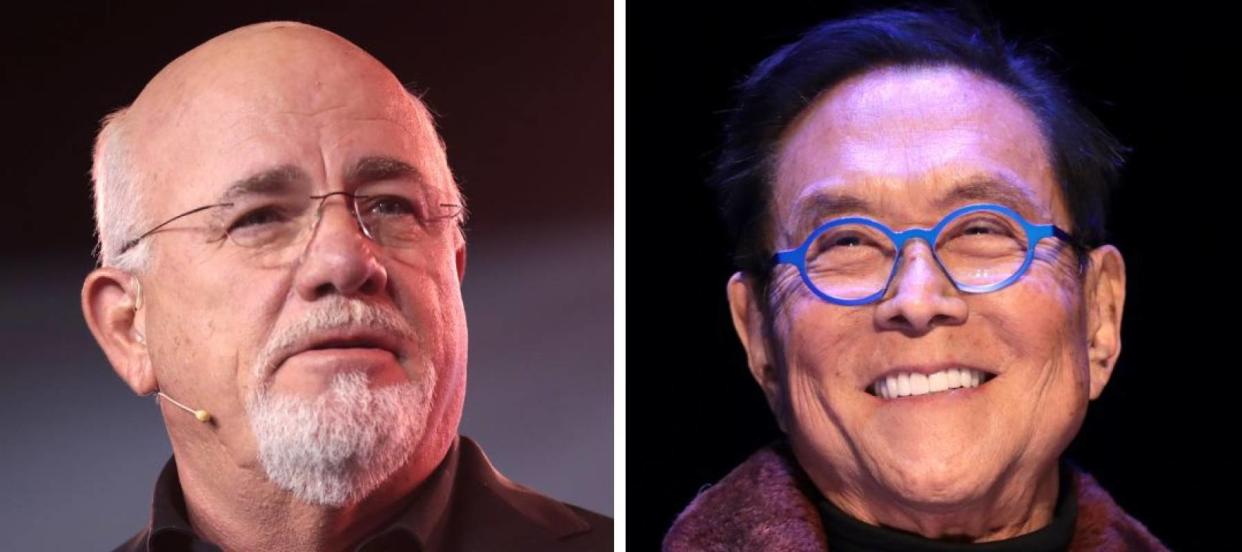

‘Who is right?’: 'Rich Dad, Poor Dad' author Robert Kiyosaki bragged that being $1.2 billion in debt is better than ‘friend’ Dave Ramsey’s mantra of living debt-free

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Robert Kiyosaki, author of the bestselling book ‘Rich Dad, Poor Dad’, publicly challenged finance guru Dave Ramsey on X. Kiyosaki proudly proclaimed his $1.2 billion debt, challenging the conventional wisdom that it’s better to be debt-free.

In March, Kiyosaki posted: “My friend Dave Ramsey says ‘Live debt free.’ I say ‘I use debt to invest. I am $1.2 billion in debt.’ Again, who is right?”

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Kiyosaki champions an investment philosophy that leverages debt, not as a burden but as a tool to build wealth by investing in tangible assets such as precious metals.

By choosing assets he believes will withstand economic fluctuations, Kiyosaki built a portfolio that reflects his skepticism for traditional monetary systems. However, this approach has resulted in a massive amount of debt, which he often brags about.

If you want to invest like Kiyosaki without going into a billion dollars of debt, here’s where you can get started.

Gold

Precious metals, like gold and silver, are widely favored as safeguards against inflation and economic instability. Kiyosaki agrees with this, acknowledging the US dollar’s disconnection from the gold standard since 1971 during the presidency of Richard Nixon.

In October, Kiyosaki predicted, “Gold will soon break through $2,100 and then take off. You will wish you had bought gold below $2,000. Next stop, gold $3,700.”

If you want to diversify your portfolio with gold, consider opening a gold IRA with help from Goldco. Instead of being made up of stocks and bonds, a gold IRA allows you to directly invest in physical precious metals. A Gold IRA merges the tax advantages of a traditional retirement account with gold’s capacity to hedge against inflation.

If you’re interested in learning more, Goldco will provide you with a free gold IRA kit so you can decide if this is the right investment for you.

Bitcoin

Though Kiyosaki has reservations about the stock market, he appears unfazed by the volatile nature of cryptocurrency.

If you’re looking to invest in Bitcoin, watch out for high commission fees on crypto trades. With Robinhood, you can buy and sell crypto with no commission fees.

With Robinhood, you can stay ahead of the ever-changing world of crypto. With its comprehensive trading tools, featuring price alerts, market trend analysis, and advanced trading options Robinhood is an ideal choice for both newbies and seasoned crypto investors.

Read more: Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Managing debt

While Kiyosaki advocates using debt to acquire assets, it’s important to remember that this approach carries many inherent risks.

If having debt hanging over your head is a burden, an online marketplace called Credible can help you consolidate.

Credible helps you to find the lowest interest rates on loans up to $100,000. Instead of throwing away your hard-earned money on interest, Credible allows you to combine all your loans, giving you one payment to make each month moving forward.

Who’s right?

If you’re unsure about where you fall on the debate between Kiyosaki and Ramsey, it might make sense to get a take from a qualified financial professional.

Kiyosaki often urges his followers on X to be cautious when choosing a financial advisor. Urging people to be cautious of the intentions of their advisors, part of a February post from Kiyosaki reads: “Don’t be a loser. Choose your financial advisors carefully.”

Advisor.com is an online platform that connects individuals with experts to help you understand your current financial situation and guide you towards a thriving financial future.

Through Advisor.com, individuals can be paired with a reputable financial advisor adept at helping you discover which alternative assets are best for you.

Once you get matched with a financial advisor, you can schedule a free consultation to discuss your goals and see which investment strategy meets your needs.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos, Mark Zuckerberg, and Jamie Dimon are selling out of US stocks in a big way — here's how to diversify into private real estate within minutes

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.