How To Find Your Routing and Account Numbers on a Check

You may need to know your bank’s routing number to pay a bill online or over the phone, send money through a wire transfer or set up a direct deposit. To receive your tax refund via direct deposit, you must provide your bank’s routing number on your tax return.

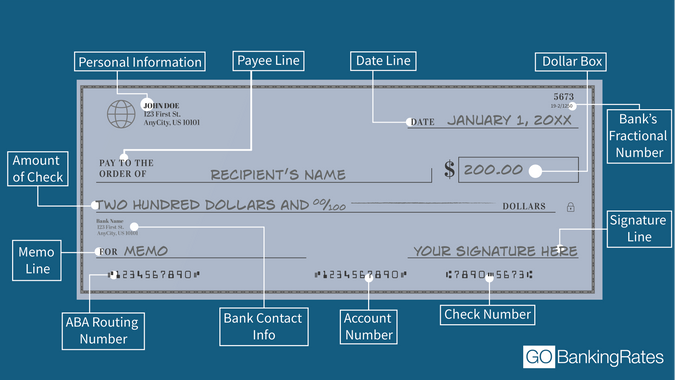

You can locate the routing number and account number on a check. The routing number, a 9-digit number on the left side, is followed by the account number.

Where Are the Account and Routing Number on a Check?

If you look at a bank-issued check, you’ll see a series of numbers printed along the bottom edge of the check.

The first set of numbers is the nine-digit bank routing number. Banks use routing numbers to process several types of transactions, including paper and digital checks, direct deposits and bill payments.

Are all check routing numbers nine digits? Yes, check routing numbers are always nine digits. They have a specific structure consisting of three parts: a four-digit Federal Reserve routing symbol, a four-digit ABA institution identifier and a single check digit.

Where is the account number on the check? It is the second set of numbers along the bottom of your check, and it may be longer or shorter than the routing number.

To the right of the account number is the check number, and this number will be different on each check.

How Do I Find My Routing Number Without a Check?

As an alternative to using a paper check to find your routing number, you can find it in your account statement and on your bank’s online banking platform or mobile app. Many banks list the routing number in the upper-right corner of the monthly statement, near the bank’s logo and other identifying information.

When you make a payment using an electronic or paper method, the receiving bank uses the routing number to identify your bank. So whenever you’re asked to provide your routing number, you should ensure you use the correct one. Otherwise, the processing of your transaction could be delayed, especially since some banks have different routing numbers for each state.

The following table lists state-specific routing numbers for Bank of America, Chase and Wells Fargo.

Note: GOBankingRates was unable to confirm Chase routing numbers for Alaska and Hawaii.

STATE | BANK OF AMERICA ROUTING NUMBERS | CHASE ROUTING NUMBERS | WELLS FARGO ROUTING NUMBERS |

|---|---|---|---|

Alabama | 051000017 | 065400137 | 062000080 |

Alaska | 051000017 | Unconfirmed | 125200057 |

Arizona | 122101706 | 122100024 | 122105278 |

Arkansas | 082000073 | 065400137 | 111900659 |

California | 121000358 | 322271627 | 1210428821 |

Colorado | 123103716 | 102001017 | 102000076 |

Connecticut | 011900254 | 021100361 | 021101108 |

Delaware | 031202084 | 083000137 | 031100869 |

District of Columbia | 054001204 | 044000037 | 054001220 |

Florida | 063100277 | 267084131 | 063107513 |

Georgia | 061000052 | 061092387 | 061000227 |

Hawaii | 051000017 | Unconfirmed | 121042882 |

Idaho | 123103716 | 123271978 | 124103799 |

Illinois | 081904808 (South and Chicago Metro) | 071000013 | 071101307 |

Indiana | 071214579 | 074000010 | 074900275 |

Iowa | 073000176 | 075000019 | 073000228 |

Kansas | 101100045 | 103000648 | 101089292 |

Kentucky | 064000020 | 083000137 | 121042882 |

Louisiana | 051000017 | 065400137 | 121042882 |

Maine | 011200365 | 083000137 | 121042882 |

Maryland | 052001633 | 044000037 | 055003201 |

Massachusetts | 011000138 | 021000021 | 121042882 |

Michigan | 072000805 | 072000326 | 091101455 |

Minnesota | 071214579 | 075000019 | 091000019 |

Mississippi | 051000017 | 065400137 | 062203751 |

Missouri | 081000032 | 103000648 | 113105449 |

Montana | 051000017 | 102001017 | 092905278 |

Nebraska | 123103716 | 103000648 | 104000058 |

Nevada | 122400724 | 322271627 | 321270742 |

New Hampshire | 011400495 | 083000137 | 121042882 |

New Jersey | 021200339 | 021202337 | 021200025 |

New Mexico | 107000327 | 102001017 | 107002192 |

New York | 021000322 | 021000021 (Downstate) | 026012881 |

North Carolina | 053000196 | 072000326 | 053000219 |

North Dakota | 051000017 | 103000648 | 091300010 |

Ohio | 071214579 | 044000037 | 041215537 |

Oklahoma | 103000017 | 103000648 | 121042882 |

Oregon | 323070380 | 325070760 | 123006800 |

Pennsylvania | 031202084 | 083000137 | 031000503 |

Rhode Island | 011500010 | 083000137 | 121042882 |

South Carolina | 053904483 | 072000326 | 053207766 |

South Dakota | 051000017 | 103000648 | 091400046 |

Tennessee | 064000020 | 065400137 | 064003768 |

Texas | 111000025 | 111000614 | 111900659 |

Utah | 123103716 | 124001545 | 124002971 |

Vermont | 051000017 | 083000137 | 121042882 |

Virginia | 051000017 | 044000037 | 051400549 |

Washington | 125000024 | 325070760 | 125008547 |

West Virginia | 051000017 | 051900366 | 121042882 |

Wisconsin | 123103716 | 075000019 | 075911988 |

Wyoming | 051000017 | 102001017 | 102301092 |

1Wells Fargo accounts opened in Southern California might have a routing number that is different from the number displayed in the chart. You can use either Wells Fargo California routing number.

Final Take

If you have a checking account, it’s helpful to know how to locate your routing number on a check and how to differentiate it from your account number. If you don’t have paper checks, check a bank statement or your online bank account to find your routing number. The next time you’re asked to provide it when setting up an automatic deposit, online bill payment or similar transaction, you’ll know you’re using the correct number so transactions process correctly and without delays.

This article originally appeared on GOBankingRates.com: How To Find Your Routing and Account Numbers on a Check