Robinhood Just Got Hit With a Wells Notice. What Is That, and Why Could It Be Huge News for the Stock?

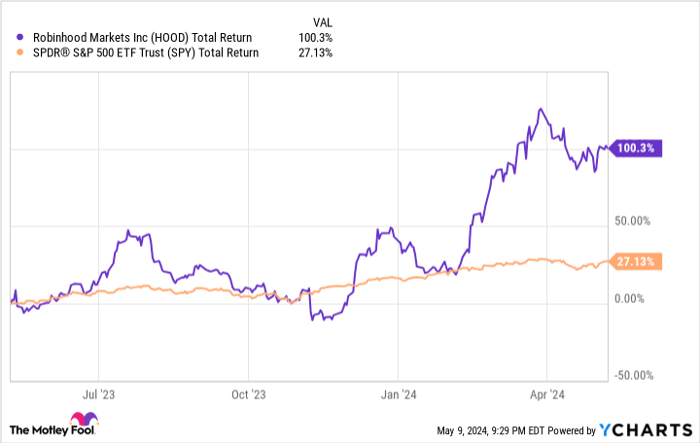

Robinhood Markets (NASDAQ: HOOD) stock has crushed it for the last year. The online brokerage that revolutionized free stock trading is up 100% in the last 12 months, compared to 27% returns for the S&P 500 index. The company just reported strong growth across the board in the first quarter of 2024 and is finally generating healthy amounts of profits.

But there is something looming above Robinhood's business, and it could be an impediment for the stock if things don't fall in its favor. I'm talking about the recent Wells Notice from the Securities and Exchange Commission (SEC), which was dropped a few days before Q1 earnings. Here's what the notice means and how it could affect Robinhood's business going forward.

Why is the SEC investigating Robinhood?

While it comes with a harmless name, a Wells Notice is a serious event for any business. It is the SEC telling a company that -- after going through an investigation -- it believes there have been violations against SEC rules and regulations committed by said business. The SEC notifies a company through a Wells Notice to give it time to respond to these allegations before going through the full legal process.

The SEC has been investigating Robinhood, and on May 4 it gave a Wells Notice to Robinhood that it believes SEC rules have been violated. Over what, you may ask? Its cryptocurrency business. Shocking, I know. Robinhood Crypto is getting a crackdown over its cryptocurrency listings and the way it operates its crypto trading platform. It is unclear exactly what laws the SEC believes Robinhood has broken, but it could lead to fines, remedies, and even banning some of its current crypto customer offerings.

Earnings were strong, but you need to look closer at what drove growth

Robinhood's stock didn't budge much after this report was released. In fact, it is still up 40% year to date. Earnings for Q1 were released this week, with the company showing strong growth across its business.

Total net revenue grew 40% year over year to $618 million in the quarter, driven by $126 million in crypto revenue (growing 232% year over year) and $254 million in interest income. Robinhood also makes a good chunk of money from options trading, generating $154 million in options revenue in the first quarter. Bottom-line profits are finally starting to show up, too. Net income was $157 million in the first quarter, a significant improvement from the last few years of losses.

From my seat, there are two major concerns with Robinhood's earnings. First, it is getting $254 million of its $618 million in revenue from interest income from customer deposits. If the Federal Reserve lowers interest rates, these earnings will face a headwind. It is also highly competitive for financial platforms to incentivize customers to keep their cash with them. For example, Robinhood Gold subscribers earn a 5% interest rate on their cash balances, which is barely lower than what Robinhood can earn by investing spare cash in short-term U.S. Treasury Bonds.

Robinhood's crypto revenue grew 232% last quarter to $126 million. With the looming Wells Notice, this revenue is at risk of completely going away. We do not know what the outcome of this SEC investigation will be, but it is in the realm of possibility that Robinhood will get banned from offering cryptocurrency trading on its platform or face a large fine for whatever laws it violated. This could be another headwind for the stock moving forward.

HOOD Total Return Level data by YCharts

Is Robinhood stock a buy?

There are a lot of risks to Robinhood's business model. Despite these risks, the stock does not look cheap. It trades at a market cap of $15 billion, generated just $2 billion in revenue over the past 12 months, and trades at a price-to-earnings ratio (P/E) above 100.

A combination of macroeconomic, regulatory, and valuation risks makes a stock like Robinhood a tough buy. At these prices and with the current Wells Notice looming over the business, investors should avoid Robinhood for the time being.

Should you invest $1,000 in Robinhood Markets right now?

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.