores even have digital coupons that help you save,” she says.

A simple online search will turn up free activities in your area. Mom blogs are also treasure troves of free activities, Williams says. Libraries and museums often offer free programs for children that will help you save.

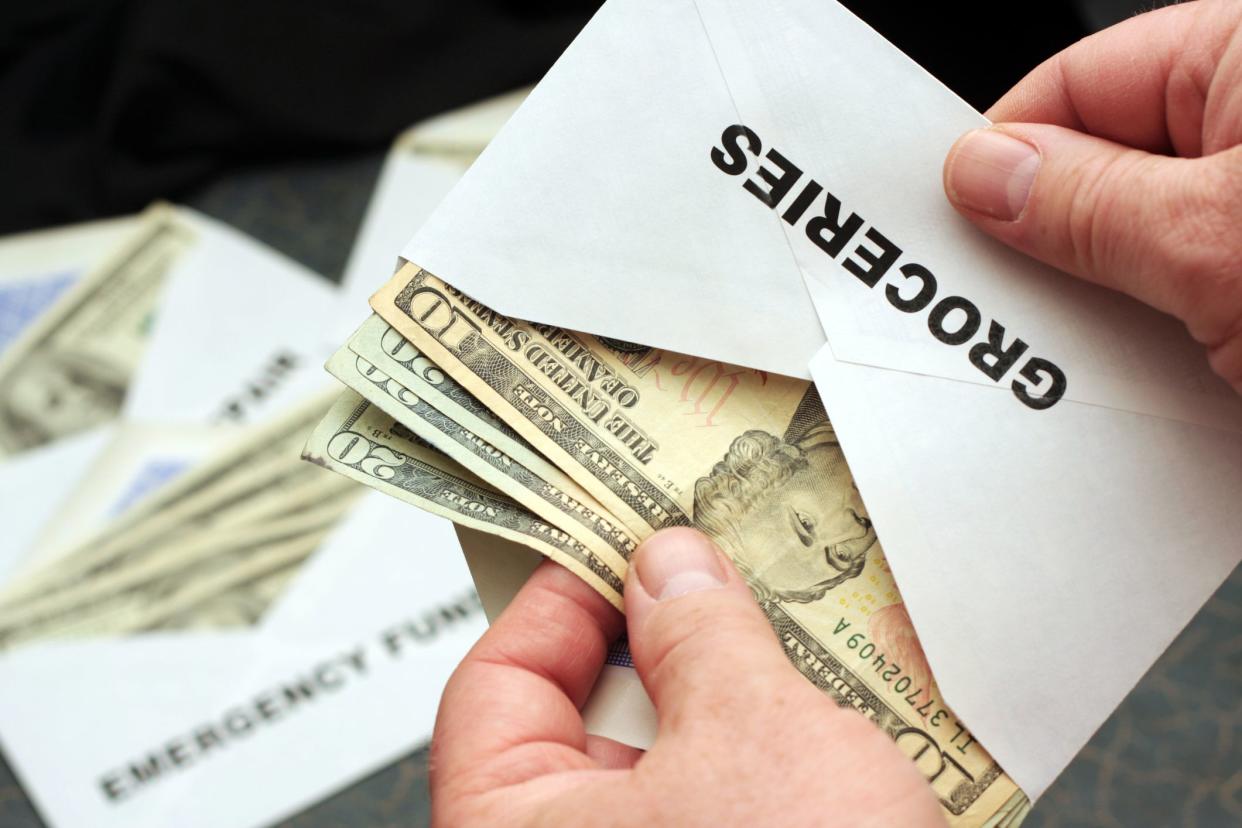

Charging a purchase to a debit card — or even more so, a credit card — might mask where your money is going. It activates the swipe-it-and-forget-it syndrome. Instead, start using cash as often as you can, which makes you aware of spending in a way using a card doesn’t. Plus, you can save your change, Williams says. “At the end of the year, take your change to a Coinstar and you can cash in your coins for a gift card with no fees. The money can be easily used for Christmas gifts or to purchase essentials,” she says. You may want to consider the envelope budget system, which prescribes putting cash for each spending area in a separate envelope.

If you do use a credit card, opt for one with cash-back rewards. “Pair those credit card purchases with a cashback app that will also pay you for your purchases and get double the money in return,” she says. “Use the cashback you’ve earned throughout the year for back-to-school, Christmas, summer camp, etc.” (Just be sure to pay your card off in full each month so you don’t accumulate debt.)

If times are tough, tap into grants available to low-income people whether they are single parents or not. Grants are available for Emergency Rental Assistance, Emergency Solutions Grants to help families regain their footing after experiencing a housing crisis, and utilities through the Low Income Home Energy Assistance Program.

Related: Energy Assistance Programs in Every State

Don’t leave money on the table by failing to get a tax refund. Single parents may be eligible for the Advance Child Tax Credit, Earned Income Tax Credit, or Child and Dependent Care Credit, all of which could increase your return.

When you’re the sole breadwinner, Johnson says there’s nothing to be lost and much to be gained by negotiating a pay raise to bring home more dough. With the great resignation still underway, the time is never better to make your case that you’re worth a raise.

Related: Ways Women Can Rescue Their Retirement

Sometimes a single job or income stream isn’t enough. In that case, the single parents recommend adding a revenue stream or side gigs. “As a single mom, it's imperative to have multiple streams of income,” Wynn says. “Consider your interests, talents, education, and experience, then research ideas that align with that. Choose something you can do without committing to more time away from your family. Freelancing, an online business, and content creation are great options.” If you’re diving into new revenue streams, Johnson suggests starting small: “Don't expect success right away. I see people bragging about having seven revenue streams but don't have any money! Try just one gig at a time, then scale that before starting another venture.”

Related: Side Hustles and Other Smart Ways to Get Through a Recession