Retire in Luxury: 10 Best US Cities for Retirees on a Budget of $5,000 a Month

If you're looking to retire in a high-cost city like Los Angeles or New York, $5,000 in monthly income isn't likely to cut it. But there are plenty of great cities across America where you could live in relative luxury off that level of income. Even better, many of the more affordable, lesser-known cities in the United States actually have a much better livability score than their big-city brethren.

I'm a Retirement Planning Expert: Here Are 4 Reasons You Shouldn't Retire in Florida If You Have a Budget of Over $5K a Month

Find Out: The Simple, Effective Way To Fortify Your Retirement Mix

To determine which cities are the best choice in terms of both quality of life and cost, GOBankingRates sourced data from a variety of sources, including the U.S. Census American Consumer Survey, Sperlings BestPlaces, the Zillow Home Value Index, the Bureau of Labor Statistics 2022 Consumer Expenditure Survey, AreaVibes and Federal Reserve Economic Data. Cities with average monthly costs above $5,000 were tossed out. Livability index results were given a 1.5 weighting, while total monthly costs were assigned a weight of 1.0. Results are presented here, in reverse order.

Leon, Iowa

Monthly Overall Costs + Monthly Mortgage: $4,192

Tiny Leon, Iowa may not be on most retirees' radar, but perhaps it should be. Those pulling down $5,000 per month in income will have more than $800 left over every month on average in the town of 1,716 residents, thanks in part to home mortgages that average just $669 per month.

First Year of Retirement: 2 Things To Save and 3 Things To Splurge On

See: 5 Actions You Must Take If Your Retirement Savings Fall Below $50,000

Tiffin, Ohio

Monthly Overall Costs + Monthly Mortgage: $4,453

Housing costs in Tiffin are actually the highest among the top 10 cities in this list, but they're still more than 70% below the national average, with the average mortgage costing just $993 monthly. Overall, costs in the city of 17,822 -- which carries a very high livability rating of 82 -- run more than 28% below the national average.

Retirement Savings: 5 Expenses You Can Easily Cut, According to Experts

Waterloo, Iowa

Monthly Overall Costs + Monthly Mortgage: $4,339

The name Waterloo may have you thinking of a famous general or even an ABBA song, but it's also a fabulous home for 67,695 residents. Transportation and housing are exceptionally cheap in Waterloo, and it boasts one of the highest livability scores in the nation at 81.

Huntington, West Virginia

Monthly Overall Costs + Monthly Mortgage: $4,318

West Virginia is an inexpensive state overall, but Huntington is one of its two cities that pair low costs with a high quality of life. Costs run about 25% below the national average overall, and the average annual mortgage payment is just $8,223. The city's 81 livability score is among the highest in the country.

Frostburg, Maryland

Monthly Overall Costs + Monthly Mortgage: $4,571

Frostburg only has a population of 7,282, but its livability score is off the charts. At 85, Frostburg boasts the highest livability score of any of the 168 cities in the entire study. Although a touch pricer than any city in the top 10, the overall cost index in Frostburg still only reaches 74.6.

Retired But Want To Work? Try These 8 Jobs for Seniors That Require Little to No Experience

Pampa, Texas

Monthly Overall Costs + Monthly Mortgage: $3,920

Pampa may not be the first name you think of if you're looking at places to retire in Texas, but it's one of two affordable towns in the state with high livability scores. In addition to being free from state taxes, residents enjoy paying just $528 monthly on average for their home mortgages while enjoying the amenities that contribute to its livability score of 76.

Clarksburg, West Virginia

Monthly Overall Costs + Monthly Mortgage: $4,070

Want to retire in a city of 16,000 residents with a livability score of 79 and annual expenses of just over $41,000 per year? Look no further than Clarksburg, where a monthly mortgage can be had for just $620 and overall costs are just 71.6% of the national average.

Robstown, Texas

Monthly Overall Costs + Monthly Mortgage: $3,974

Robstown is the second Texas town to crack the top five, and the small town's 10,372 residents no doubt enjoy its high livability score of 78. Transportation and housing are extremely cheap on a relative basis in Robstown, and overall the city's costs are about 29% below the national average.

Grant Cardone: Here's How Wealthy People Invest Their Money for Retirement

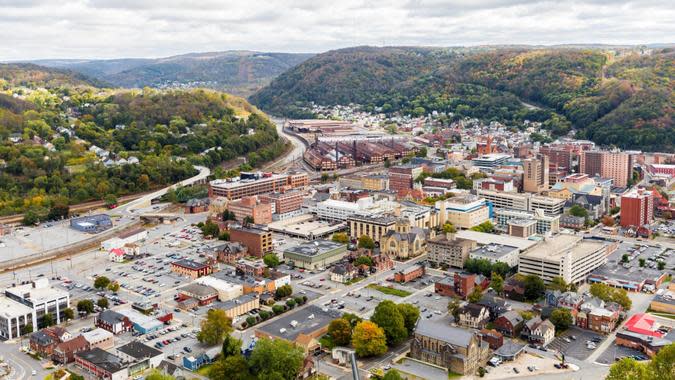

Johnstown, Pennsylvania

Monthly Overall Costs + Monthly Mortgage: $3,907

Johnstown's lofty livability index of 78 pushes it near the very top of the rankings, but its cost structure plays a big role as well. Johnstown has the smallest housing cost of the entire survey's 168 cities, at just 13.3% of the national average. Overall, costs run more than 30% below national norms.

Akron, Ohio

Monthly Overall Costs + Monthly Mortgage: $4,019

Akron, Ohio steals the top spot in terms of places to retire in luxury on $5,000 per month. Even with its relatively large population of 191,483, the city still sports a high 81 livability score while keeping average costs more than 31% below the national average.

Methodology: To find the Best Cities to Retire on $5,000 a month, GOBankingRates used a list of cities from U.S. Census American Consumer Survey. Using Sperlings BestPlaces, the cost of living across many expenditure categories was calculated with the Bureau of Labor Statistics 2022 Consumer Expenditure Survey for people aged 65 and older, giving the expenditure costs for each expenditure category for each city. Using the Zillow Home Value Index to find the average July 2023 home value for each city and the 30-year fixed national mortgage rate sourced from the Federal Reserve Economic Data, the average monthly mortgage cost was calculated for each city. Adding the mortgage cost and the expenditure costs resulted in the average total monthly costs. All cities above $5,000 were removed, and for the remaining cities, the livability index was sourced from AreaVibes. The livability index and the total monthly cost were scored, with the livability index weighted at 1.5 and the total cost weighted at 1.0. The scores were combined and sorted to show the best cities to retire on $5,000 a month. All data was collected and is up-to-date as-of Sept. 13th, 2023.

Photo Disclaimer: Please note photos are for representational purposes only. As a result, some of the photos might not reflect the locations listed in this article.

More From GOBankingRates

The Financial Feng Shui Rule: 7 Chinese Secrets to Attract Wealth

Experts Share the 5 Best Money Moves To Make Before Retiring

This article originally appeared on GOBankingRates.com: Retire in Luxury: 10 Best US Cities for Retirees on a Budget of $5,000 a Month