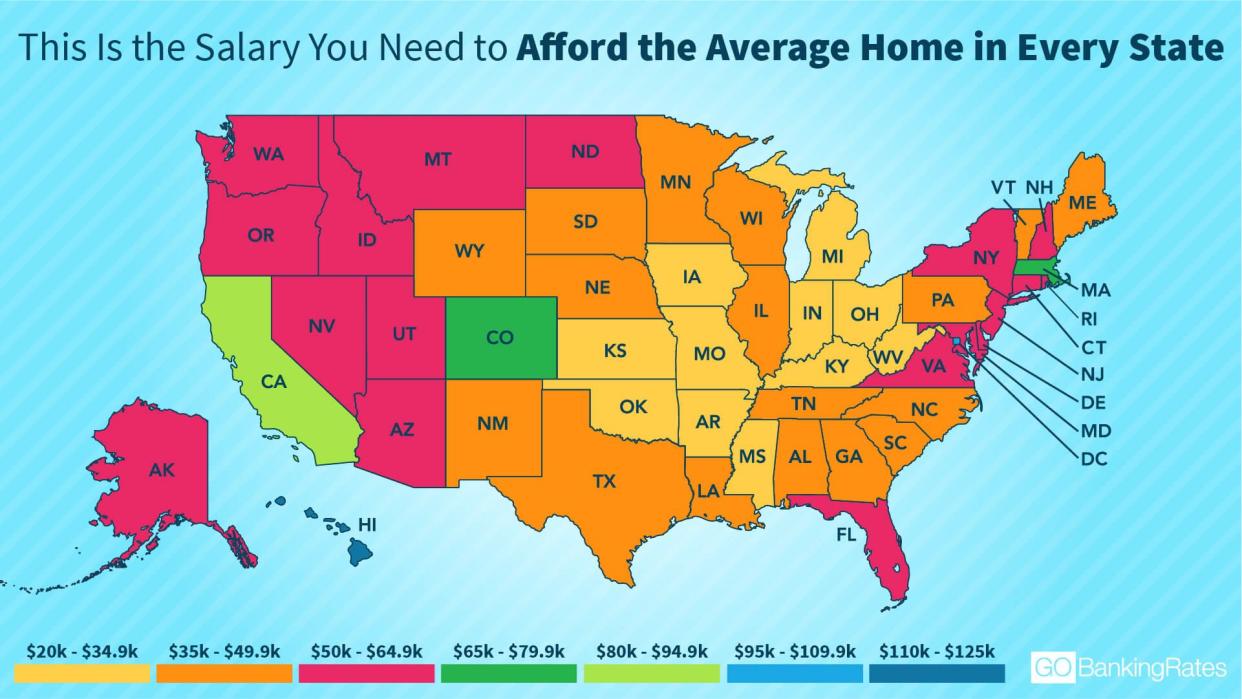

This Is the Salary You Need To Afford the Average Home in Your State

Before you buy a home, it's important to find out if you can afford the monthly mortgage payment.

Read: Tips To Get Your Mortgage Payments as Low as Possible

See: 32 Insider Tips for Buying and Selling a House

To do this, some financial experts recommend your housing costs -- primarily your mortgage payments -- shouldn't consume more than 30% of your monthly income. With this rule of thumb in mind, GOBankingRates looked at home prices and mortgage rates in every state and estimated the minimum salary needed to afford the average home.

Last updated: June 18, 2021

Alabama: $36,760

Monthly mortgage payment: $919

Monthly income needed: $3,063.33

Alabamians enjoy a lower cost of living, with home prices well below the national average. In fact, another GOBankingRates study found Alabama is one of the few states where it costs about the same to own or rent a home.

See: The Salary You Need To Afford Rent in Every State

Alaska: $51,320

Monthly mortgage payment: $1,283

Monthly income needed: $4,276.67

Alaska is one of the most expensive places to live, typically 40% above the national average.

Afford More Rent: 10 Best Lucrative Side Business Ideas

Arizona: $50,880

Monthly mortgage payment: $1,272

Monthly income needed: $4,240

An earlier GOBankingRates study found Arizona to be one of the popular states for millennial homebuyers because of its affordable home values. The average salary required to purchase a home is not among the lowest, however.

Arkansas: $31,320

Monthly mortgage payment: $783

Monthly income needed: $2,610

If you want to stretch your home-buying dollar, Arkansas is a great place to do it, another GOBankingRates study indicates.

Read: Best States To Buy a $300K House

California: $89,280

Monthly mortgage payment: $2,232

Monthly income needed: $7,440

California is one of the most expensive places to buy a home, with Zillow predicting home prices will increase even more. The average home price in the state is $495,000.

Learn: How Real Estate in California Differs From Every Other State

Colorado: $73,600

Monthly mortgage payment: $1,840

Monthly income needed: $61,333.33

Colorado is the fifth most expensive place to purchase a home, found a separate GOBankingRates study, and requires one of the highest average salaries. The average home price is $405,000.

Connecticut: $55,360

Monthly mortgage payment: $1,384

Monthly income needed: $4,613.33

Although the cost of homes in Connecticut is above average, it's one of the best states for first-time home buyers.

Delaware: $51,040

Monthly mortgage payment: $1,276

Monthly income needed: $4,253.33

Delaware housing prices are slightly more affordable than bordering states. The average home price in the state is $275,000.

Check Out: Tax Breaks Every First-Time Homebuyer Should Know About

District of Columbia: $97,280

Monthly mortgage payment: $2,432

Monthly income needed: $8,106.67

Housing costs in D.C. are 134.6% more in the nation's capital than any state in the country, found a separate study. The average home price is over a half million dollars -- $535,000 to be exact.

Florida: $52,640

Monthly mortgage payment: $1,316

Monthly income needed: $4,386.67

Florida is one of the best states to retire rich. The average home price is $285,000 in the Sunshine State.

Georgia: $44,760

Monthly mortgage payment: $1,119

Monthly income needed: $3,730

Georgia offers some of the most affordable housing in the country. The average home price is just $239,000.

Hawaii: $110,520

Monthly mortgage payment: $2,763

Monthly income needed: $9,210

Hawaii requires the highest annual salary to own a home. However, Hawaii is also one of the states where people are making more money compared to residents in other states.

Idaho: $51,560

Monthly mortgage payment: $1,289

Monthly income needed: $4,296.67

Idaho has one of the more modest average rates on 30-year fixed mortgages at 4.33 percent. In comparison, the highest rate -- 4.38% APR -- is in Vermont and West Virginia.

Illinois: $37,840

Monthly mortgage payment: $946

Monthly income needed: $3,153.33

The average cost of purchasing a home in Illinois is much less than average, making it one of the cheapest places to live.

Indiana: $31,320

Monthly mortgage payment: $783

Monthly income needed: $2,610

Indiana is one of the best places to buy a home, with the minimum salary to buy a house at just $31,320.

Iowa: $32,400

Monthly mortgage payment: $810

Monthly income needed: $2,700

Iowa also is one of the cheapest places to purchase a home, with a median list price of only $169,000. That's why the salary needed to own a home is only $32,400.

Kansas: $31,760

Monthly mortgage payment: $794

Monthly income needed: $2,646.67

Kansas requires one of the lowest average salaries for purchasing a home, and the average mortgage payment in the state is under $800.

Kentucky: $32,600

Monthly mortgage payment: $815

Monthly income needed: $2,716.67

Kentucky ranks among the most affordable places to live. The salary needed to buy a house is just $32,600.

Louisiana: $38,080

Monthly mortgage payment: $952

Monthly income needed: $3,173.33

Your dollars will stretch further in Louisiana -- it's one of the states where you're least likely to live paycheck to paycheck, partially thanks to lower housing costs.

Maine: $42,320

Monthly mortgage payment: $1,058

Monthly income needed: $3,526.67

Housing costs are a little more for those living in Maine. According to another GOBankingRates study, housing is generally 21.9% higher in the Pine Tree State.

Maryland: $54,920

Monthly mortgage payment: $1,373

Monthly income needed: $4,576.67

Over the last year, home values have risen slowly in Maryland. The median home price is just shy of $300,000, but where you choose to buy in the state is key to what you'll pay.

Massachusetts: $75,360

Monthly mortgage payment: $1,884

Monthly income needed: $6,280

When comparing the average home price by state, Massachusetts ranks among the highest in the country. The median list price is $415,000, according to the study.

Michigan: $30,680

Monthly mortgage payment: $767

Monthly income needed: $2,556.67

Michigan has the third-lowest annual salary needed. And its typical mortgage payments are well below average.

Minnesota: $46,720

Monthly mortgage payment: $1,168

Monthly income needed: $3,893.33

In Minnesota, the minimum salary needed to buy a home is less than $50,000. However, the median home value is expected to rise nearly 4% within the next year -- which could mean the minimum salary needed to own a home might increase.

Mississippi: $33,120

Monthly mortgage payment: $828

Monthly income needed: $2,760

Mississippi is among the most affordable states to own a home with mortgage payments that are well below average.

Missouri: $31,800

Monthly mortgage payment: $795

Monthly income needed: $2,650

Home-buying dollars also go far in Missouri, where the average income required is only $31,800. The median price of a home is $165,000.

The Opposite: States Where You're Most Likely To Live Paycheck to Paycheck

Montana: $55,640

Monthly mortgage payment: $1,391

Monthly income needed: $4,636.67

Although not the costliest place to live, Montana does require a bit more than some of its bordering states. The median home price in the state is $299,999.

Nebraska: $37,040

Monthly mortgage payment: $926

Monthly income needed: $3,086.67

Nebraska housing prices are among the best in the country. The median home price is only $195,000.

Nevada: $55,680

Monthly mortgage payment: $1,392

Monthly income needed: $4,640

Home prices in Nevada have risen steadily in the last few years. Nevada is also one of the states being hit hard by the foreclosure crisis, according to another GOBankingRates study.

New Hampshire: $51,720

Monthly mortgage payment: $1,293

Monthly income needed: $4,310

It costs a little more in New Hampshire to afford the average home, although another GOBankingRates study found the state to be one of the best places in the country to live a richer life.

New Jersey: $51,720

Monthly mortgage payment: $1,293

Monthly income needed: $4,310

The median home list price in New Jersey has fallen over the last couple of months. At the time of the study, it was $279,900 -- nearly $20,000 less than the median price in November 2017.

New Mexico: $40,960

Monthly mortgage payment: $1,024

Monthly income needed: $3,413.33

The average salary to afford a home in New Mexico is lower than in more than half the states.

New York: $63,360

Monthly mortgage payment: $1,584

Monthly income needed: $5,280

Your home-buying money won't go in New York, as the annual salary required to own a home in the state is $63,360. As for the median home price, you'll spend about $345,000.

North Carolina: $46,600

Monthly mortgage payment: $1,165

Monthly income needed: $3,883.33

In North Carolina, home values have grown 6.6% over the past year, according to Zillow. And, it predicts values will continue to grow over 3% within the next year.

North Dakota: $54,480

Monthly mortgage payment: $1,362

Monthly income needed: $4,540

You'll typically need a salary of at least $54,480 to afford the average home in North Dakota.

Ohio: $28,800

Monthly mortgage payment: $720

Monthly income needed: $2,400

Ohio residents enjoy a low cost of living. You can own a typical home there on a $28,800 salary. That means the average home costs just under $150,000.

Oklahoma: $33,640

Monthly mortgage payment: $841

Monthly income needed: $2,803.33

Although not as cheap as Ohio, Oklahoma is still an affordable state to live. You'll only need a salary of $33,640 to own the average home in the state.

Oregon: $64,040

Monthly mortgage payment: $1,601

Monthly income needed: $5,336.67

You'll need to make a little more in Oregon to afford the average home, as it's one of the costliest states to live.

Pennsylvania: $35,760

Monthly mortgage payment: $894

Monthly income needed: $2,980

Pennsylvania is middle ground in terms of pricing and affordability when compared to other states. You can own a home, however, on a $35,760 income.

Rhode Island: $51,960

Monthly mortgage payment: $1,299

Monthly income needed: $4,330

The median home price in Rhode Island is $280,000. That's a little more expensive than the national average, requiring homebuyers in the state to make a bit more.

South Carolina: $44,800

Monthly mortgage payment: $1,120

Monthly income needed: $3,733.33

In the Palmetto State, the average salary needed to own a home is $44,800.

South Dakota: $40,880

Monthly mortgage payment: $1,022

Monthly income needed: $3,406.67

The average home has a mortgage payment of $1,022 in South Dakota, which is still on the low end. If you want to purchase a home as an investment property, do so in Rapid City, where the rental income potential is over $15,000 per year, found a separate GOBankingRates study.

Tennessee: $42,280

Monthly mortgage payment: $1,057

Monthly income needed: $3,523.33

Expect to pay more in Nashville to purchase the average home.

Time for a Move: 8 Startling Facts That Blindside Homebuyers

Texas: $49,840

Monthly mortgage payment: $1,246

Monthly income needed: $4,153.33

You can make less than $50,000 and still be able to afford a home, found this study.

Utah: $61,840

Monthly mortgage payment: $1,546

Monthly income needed: $5,153.33

The median home list price in Utah is $337,500, which is on the higher end compared to other states. As a result, you'll need to make a minimum of nearly $62,000 to afford the typical home.

Vermont: $49,960

Monthly mortgage payment: $1,174

Monthly income needed: $3,913.33

Vermont can be a cheap alternative to other New England states. Home prices, however, have risen over the past few years.

Virginia: $53,400

Monthly mortgage payment: $1,335

Monthly income needed: $4,450

Virginia can be an affordable place to purchase a home, but you'll need to make more than $50,000 to afford the mortgage payments.

Washington: $64,200

Monthly mortgage payment: $1,605

Monthly income needed: $5,350

To live in Washington, you'll need a higher salary than residents in 45 other states to afford the typical home.

West Virginia: $29,240

Monthly mortgage payment: $731

Monthly income needed: $2,436.67

When considering the median home price by state, don't pass up West Virginia. The salary needed to afford a house -- just $29,240 -- makes the state one of the best bargains in the country.

Wisconsin: $36,040

Monthly mortgage payment: $901

Monthly income needed: $3,003.33

Wisconsin is also quite reasonable when comparing the median house price by state. The median list price is only $189,900.

Wyoming: $44,600

Monthly mortgage payment: $1,115

Monthly income needed: $3,716.67

If you want to live out West, Wyoming is certainly a relatively cheap place to live with a median home price of $237,500. Its neighbors Colorado and Utah have a median house price by state that's higher.

What’s the Salary You Need To Afford a House in Your State?

There are many financial factors to consider when you're choosing a home. The down payment, closing costs, property taxes, insurance -- the list goes on. However, it's also important to figure out if your salary is large enough to pay the mortgage payments.

Here are the five states that require the highest salaries to afford a home:

1. Hawaii: $110,520

2. District of Columbia: $97,280

3. California: $89,280

4. Massachusetts: $75,360

5. Colorado: $73,600

And here are the five states that require the lowest salaries to afford a home:

1. Ohio: $28,800

2. West Virginia: $29,240

3. Michigan: $30,680

4. Indiana: $31,320

5. Arkansas: $31,320

More From GOBankingRates

Methodology: To find the minimum salary needed to own a home in every state (except North Dakota, whose median home list price information was sourced for Realtor.com) and the District of Columbia, GOBankingRates calculated the average mortgage payment in every state using the state's median home list price and the average APR on a 30-year fixed loan, sourced from Zillow. Using the general rule of thumb that no more than 30% of your income should go toward housing, we then calculated the annual income needed to afford the average mortgage payment in every state. The study results do not account for other home costs, such as property taxes or insurance. All information in this article is accurate at the time the study was conducted in November 2018.

This article originally appeared on GOBankingRates.com: This Is the Salary You Need To Afford the Average Home in Your State