Safety, new high schools and more at stake on Tri-Cities ballots. What districts are asking for

Tri-City school districts will ask voters to approve funding in February for basic education programs, safety and security upgrades and new high school buildings.

Richland, Kennewick, Pasco and Finley school districts in recent weeks passed resolutions to put tax measures on the Feb. 14 special election ballot.

Kennewick is looking to renew its operations levy to fund basic education and extracurricular funding. This is not a new tax.

Twice voters failed to pass the levy renewal this year, causing the district to lose out on $34 million in local and state-matching funding for the 2022-23 and 2023-24 school years. It was the first double levy failure in the history of the Kennewick district.

The district absorbed the blow by using $30 million from its existing fund balance, state COVID relief funds and by making budget reductions and not filling open positions.

If this new measure does not pass, Kennewick School District, the city’s largest employer, will be forced to make cuts that will be detrimental to staffing and programs starting next school year, say school officials.

Meanwhile, both Richland and Pasco hope to secure funding for their third comprehensive high schools — but they’re coming at it with two different approaches.

Richland plans to start the process off first by passing a $23 million capital improvement levy in February that will include school safety upgrades and planning for its new buildings. Then, in 2024, it will run a bond to cover construction of those buildings, including a third high school to be built in West Richland.

Pasco plans to move forward with a 21-year capital improvement bond that would pay for a third high school near Barbara McClintock STEM Elementary, construction of a small innovative high school, enhanced athletic facilities, classroom upgrades for career and technical programs at Pasco and Chiawana high schools and for new land for future schools.

Finley School District will take a third shot at renewing its two-year operations levy after also experiencing a double levy failure this year. The small Benton County school district had to slash 12% of its school budget earlier this year to account for the lost revenue. By reinstating local funding, district staff say they plan on reducing class sizes, increasing opportunities for the arts, resume adopting new curriculum materials and make improvements to sports programs and buildings.

Bonds vs. levies

In Washington state, bonds are for building schools and facilities, and levies are for learning and education programs.

Bonds require a “super majority” of district support to pass, which is 60%.

Levies need a majority — greater than 50% — to pass. While the state funds “basic education,” local dollars that come from education and operational levies fund the difference between what the state provides and what schools need to serve every student.

Capital levies are different from enrichment levies in that they don’t fund education programs and extracurricular activities. Instead, they pay for technology upgrades, safety improvements and substantial renovations and additions.

A variety of tax relief and deferral options are available to most seniors, people with disabilities and widows, according to the Washington Department of Revenue.

Kennewick’s 3-year operations levy

Kennewick will ask voters to pass a reduced three-year operations levy to fund security upgrades, more school resource officers, special education support and advance placement programs, instructional support, maintenance workers and athletics.

“As a husband of a teacher in the district, I’ve been in the classrooms and seen first-hand how this money can impact our schools, and I would just highly encourage people to ask questions,” said school board member Gabe Galbraith at a meeting earlier this month. “Don’t just read stuff on social media — ask your questions because we need this levy.”

The district would levy $71.55 million in local collection over three years, starting in 2024. Because of the double levy failure, Kennewick will not collect any local taxes in 2023.

Here’s a breakdown of the proposal:

In 2024, Kennewick would collect $1.73 per $1,000 of assessed property value totaling $23 million.

In 2025, they would collect $1.68 on every $1,000 assessed to total $23.85 million.

And in 2026, they would collect $1.63 on every $1,000 assessed to total $24.7 million.

The district will also receive an additional $15 million annually in state-matching levy funds.

The annual burden on a home valued at $300,000 would be $519 in 2024, $504 in 2025, and $489 in 2026.

Kennewick voters have a history of supporting school district levies and bonds. Their last operations levy, which guaranteed four years of funding, passed in 2018 and succeeded with 65% of the vote.

But COVID-related vaccine and mask mandates soured some voters’ perceptions of public schools. With those mandates now gone, the district’s administration is hoping to rekindle that flame with voters to pass necessary funding that will improve education.

Pasco’s 21-year bond

Pasco is home to the largest high school in the state: Chiawana High School with 3,150 students. That’s 33% more students attending the school than what it was originally built for.

It’s so crowded, in fact, that the school district had to install six new portables over the summer to address growing student populations. Between Chiawana and Pasco High, the Tri-City’s second-largest school, about 1,800 students are served in portable buildings.

That’s why the district is proposing a 21-year construction bond measure that would raise $195.5 million in order to build a third high school.

Starting in 2024, the district would tax an additional 31 cents per $1,000 of assessed property value — that’s an extra $93 annually on a home valued at $300,000.

The project would build out a 2,000-seat comprehensive high school, a small 600-seat innovative high school similar to Delta High School, athletic field improvements including a new softball field at Pasco High School, career and technical classroom improvements at Pasco and Chiawana, and money for new land.

Pasco School Board President Scott Lehrman at a meeting earlier this month said building the new facilities would provide immediate and future population relief at all schools in the district, and improve educational opportunities.

Richland’s 6-year capital levy

Richland is also going out for a third comprehensive high school, albeit with a different game plan.

The district in February will ask voters to pass a six-year $23 million capital improvement levy to begin the design, specification and pre-work for a third high school, as well as to implement districtwide safety and security upgrades.

A tax calculator for Richland voters is available on the district’s website. For a home valued at $300,000, the additional tax burden for the capital levy would be about $93 a year.

Here’s a breakdown of the proposal:

In 2024, Richland would collect an additional 31 cents per $1,000 of assessed property value totaling $3.9 million.

In 2025, they’d collect 30 cents per $1,000 assessed to total $3.9 million.

In 2026, 29 cents per $1,000 assessed would be collected to total $3.9 million.

In 2027, 28 cents per $1,000 assessed would be collected totaling $3.8 million.

In 2028 and 2029, the district would collect 27 cents per $1,000 assessed for $3.75 million both years.

If passed, Richland School District administrators plan to go back to the voters again, likely in February 2024, to ask for construction funding for its third high school. That amount has not yet been determined, but it’s expected to be far less than the $300+ million the district had proposed in its original bond package.

“What that capital projects levy would enable us to do (is) continue to move forward with the goals and objectives that the community and board thought was important without causing that much of a greater tax burden on our communities with the unforeseen — not knowing for sure exactly what the economy will do next,” board President Jill Oldson previously said.

The measure also allows the district time to flesh out the community’s priorities on these projects and to narrow down a bond package they’re certain will pass the scrutiny of voters.

The capital levy proposal would also fund safety improvements, including constructing secure front-office visitor vestibules and installing surveillance systems. School board-specific improvements to current school facilities will also be made under this proposal.

Finley’s 2-year operations levy

Finley is hoping voters will renew their two-year measure that will cover $2.9 million in funding for athletics, technology equipment, maintenance and operations, and staffing and student support.

The district would collect $1.43 million in 2024, and another $1.47 million in 2025.

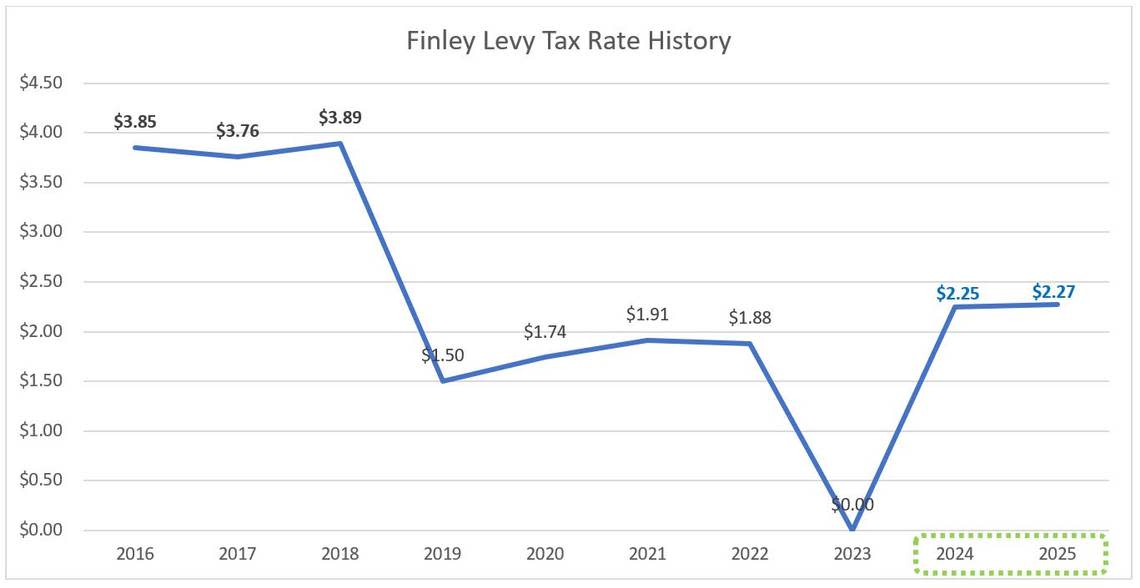

It’s estimated the tax rate would be about $2.25 per $1,000 of assessed property value in its first year and 2 cents higher its second year.

The annual burden on a home valued at $300,000 would be $675 and $681.