The restaurant industry faces a long and uneven recovery: Morning Brief

Wednesday, November 11, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

McDonald’s and Beyond Meat reveal the divide between the haves and have nots.

The ongoing economic recovery has been defined by its K-shape.

Across the labor market, financial markets, and all sectors of the economy there is a stark and clear split between the winners and losers during this crisis and recovery.

And few industries have been hit harder — and are seeing more uneven rebounds — than restaurants.

Big national quick-service chains have fared well with many of these stocks trading at record highs. Meanwhile, the local restaurants we love in our hometowns have been closing en masse as COVID infections, government restrictions, and reduced staff weigh on the industry.

Last week, the October jobs report showed employment at food and drinking places is still more than 2 million jobs below where it stood as the recession began in February.

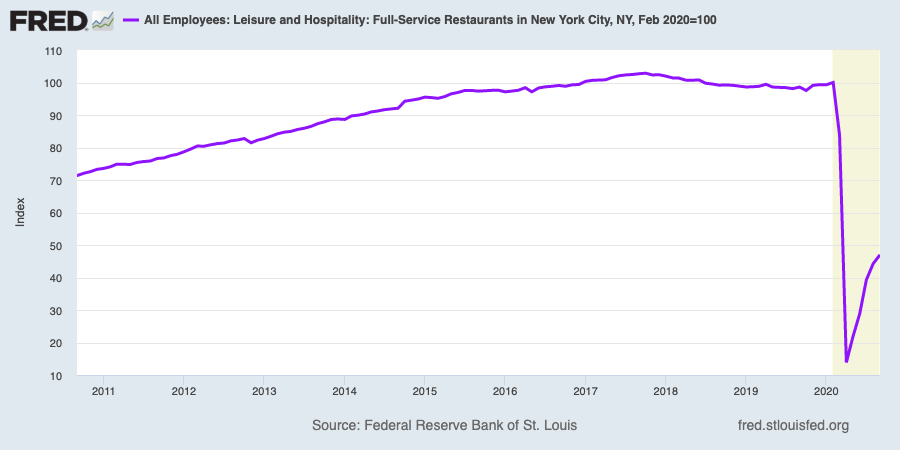

And in New York City, for instance, employment in the full-service restaurant industry is down over 50% from its February peak, a grim state of affairs for an industry that is an essential part of the city’s economy.

Earlier this week, results from McDonald’s (MCD) and Beyond Meat (BYND) offered another window into how fortunes have diverged across the restaurant space and outlined how tough things can be on the wrong side of this divide.

On Tuesday, shares of Beyond Meat fell 16.9% after the company reported revenue grew just 2.7% over the same quarter last year. CEO Ethan Brown said these results reflected a company, “[experiencing] the full brunt and unpredictability of COVID-19.”

And the biggest hit to Beyond Meat came from its restaurant customers. In Beyond’s U.S. segment, third quarter sales to foodservice customers fell 11.1% over last year while sales in the retail channel were up 40.5%. Internationally, foodservice revenues dropped 65% against a 26.7% increase in sales at retail locations.

Looking even more granularly within this foodservice segment, however, and we see the full force of the pandemic’s unequal impacts.

Brown outlined on the company’s earnings call that two-thirds of Beyond’s foodservice revenue comes from independent restaurants, smaller regional chains, bars and pubs, corporate catering services, government institutions, movie theaters, sports arenas and so on. Essentially anything that isn’t a major quick-service restaurant chain like McDonald’s is two-thirds of sales in Beyond’s hardest-hit segment.

And these businesses are hurting.

Citing data from NPD Group, which excludes major national chains, Brown said Beyond’s sales were down 34.7% in the third quarter. Sales across the industry to these customers fell 37.5% in the quarter. So while Brown told investors that this does indeed show Beyond gaining share, this customer base is getting crushed by the pandemic’s economic impacts.

In its latest local economic impact report, Yelp data showed that through August, over 97,000 businesses have permanently closed, including 19,590 restaurants. When The Morning Brief covered an earlier version of Yelp’s report back in July there had been around 72,000 permanent business closures and 15,770 permanent restaurant closures.

And Beyond’s results came on the same day that McDonald’s reported U.S. comp sales growth in the “low double-digits” for September, the best month for U.S. comps in almost a decade, according to CFO Kevin Ozan.

Ozan added that comp sales grew during each month of the third quarter at McDonald’s U.S. locations while international comps fell 4.4% in the third quarter after a 41% drop in the second. Contrast this with Beyond’s international foodservice decline increasing to 65% in the third quarter against a 56.5% drop during the second quarter.

Of course, Beyond Meat has partnered with McDonald’s on its new McPlant burger, and some analysts think a broader partnership could be worth $300 million annually to Beyond. And on Tuesday, Beyond Meat announced a new deal with Yum Brands-owned Pizza Hut (YUM) to offer Beyond Sausage toppings in the U.S. and U.K.

Clearly more deals with larger brands is a key part of Beyond’s strategy to get more consumers familiar with and hopefully hooked on their products. But in the interim, the restaurant, catering, and event customers that are an important leg of Beyond’s growth strategy remain in dire straits.

Many of these smaller, local businesses just do not have the resources to compete with conglomerates like McDonald’s or Pizza Hut through a global pandemic. Tough sledding at the bottom of the restaurant industry’s K-shaped recovery.

By Myles Udland, reporter and anchor for Yahoo Finance Live. Follow him at @MylesUdland

What to watch today

Economy

7:00 a.m. ET: MBA Mortgage Applications, week ended November 6 (3.8% during prior week)

Earnings

Pre-market

Before market open: Lemonade (LMND) is expected to report an adjusted loss of 64 cents per share on revenue of $14.68 million

Post-market

4:00 p.m. ET: Revolve (RVLV) is expected to report adjusted earnings of 14 cents per share on revenue of $158.07 million

4:20 p.m. ET: Vroom (VRM) is expected to report an adjusted loss of 37 cents per share on revenue of $310.64 million

Top News

Russia claims its COVID-19 vaccine is 92% effective [Yahoo Finance UK]

Vaccine rally continues as trillions change hands [Yahoo Finance UK]

Alibaba sees over $56bn in Singles' Day sales [Yahoo Finance UK]

Lyft beats earnings estimates; co-founder says it's one of the best COVID-19 recovery stocks [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

A near-record number of people own stocks — but that might not mean much

Supreme Court signals Obamacare may survive. Here’s how Democrats say they will try to expand it

Apple announces its first-ever M1 processor, coming to MacBooks and Macs

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay