'She gets none of your money': This Tacoma mom told her daughter she'd pay for her college tuition at a school near home — but Dave Ramsey says it's time to cut her off. Here's why

Kinzi from Tacoma, Wash., faces an extremely common dilemma — her kids won’t listen to her.

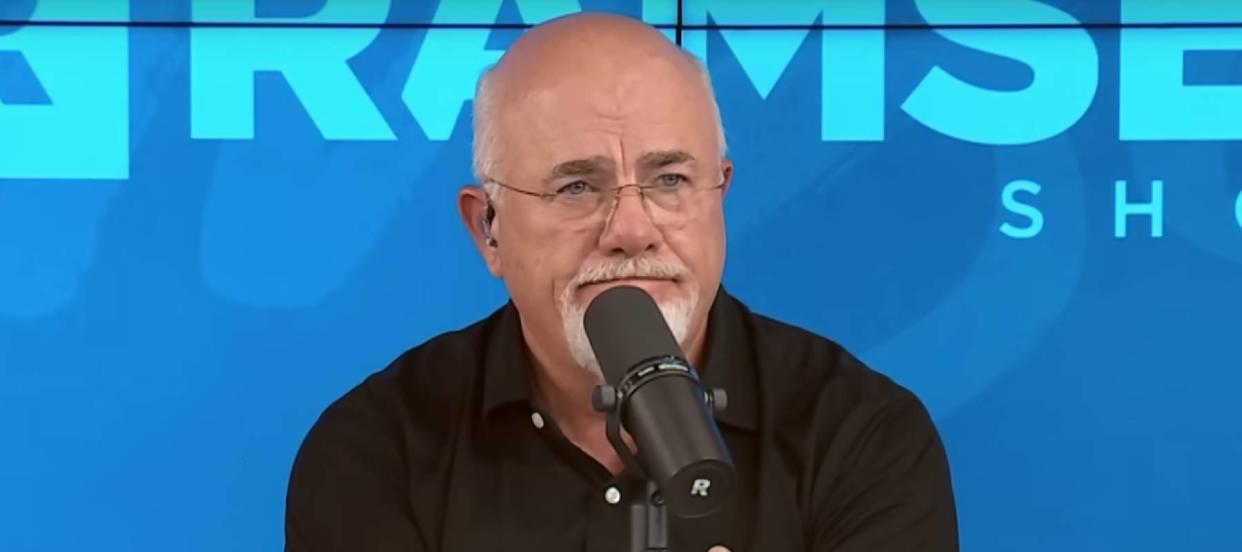

The mother of three recently called into Dave Ramsey’s show to get his advice on how to get them to see reason. She wants to save her daughters from student debt, but after years of struggling with her own financial woes has had to set some clear boundaries around how that will work. Those include living at home and going to a school their parents sign off on.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Find out how to save up to $820 annually on car insurance and get the best rates possible

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

But one of her daughters isn’t happy with those rules and wants her parents to bankroll her life on campus at a state school six hours away.

Finance personality Dave Ramsey had clear advice: “She gets none of your money. None of your money”

Ramsey wants her to stand her ground, but with the rising cost of living, education and food, Kinzi worries about the cost of deploying this tough-love strategy.

College tuition crisis

There’s no denying it, going to college is massively expensive — and it’s only getting worse. From 2010 to 2022, the cost of college tuition rose 12% on average annually, according to the Education Data Initiative. On average, going to a public college for a four-year program is 23 times more expensive than it was in 1963.

Higher fees have compelled students to rely on either student loans (which is now a $1.7-trillion crisis) or their parents. Family income and savings account for roughly half the source of payment for college costs in academic year 2022-23, according to data published by Sallie Mae.

Kinzi’s daughters are aged 17, 19 and 21. One has already moved out and thus isn’t receiving support from her parents anymore. “I don’t pay for other people’s rent,” she told Ramsey and his co-host John Delony, explaining the reasoning behind her rules around supporting her girls through college.

“There are so many colleges within 20 minutes of our home that there is no reason for you to not live at home.”

But that hasn’t changed her youngest’s mind about wanting to go away for school. Besides the cost of living on campus, she would also need to pay for a food program that Kinzi says could cost “$2,500 to $4,000 a year.”

Read more: Owning real estate for passive income is one of the biggest myths in investing — but here's how you can actually make it work

Tough love

Ramsey says her daughter is free to make her own choice — but Kinzi isn’t obligated to pay for it.

“It’s very simple, she’s opting out of your rule,” says Delony.

“She gets none of your money,” Ramsey agrees. “She opted out.”

In fact, Ramsey doesn’t want her to pay for groceries or co-sign any student loans either — but he encourages her to speak with her husband to ensure they’re on the same page before laying down the law. This will help them present a united front and push back on their daughter’s demands.

Kinzi’s daughter can still choose to go to college away from home, Ramsey insists, but must finance it all herself. “It’s really heart-breaking to watch people you love do stupid-butt things,” he says, referring to taking on thousands of dollars of debt for school. “But you don’t get to vote anymore once they’re adults.”

Many Americans seem to agree with Ramsey’s sentiment. On average, they say a child should be financially responsible for car payments and credit card bills by the age of 20 and for student loans by the age of 23, according to a survey by Bankrate.

However, the same survey also found a gap between what parents expect and what they actually do. A whopping 68% of parents with adult children have made or are currently making financial sacrifices to support them, results from the same Bankrate survey show.

So while it might be hard to stand by and watch, Kinzi letting her daughter make her own decisions around her future might be an education for them both.

What to read next

You can cash in on prime real estate for as little as $20. Here’s how.

Millions of Americans are in massive debt in the face of rising rates. Here's how to get your head above water ASAP

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.