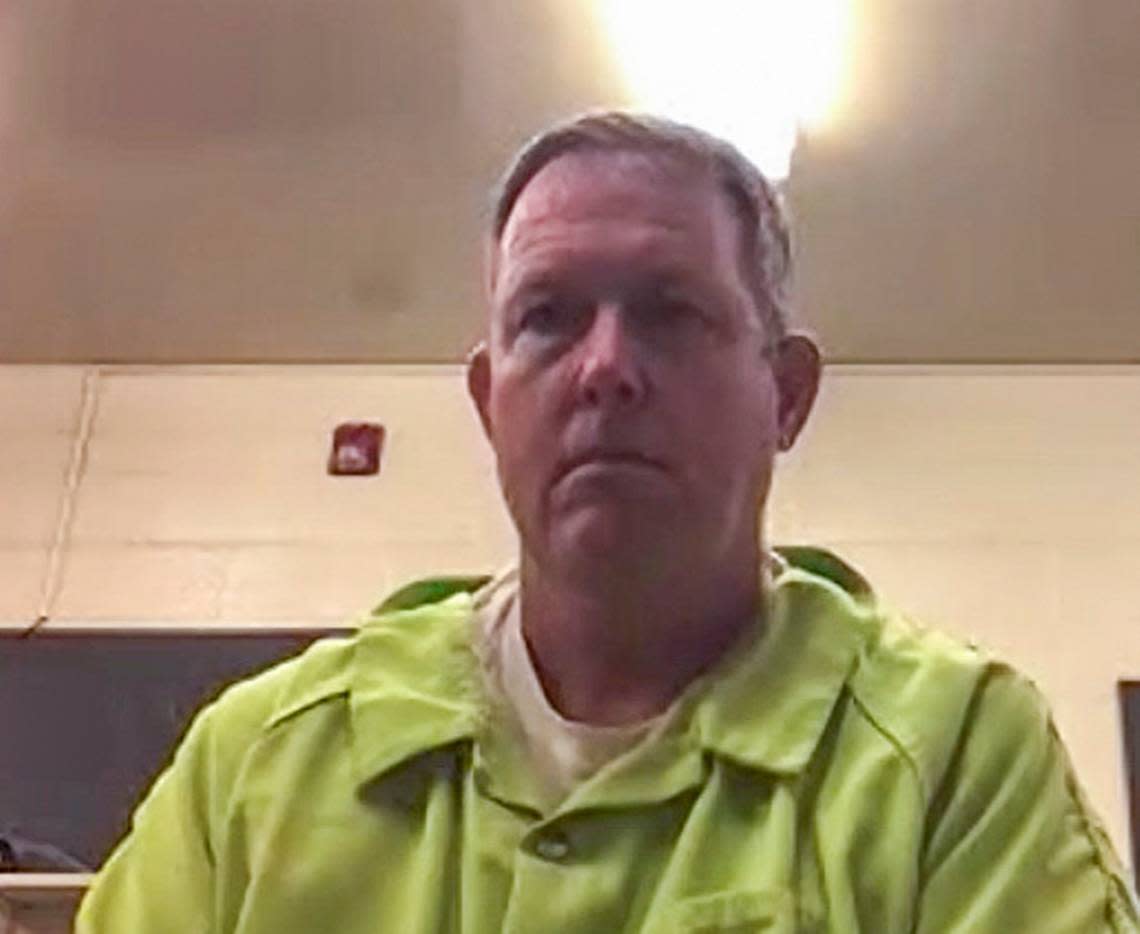

Russell Laffitte, Murdaugh’s friend and ex-Hampton banker, indicted by federal grand jury

A federal grand jury has indicted former Hampton banker Russell Laffitte on various counts of bank and wire fraud in connection with alleged schemes by disbarred attorney Alex Murdaugh to misappropriate millions of dollars supposedly under bank supervision.

The indictment, issued Wednesday by a federal grand jury in Columbia, alleges a longstanding conspiracy between an unidentified “bank customer,” whom sources identified as Murdaugh, and Laffitte to use the Palmetto State Bank in Hampton County bank as a tool for laundering money that Murdaugh stole.

The indictment was made public Wednesday afternoon, hours after a judge denied Murdaugh bond in the double slaying of his wife Maggie and son Paul in June 2021. Murdaugh has pleaded not guilty.

Its 17 pages brim with specific allegations of how Murdaugh and Laffitte carried out their financial thefts, and contains details of how they used their access to a federally-insured financial institution to steal millions of dollars. The bank was at the center of their money-making schemes, the indictment asserts.

With the stolen money, Murdaugh and Laffitte sent money to relatives and their own checking accounts and paid off loans and bills, the indictment said.

The bank was used as a “slush fund” for Murdaugh and Laffitte, said lawyers for two of the alleged victims in case.

The indictment is the first, but likely not the last, charge by the federal government in what has turned into one of South Carolina’s largest financial scandals in years in which the banking industry and the legal profession have come under scrutiny by law enforcement.

Laffitte, 51, who already was been indicted by a state grand jury, used his high position of trust at his family-owned bank in Hampton, Palmetto State Bank, to help Murdaugh steal and launder millions, the indictment said.

In all, the federal indictment said, Laffitte and Murdaugh looted six conservatorships over the years, often siphoning money out of one and then, as deadlines approached, repaying one depleted conservatorship with funds from another conservatorship.

The indictment charges Laffitte with conspiracy to commit wire fraud and bank fraud, wire fraud, bank fraud and misapplication of bank funds.

He faces a maximum 30 years in prison on each charge.

“We intend to vigorously fight the charges at trial or otherwise,” Bart Daniel, Laffitte’s attorney, told The State.

An arraignment and first court appearance has been set for Aug. 3 at the federal courthouse in Charleston before U.S. Magistrate Judge Mary Gordon Baker.

Federal indictment lays out money schemes

Laffitte’s alleged illegal actions with the “bank customer” began in 2011 and continued through October of last year, the 16-page indictment said.

Banks and bankers are governed by a vast set of federal laws to protect the nation’s financial system, and a federal grand jury has been quietly investigating Laffitte and the inner workings of Palmetto State Bank for months, The State reported earlier this year.

Wednesday’s indictment alleges that Laffitte, while a conservator for the bank customer’s personal injury clients, extended $355,000 in personal loans to himself and $990,000 in personal loans to the bank customer (Murdaugh) from money that belonged to the personal injury clients and that were under Palmetto State Bank’s care.

Laffitte knew that the money loaned to the Palmetto State Bank customer was used cover hundreds of thousands of dollars in overdrafts that the bank customer had made, the indictment says.

Laffitte made $391,781 in fees for serving as conservator and personal representative in this matter, the indictment said.

The indictment also details some of the destinations where the stolen money went to.

In one case, instead of routing $634,581 in settlement money to conservatorships of people identified only as H.P.Y. and N.T., Laffitte and Murdaugh divided the money up in part this way:

▪ $10,000 deposit for Murdaugh’s late wife Maggie

▪ $100,000 money order to Laffitte’s father to pay off a personal loan

▪ $329,500 to Murdaugh’s late father

▪ $4,057 to make loan payments for Murdaugh’s boat

In another case, acting at Murdaugh’s direction according to the indictment, Laffitte distributed much of $1.3 million that was supposed to go in a conservatorship to destinations chosen by Murdaugh that included:

$250,987 to Murdaugh’s personal account

▪ $75,000 money order to Murdaugh’s father

▪ $7,500 money order to Murdaugh’s wife

▪ $388,687 money order “to a third party individual to repay a private loan”

Laffitte, Murdaugh intertwined for years

Laffitte’s family owns a majority of Palmetto State Bank shares.

After he joined the bank in 1997 as a young man, he started as a teller and loan officer. In 2015, he became the bank’s executive vice president and chief operating officer. In 2020, he became the CEO.

He also served on the bank’s executive committee, where he helped approve large loans, the indictment said.

Since last November, a state grand jury has indicted Murdaugh on numerous fraud charges connected with the alleged theft of roughly $8.5 million from his clients, law firm, associates and fellow lawyers. Some of the state indictments charge that Murdaugh stole money from his law firm’s client trust account and then, with Laffitte’s help, laundered the money for Murdaugh’s personal use.

Laffitte also profited from his relationship with Murdaugh, according to state indictments.

Murdaugh is not mentioned by name in the federal indictment, but he is the unidentified bank “customer” who appears throughout the indictment, sources said and documents confirm.

Laffitte and Murdaugh are childhood friends, having grown up in the same Hampton neighborhood and having lived close to each other. Both are members of wealthy, prominent families whose names are closely intertwined with major local businesses.

As adults, Laffitte and Murdaugh established a longterm business relationship, the indictment said.

Murdaugh, his law firm and lawyers at that firm established accounts at Palmetto State Bank “were long-time clients of the bank,” the indictment said. Over the years, Laffitte came to handle nearly all of Murdaugh’s banking needs, including negotiating checks and extending loans and served as Murdaugh’s “primary point of contact” at the bank, the indictment said.

In Murdaugh’s case, he is a fourth-generation lawyer in a family-based law firm that is regarded as one of the best personal injury firms in the state. Laffitte’s family has run the Palmetto State Bank for decades. The law firm and the Palmetto State Bank’s affairs have been intertwined for years, with the law firm keeping its financial accounts there.

Murdaugh was fired by his family law firm — what was Peters Murdaugh Parker Eltzroth & Detrick — last September. The firm has since jettisoned the family name and is now known as the Parker Law Group.

Laffitte, a third-generation banker, was fired in early January by his bank, on whose board of directors sit several members of the Laffitte family, after an in-house investigation disclosed numerous irregularities in his relationship with Murdaugh.

At that time, Laffitte was also under investigation by state and federal authorities.

One irregularity concerned a $750,000 commercial loan at favorable interest rates that Laffitte made to Murdaugh in July 2021, about six weeks after Murdaugh’s wife and son were slain, the indictment said.

That loan was supposedly for repairs to Murdaugh’s beach house, but Laffitte knew that the money was going to be paid to a person identified as “Attorney 1” and to cover hundreds of thousands of dollars in overdrafts in Murdaugh’s checking account at Palmetto State Bank.

The State newspaper reported earlier this month that Murdaugh was under enormous financial pressure in the years, months and days leading up to the murders of his wife and son.

Laffitte used the bank to help Murdaugh in numerous ways, from giving him hefty loans from cash-laden conservatorships that Laffitte controlled to helping Murdaugh cope with his frequently overdrawn checking accounts, according to lawsuits and April indictments.

Eric Bland and Ronnie Richter, lawyers who are representing several victims in Murdaugh financial fraud cases, said in a statement late Wednesday that they represent adults who, as two young girls, received a large settlement after the 2005 deaths of their mother and brother in a “tragic rollover accident.” The money was entrusted to Palmetto State Bank under Laffitte’s care.

“As the years ensued, the girls viewed Russ Laffitte as a father figure and trusted him to navigate the waters ahead for them and to guide them. It is difficult to express the emotions and disappointment of learning years later that those who had sworn to protect the Plylers chose instead to prey upon them,” they said. “Russ Laffitte and Alex Murdaugh plundered their conservator accounts and treated it like their own personal slush fund.”

The Plyler sisters, Alania Spohn and Hannah Plyler, are among the six victims identified only by initials in Wednesday’s federal indictment, Bland and Richter said.

Wednesday’s indictment made repeated references to Palmetto State Bank being insured by the Federal Deposit Insurance Corp., an agency established by Congress to maintain stability and public confidence in the nation’s financial system. Among its roles are examining banks “for safety, soundness, and consumer protection,” according to its website.

The FBI, the State Law Enforcement Division and the state Attorney General’s office investigated.

Assistant U.S. Attorney Emily Limehouse is prosecuting.