Should I Put My Bonus Into My 401(k)?

If you received a bonus and you’re wondering what to do with the bonus money, you’re not alone. Investing your bonus money in a tax-advantaged retirement account like a 401(k) has some tangible advantages. Not only will the extra cash help your nest egg to grow, you could also see some potential tax benefits.

Of course, we live in a world of competing financial priorities. You could also pay down debt, spend the money on something you need, save for a near-term goal — or splurge! The array of choices can be exciting — but if a secure future is your top goal, it’s important to consider a 401(k) bonus deferral.

Receiving a Bonus Check

First, a practical reminder. When you get a bonus check, it may not be in the amount that you expected. This is because bonuses are subject to income tax withholding. Knowing how your bonus is taxed can help you understand how much you’ll end up with so you can determine what to do with the money that’s left, such as making a 401(k) bonus contribution. The IRS considers bonuses as supplemental wages rather than regular wages.

Ultimately, your employer decides how to treat tax withholding from your bonus. Employers may withhold 22% of your bonus to go toward federal income taxes. But some employers may add your whole bonus to your regular paycheck, and then tax the larger amount at normal income tax rates. If your bonus puts you in a higher tax bracket for that pay period, you may pay more than you expected in taxes.

Also, your bonus may come lumped in with your paycheck (not as a separate payout), which can be confusing.

Whatever the final amount is, or how it arrives, be sure to set aside the full amount while you weigh your options — otherwise you might be tempted to spend it.

What to Do With Bonus Money

There’s nothing wrong with spending some of your hard-earned bonus from your compensation. One rule of thumb is to set a percentage of every windfall (e.g. 10% or 20%) — whether a bonus or a birthday check — to spend, and save the rest.

To get the most out of a bonus, though, many people opt for a 401k bonus deferral and put some or all of it into their 401(k) account. The amount of your bonus you decide to put in depends on how much you’ve already contributed, and whether it makes sense from a tax perspective to make a 401(k) bonus contribution.

Contributing to a 401(k)

The contribution limit for 401(k) plans in 2024 is $23,000; for those 50 and older you can add another $7,500, for a total of $30,500. The contribution limit for 401(k) plans in 2023 is $22,500; for those 50 and older you can add another $7,500, for a total of $30,000. If you haven’t reached the limit yet, allocating some of your bonus into your retirement plan can be a great way to boost your retirement savings.

In the case where you’ve already maxed out your 401(k) contributions, your bonus can also allow you to invest in an IRA or a non-retirement (i.e. taxable) brokerage account.

Contributing to an IRA

If you’ve maxed out your 401k contributions for the year, you may still be able to open a traditional tax-deferred IRA or a Roth IRA. It depends on your income.

In 2024, the contribution limit for traditional IRAs and Roth IRAs is $7,000; with an additional $1,000 if you’re 50 or older. In 2023, the contribution limit for traditional IRAs and Roth IRAs is $6,500; with an additional $1,000 if you’re 50 or older. But if your income is over $161,000 (for single filers) or over $240,000 (for married filing jointly) in 2024, you aren’t eligible to contribute to a Roth. For 2023, you can’t contribute to a Roth if your income is over $153,000 (for single filers) or over $228,000 (for married filing jointly). And while a traditional IRA doesn’t have income limits, the picture changes if you’re covered by a workplace plan like a 401(k).

If you’re covered by a workplace retirement plan and your income is too high for a Roth, you likely wouldn’t be eligible to open a traditional, tax-deductible IRA either. You could however open a nondeductible IRA. To understand the difference, you may want to consult with a professional.

Contributing to a Taxable Account

Of course, when you’re weighing what to do with bonus money, you don’t want to leave out this important option: Opening a taxable account.

While employer-sponsored retirement accounts typically have some restrictions on what you can invest in, taxable brokerage accounts allow you to invest in a wider range of investments.

So if your 401(k) is maxed out, and an IRA isn’t an option for you, you can use your bonus to invest in stocks, bonds, exchange-traded funds (ETFs), mutual funds, and more in a taxable account.

Deferred Compensation

You also may be able to save some of your bonus from taxes by deferring compensation. This is when an employee’s compensation is withheld for distribution at a later date in order to provide future tax benefits.

In this scenario, you could set aside some of your compensation or bonus to be paid in the future. When you defer income, you still need to pay taxes later, at the time you receive your deferred income.

Your Bonus and 401(k) Tax Breaks

Wondering what to do with a bonus? It’s a smart question to ask. In order to maximize the value of your bonus, you want to make sure you reduce your taxes where you can.

One method that’s frequently used to reduce income taxes on a bonus is adding some of it into a tax-deferred retirement account like a 401(k) or traditional IRA. The amount of money you put into these accounts typically reduces your taxable income in the year that you deposit it.

Here’s how it works. The amount you contribute to a 401(k) or traditional IRA is tax deductible, meaning you can deduct the amount you save from your taxable income, often lowering your tax bill. (The same is not true for a Roth IRA or a Roth 401(k), where you make contributions on an after-tax basis.)

The annual contribution limits for each of these retirement accounts noted above may vary from year to year. Depending on the size of your bonus and how much you’ve already contributed to your retirement account for a particular year, you may be able to either put some or all of your bonus in a tax-deferred retirement account.

It’s important to keep track of how much you have already contributed to your retirement accounts because you don’t want to put in too much of your bonus and exceed the contribution limit. In the case where you have reached the contribution limit, you can put some of your bonus into other tax deferred accounts including a traditional IRA or a Roth IRA.

How Investing Your Bonus Can Help Over Time

Investing your bonus may help increase its value over the long-run. As your money potentially grows in value over time, it can be used in many ways: You can stow part of it away for retirement, as an emergency fund, a down payment for a home, to pay outstanding debts, or another financial goal.

While it can be helpful to have some of your bonus in cash, your money is typically better in a savings or investment account where it has the potential to work for you. If you start investing your bonus each year in either a tax-deferred retirement account or non-retirement account, this could help you save for the future.

Investing for Retirement With SoFi

The yearly question of what to do with a bonus is a common one. Just having that windfall allows for many financial opportunities, such as saving for immediate needs — or purchasing things you need now. But it may be wisest to use your bonus to boost your retirement nest egg — for the simple reason that you may stand to gain more financially down the road, while also potentially enjoying tax benefits in the present.

The fact is, most people don’t max out their 401(k) contributions each year, so if you’re in that boat it might make sense to take some or all of your bonus and max it out. If you have maxed out your 401(k), you still have options to save for the future via traditional or Roth IRAs, deferred compensation, or investing in a taxable account.

Keeping in mind the tax implications of where you invest can also help you allocate this extra money where it fits best with your plan.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below: Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by email customer service at investsupport@sofi.com. Please read the prospectus carefully prior to investing.

Shares of ETFs must be bought and sold at market price, which can vary significantly from the Fund’s net asset value (NAV). Investment returns are subject to market volatility and shares may be worth more or less their original value when redeemed. The diversification of an ETF will not protect against loss. An ETF may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

More from MediaFeed:

401(k) Contribution Limits 2024 vs 2023: Are You Contributing Enough?

Once you set up your retirement plan at work, the next natural question is: How much to contribute to a 401(k)? While there’s no ironclad answer for how much to save in your employer-sponsored plan, there are some important guidelines that can help you set aside the amount that’s right for you, such as the tax implications, your employer match (if there is one), the stage of your career, your own retirement goals, and more.

Andrii Zastrozhnov/istockphoto

Like most tax-advantaged retirement plans, 401(k) plans come with caps on how much you can contribute. The IRS puts restrictions on the amount that you, the employee, can save in your 401(k); plus there is a cap on total employee-plus-employer contributions.

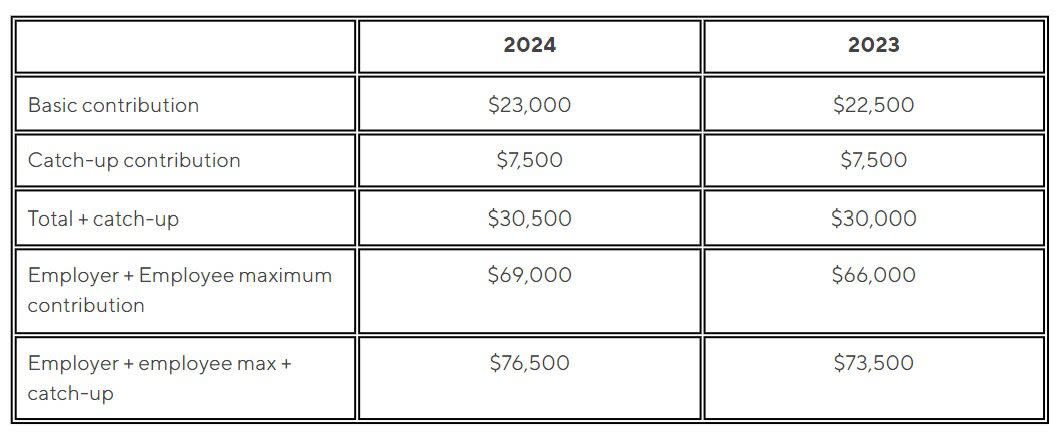

For tax year 2024, the contribution limit is $23,000, with an additional $7,500 catch-up provision for those 50 and older, for a total of $30,500. The combined employer-plus-employee contribution limit for 2024 is $69,000 ($76,500 with the catch-up amount).

Those limits are up from tax year 2023. The 401(k) contribution limit in 2023 is $22,500, with an additional $7,500 catch-up provision for those 50 and older, for a total of $30,000. The combined employer-plus-employee contribution limit for 2023 is $66,000 ($73,500 with the catch-up amount).

Sofi

Next you may be thinking, now I know the retirement contribution limits, but how much should I contribute to my 401(k)? Here are some guidelines to keep in mind as you’re deciding on your contribution amount.

When You’re Starting Out in Your Career

At this stage, you may be starting out with a lower salary and you also likely have commitments to pay for, like rent, food, and maybe student loans. So you may decide to contribute a smaller amount to your 401(k). If you can, however, contribute enough to get the employer match, if your employer offers one.

Here’s how it works: Some employers offer a matching contribution, where they “match” part of the amount you’re saving and add that to your 401(k) account. A common employer match might be 50% up to the first 6% you save.

In that scenario, let’s say your salary is $100,000 and your employer matches 50% of the first 6% you contribute to your 401(k). If you contribute up to the matching amount, you get the full employer contribution. It’s essentially “free” money, as they say.

To give an example, if you contribute 6% of your $100,000 salary to your 401(k), that’s $6,000 per year. Your employer’s match of 50% of that first 6%, or $6,000, comes to $3,000 for a total of $9,000.

Liubomyr Vorona/istockphoto

At this stage of life you likely have a lot of financial obligations such as a mortgage, car payments, and possibly child care. It may be tough to also save for retirement, but it’s important not to fall behind. Try to contribute a little more to your 401(k) each year if you can — even 1% more annually can make a difference.

That means if you’re contributing 6% this year, next year contribute 7%. And the year after that bump up your contribution to 8%, and so on until you reach the maximum amount you can contribute. Some 401(k) plans have an auto escalation option that will automate the extra savings for you, to make the process even easier and more seamless. Check your plan to see if it has such a feature.

Drazen Zigic/istockphoto

Once you reach age 50, you’ll likely want to figure out how much you might need for retirement so you have a specific goal to aim for. To help reach your goal, consider maxing out your 401(k) at this time and also make catch-up contributions if necessary.

Maxing out your 401(k) means contributing the full amount allowed. For 2024, that’s $23,000 for those 49 and under. If, at 50, you haven’t been contributing as much as you wish you had in previous years, you can also contribute the catch-up contribution of $7,500. So you’d be saving $30,500 for retirement in your 401(k) in 2024. With the potential of compounding returns, maxing out your 401(k) until you reach full retirement age of 67 could go a long way to helping you achieve financial security in retirement.

Liubomyr Vorona/istockphoto

The earlier you start saving for retirement, the more time your money will potentially have to grow, thanks to the power of compounding returns, as mentioned above.

In addition, by increasing your 401(k) contributions each year, even by just 1% annually, the savings could really add up. For instance, consider a 35-year-old making $60,000 who contributes 1% more each year until their full retirement age of 67. Assuming a 5.5% annual return and a modest regular increase in salary, they could potentially save more than an additional $85,000 for retirement.

That’s just an example, but you get the idea. Increasing your savings even by a modest amount over the years may be a powerful tool in helping you realize your retirement goals.

In addition to the general ideas above for the different stages of your life and career, it’s also wise to think about taxes, your employer contribution, your own goals, and more when deciding how much to contribute to your 401(k).

1. The Tax Effect

The key fact to remember about 401(k) plans is that they are tax-deferred accounts, and they are considered qualified retirement plans under ERISA (Employment Retirement Income Security Act) rules.

That means: The money you set aside is typically deducted from your paycheck pre-tax, and it grows in the account tax free — but you pay taxes on any money you withdraw. (In most cases, you’ll withdraw the money for retirement expenses, but there are some cases where you might have to take an early 401(k) withdrawal. In either case, you’ll owe taxes on those distributions.)

The tax implications are important here because the money you contribute effectively reduces your taxable income for that year, and potentially lowers your tax bill.

Let’s imagine that you’re earning $100,000 per year, and you’re able to save the full $23,000 allowed by the IRS for 2024. Your taxable income would be reduced from $100,000 to $77,000, thus putting you in a lower tax bracket.

Ridofranz/istockphoto

One rule-of-thumb is to save at least 10% of your annual income for retirement. So if you earn $100,000, you’d aim to set aside at least $10,000. But 10% is only a general guideline.

In some cases, depending on your income and other factors, 10% may not be enough to get you on track for a secure retirement, and you may want to aim for more than that to make sure your savings will last given the cost of living longer.

For instance, consider the following:

- Are you the sole or primary household earner?

- Are you saving for your retirement alone, or for your spouse’s/partner’s retirement as well?

- When do you and your spouse/partner want to retire?

If you are the primary earner, and the amount you’re saving is meant to cover retirement for two, that’s a different equation than if you were covering just your own retirement. In this case, you might want to save more than 10%.

However, if you’re not the primary earner and/or your spouse also has a retirement account, setting aside 10% might be adequate. For example, if the two of you are each saving 10%, for a combined 20% of your gross income, that may be sufficient for your retirement needs.

All of this should be considered in light of when you hope to retire, as that deadline would also impact how much you might save as well as how much you might need to spend.

Tijana Simic/istockphoto

What sort of retirement do you envision for yourself? Even if you’re years away from retirement, it’s a good idea to sit down and imagine what your later years might look like. These retirement dreams and goals can inform the amount you want to save.

Goals may include thoughts of travel, moving to another country, starting your own small business, offering financial help to your family, leaving a legacy, and more.

You may also want to consider health factors, as health costs and the need for long-term care can be a big expense as you age.

Dmitry Belyaev/istockphoto

It can be hard to prioritize saving if you have debt. You may want to pay off your debt as quickly as possible, then turn your attention toward saving for the future.

The reality is, though, that debt and savings are both priorities and need to be balanced. It’s not ideal to put one above the other, but rather to find ways to keep saving even small amounts as you work to get out of debt.

Then, as you pay down the money you owe — whether from credit cards or student loans or another source — you can take the cash that frees up and add that to your savings.

KucherAV/istockphoto

Many people wonder how much to contribute to a 401(k). There are a number of factors that will influence your decision. First, there are the contribution limits imposed by the IRS. In 2024, the maximum contribution you can make to your 401(k) is $23,000, plus an additional $7,500 catch-up contribution if you’re 50 and up

.

While few people can start their 401(k) journey by saving quite that much, it’s wise, if possible, to contribute enough to get your employer’s match early in your career, then bump up your contribution amounts at the midpoint of your career, and max out your contributions as you draw closer to retirement, if you can.

Another option is follow a common guideline and save 10% of your income beginning as soon as you can swing it. From there, you can work up to saving the max. And remember, you don’t have to limit your savings to your 401(k). You may also be able to save in other retirement vehicles, like a traditional IRA or Roth IRA.

Of course, a main determination of the amount you need to save is what your goals are for the future. By contemplating what you want and need to spend money on now, and the quality of life you’d like when you’re older, you can make the decisions that are best for you.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest encompasses two distinct companies, with various products and services offered to investors as described below: Individual customer accounts may be subject to the terms applicable to one or more of these platforms.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.