Rochester grants 79-E tax relief for downtown property owner to renovate vacant building

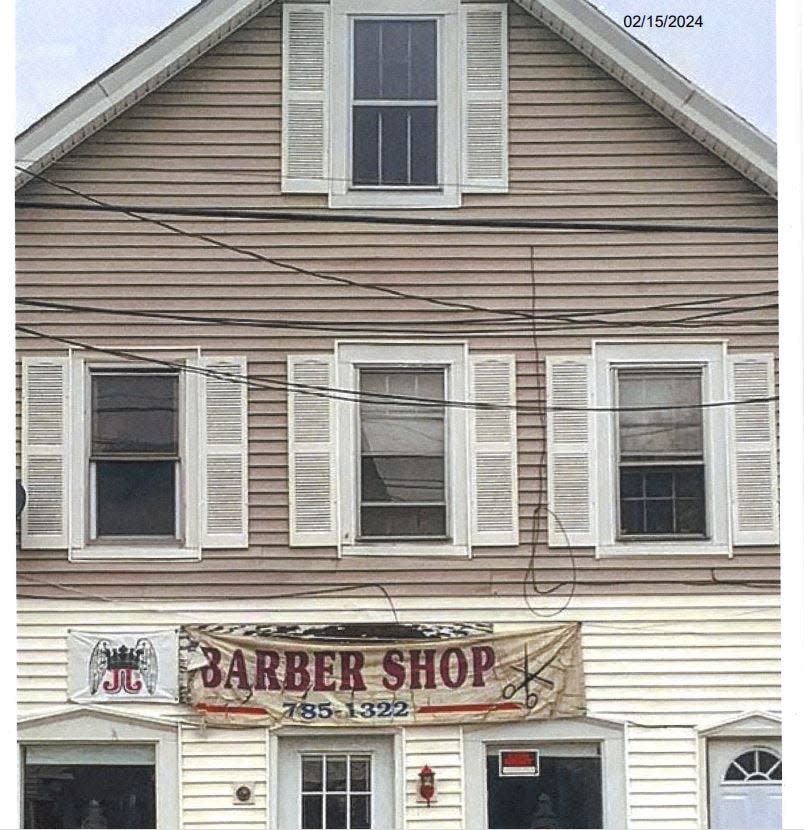

ROCHESTER — On Tuesday, city councilors gave approval to developer Andy Yau to renovate property at 135 North Main St., using a 79-E tax benefit.

This means a city assessor will look at the building and set an assessed value on the property, which has been vacant for at least five years. Mayor Paul Callaghan said the building's assessment will be held at that value for a period of five years while Yau completes the renovation.

The building, built in 1920, is in poor condition, said Yau. Currently it has two apartments on the second and third floor (one and two bedrooms). The first-floor space was a barbershop, and Yau's intention is to convert that space to a three-bedroom apartment, and to completely renovate the building.

A public hearing held Tuesday showed there was some opposition to granting the 79-E tax credit.

One resident, Lou Archibald, said it might set a precedent the city did not want.

"Are there others waiting to pounce on this, on other abandoned buildings," he asked. "There are similar properties on Portland Street. Will things such as lead paint, asbestos be considered?"

More housing in Rochester: Affordable apartment units proposed in Merchants Plaza building

State Rep. Tom Kaczynski, R-Rochester, said while he understands a 79-E program is a state program, he disagrees with it.

"You make taxpayers part of the project," he said. "The developer benefits, his business benefits, but taxpayers pick up the slack."

What is 79-E?

Per information in the council packet, 79-E is a state program, a community revitalization tax relief incentive. The purpose is for the revitalization of downtown areas as a public benefit, through the rehabilitation of buildings for commercial or residential use.

"The renovations will improve the appearance, which is in the downtown area," said Yau. "It will greatly improve the value of the property and will benefit the downtown area."

Callaghan said while most buildings in the area are required to have a commercial use, and be a mixed-use building, the location of this property does not have that requirement, so converting it to strictly residential is allowed.

"The key here is the exterior," said Callaghan. "It will greatly improve the look of the area. We did a 79-E on a similar property several years ago."

Yau had asked for seven years for the 79-E tax benefit. The council approved the 79-E but limited the benefit to five years, pointing out large projects like The Howard got seven years, and this much smaller conversion should not require that much time.

This article originally appeared on Fosters Daily Democrat: Rochester NH grants 79-E tax relief for 135 North Main St. property