There are reasons to be cautiously bullish about stocks: Morning Brief

This is The Takeaway from today's Morning Brief, which you can receive in your inbox every Monday to Friday by 6:30 a.m. ET along with:

The chart of the day

What we're watching

What we're reading

Economic data releases and earnings

The stock market has quietly been at work reversing the pain of 2022.

Last year, the Nasdaq fell nearly 30%, the S&P 500 dropped 19%, while the Dow lost just 9% during the stock market's worst year since 2008. So far this year the Nasdaq is up more than 14%, the S&P 500 is up 7%, and the Dow is up a more modest 2%.

And yet it certainly doesn't feel like the market has brought investors much joy in 2023.

Recession fears are omnipresent. A bank crisis last month saw the second- and third-largest bank failures in US history take place. Commercial real estate has taken up the mantle as the next big problem no one is talking about, even though people can't stop talking about it.

For Savita Subramanian and the equity strategy team at Bank of America Global Research, however, the wait is over — it is time for investors to make their peace with this market. And buy. Selectively.

"In what feels like a conviction-less market, we have high conviction in upside risk in cyclical sectors within the S&P 500 this quarter (overall, we are neutral on stocks with a year-end S&P 500 target of 4000)," Subramanian wrote in a note to clients on Monday.

The oversimplified way to think about cyclical sectors is that they are those which tend to rise and fall with the economic cycle and, thus, present a bit more risk for investors. Think consumer discretionary (XLY), communication services (XLC), and technology (XLK).

Look at names like Meta Platforms (META), Tesla (TSLA), and Nvidia (NVDA) so far this year and we see many investors have been on this theme already.

In their note to investors, Subramanian and her team outlined 10 reasons these stocks should outperform bonds and more defensive-oriented stocks. A few stood out to us.

"First," Subramanian wrote, "everyone hates stocks and loves bonds: individual investors are selling stocks to buy bonds, institutional investors and asset allocators have the lowest stock v. bond allocation since 2009, and one [in] three Wall Street strategists tracked by Bloomberg expect a 5%+ drop from here."

This is the classic "it's so bearish it's bullish" argument.

Which pairs with Subramanian's second point on the economic conversation.

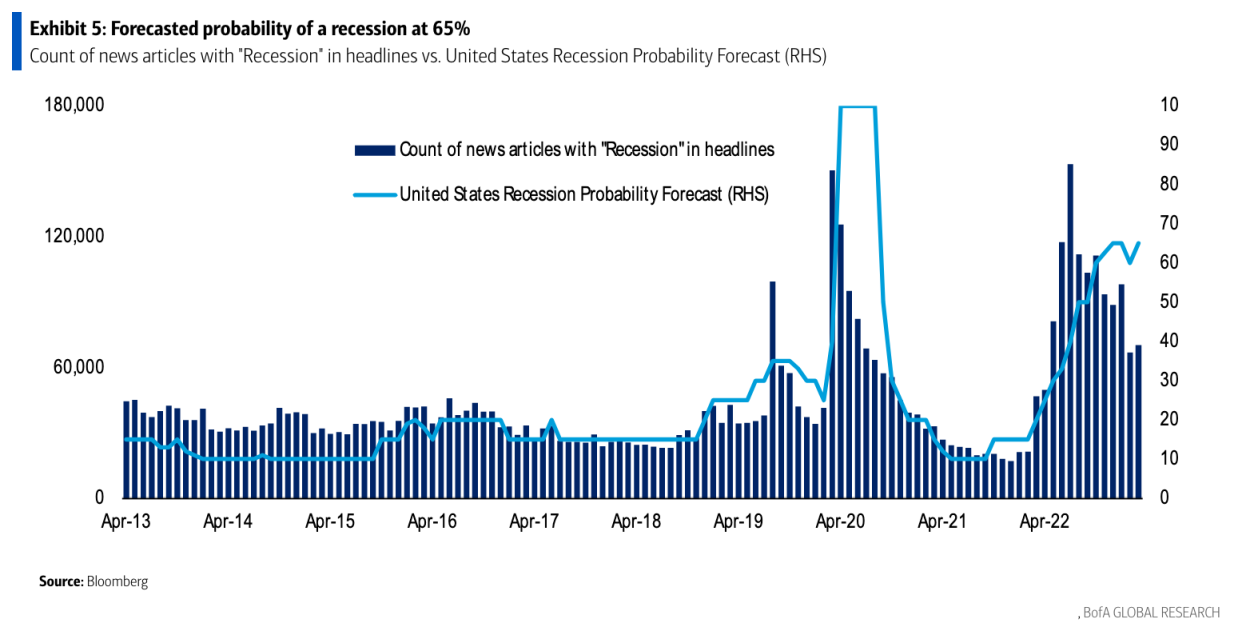

"The good news is everyone is talking about the bad news," Subramanian wrote. "News trends and recession likelihood barometers are at levels only seen during actual recessions."

The risk with recessions, in general, is that economic downturns surface events you hadn't expected.

Like, say, the collapse of several regional banks as interest rates torpedo their investment portfolios many investors didn't really know existed.

The Wall Street conventional wisdom on this count is that just because we haven't had a recession, or seen more consequential fallout from the Federal Reserve's rate hikes than SVB's collapse, doesn't mean it won't happen.

But if "everyone knows" a recession is pending, the question is not about what the recession brings but what happens next?

It is also notable that in the aggregate Bank of America's team still expects the S&P 500 to finish the year below where it stands today. As mentioned above, the firm's year-end price target for the index is 4,000. As of Monday's close, the S&P 500 stood at 4,137.

And that forecasting a ~2% drop in the stock market passes for bullish commentary today perhaps speaks loudest of all.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance