Prices Surge 5% as Inflation Rises with No End in Sight – May’s Consumer Price Index, By the Numbers

The Labor Department has released its latest Consumer Price Index, revealing that consumer prices jumped in May by the most in any 12-month period since 2008. Overall, there was an increase of 5.4% from May of 2020 and an additional 0.6% increase on top of the 0.8% increase in April 2021.

See: Inflation’s Ups and Downs: How It Impacts Your Wallet

Find: What $1 Could Buy the Year You Were Born

Rising prices and mounting fears of enduring inflation have been the main focus of Wall Street since the United States rolled out its first vaccines and the economic recovery began. The combination of supply-side pressures still squeezed by effects of the pandemic and historic surges in demand have driven prices up in almost every major consumer sector.

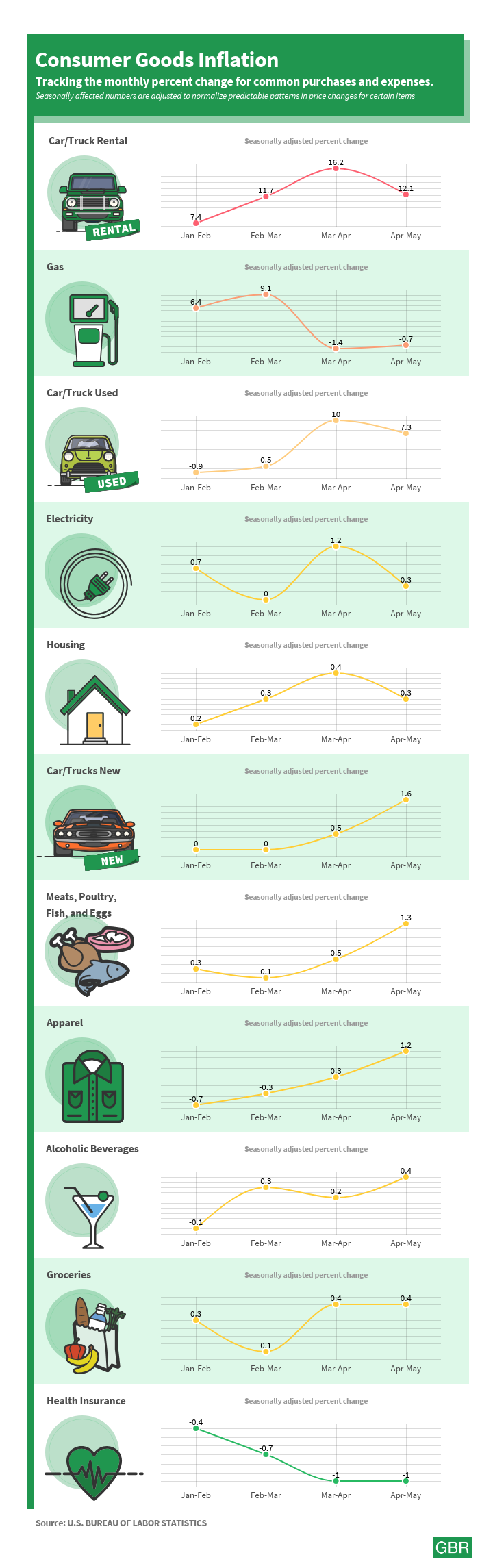

But which prices are increasing and why? Take a deep dive in the infographic below.

See: Inflation Hits Purchases of Used Cars, Bacon, Citrus Fruit and Airline Fares the Most

Find: Understanding Interest Rates — How They Affect You and the US Market

Both the Fed and economists alike have been touting for months that the recent increase in prices is a transitory side effect of the pandemic, and should correct itself in the near future.

Wall Street maintains its concerns though, and after the last CPI report was released in May, markets closed far lower than expected with traders exiting their positions in growth-led stocks and favoring cyclicals that stand to improve along with the economy. A similar impact is expected after this June release.

Find out what’s going on in each economic sector below.

Energy (i.e., Gas) Prices

As with all consumer goods, petroleum products too are governed by the laws of supply and demand. Many Americans have been baffled as to why gas prices have increased so sharply over the last few months, particularly when the U.S. produces much of its own oil at home. While the gasoline index gasoline index declined 0.7% in May, prices have remained higher than recent averages.

Related: Gas Prices Are on the Rise — And Not Because of the Pipeline Hack

There are several factors maintaining these high levels, including:

Increased Demand: The rollout of vaccines and the gradual return to semblance of normalcy, has largely driven the large and sudden increase in demand for more oil. The easing of COVID-19 restrictions has led Americans to return to work, travel and generally move more than they were allowed to in the past 12 months. This return though largely happened all at once – imagine for example a local highway going from 20 to 20,000 cars in about a month or two and that is the scope of increased demand the oil industry had to deal with.

OPEC Supply Restrictions: Unique to the oil industry are the controlling forces of the OPEC+ countries that largely determine the world’s oil supply – and prices. In April of 2020, members of the Organization of Petroleum Exporting Countries and 10 non-OPEC partner countries collectively known as OPEC+ agreed to reduce oil production in response to rapidly increasing global inventories in the first quarter of 2020. At the same time, the unconfined spread of the coronavirus was also contributing to a steep decline in demand for oil products, specifically as airlines were forced to largely shut down. There is currently an agreement in place to taper production through April 2022. This has presented a problem though, as demand has suddenly increased and the OPEC countries are purposely keeping their production low to get rid of the oil surplus they still have from the early days of the pandemic, Bloomberg reports. Their efforts have paid off as crude oil returned to pre-pandemic price levels. Recently, the participating countries have agreed to ease some production restrictions as demand has picked back up to a level they believe warrants new production. This push-and-pull dance between demand and OPEC country supply has long driven gas prices, but its current movements have been unique to a surplus that was not depleted on time due to the pandemic.

Gas prices are affected by these confluence of factors, and you might have seen them dip a bit in March and April with another uptick in the past few weeks. They are expected to remain fairly elevated.

See: OPEC Increases Production as Oil Prices Begin to Impact Summer Travel Plans

Find: Flying vs. Driving: Which Is More Cost Effective for Travel This Year?

Food Costs

The prices for food at home, meaning food you buy at the grocery store, increased 0.4% over the past 12 months as of May. All six major grocery store categories increased over the period, mostly due to the index for meats, poultry, fish, and eggs, which increased 1.3% over the month. In particular, the beef index rose 2.3% in May, its largest increase since June 2020. Economists say that rising gas prices, a spike in commodity prices, increased imports by China, and heavy Midwest crop damage have all contributed to rising costs in food in recent months, CNBC reports. Much of the supply chain disruptions that have caused issues throughout the world have also caused severe inefficiencies to the transportation of food. CNBC adds that supply chains are still largely inefficient at this time, and we’re still dealing with the fallout of the pandemic.

This also caused the prices for food away from home to rise 0.6% seeing a total of a 4% increase in the past year. As gas prices and transportation costs increase, this eventually gets passed on to consumers, especially for things like food.

Used Cars and Trucks

Prices for used cars and trucks have increased a whopping 29.7% over the past 12 months period ending April. The main reason for this is scarcity. Almost all the regular providers of used cars for the market have been affected by the pandemic. Not as many new cars on the market mean fewer cars are available to be traded in. People tightening their spending also means lower demand for newer cars, and more lease renewals. With tourism coming to a virtual halt, rental car companies are actually buying used cars themselves instead of providing them. All of these factors have contributed to one of the largest price increases for this market in history.

Additionally, a global microchip shortage has recently made it even more difficult to buy a new car, leading more people to used vehicles, and driving the price up even further.

CBS predicts that prices won’t normalize until late this year or early 2022, as supply is slated to remain thin.

See: 25 Things You Should Always Do Before Buying a Used Car

Find: The Most Reliable Car Brands on the Road

Travel

Despite global travel coming to a standstill for much of 2021, prices for car and truck rental rose another 7.3%. Prices for lodging away from home, like hotel and motel rooms, were also up. Increases in oil prices and surges in demand are largely the cause for the increase. As for car and truck rentals, the mass exodus of people out of urban areas during the pandemic and inot less populated states and suburbs caused a shortage of available vehicles and a spike in prices.

Airline fares saw an increase of 7.0% in May, in addition to increasing 10.2 % in April.

Looking Forward

Many different stressors have caused these recent price swings, but overall the aftershocks of the pandemic are largely to blame for throwing the global economy off balance. If anything, the crisis has highlighted how interconnected the international economy truly is, and how delicate its balance remains in the face of demand shocks. No one major sector emerged immune from the pandemic’s wrath – especially food, an essential item with sustained demand throughout the pandemic, was affected as supply-chains are so reliant on international cooperation and movement.

Weak jobs reports performance coupled with unrelenting price increases has forced the previously staunch attitude of government agencies to recently turn. Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen have largely maintained their opinions that an increase in prices is temporary and will taper off as the economy recovers. Recently though, Yellen ceded to market pressures and stated that it would be a possibility that rates may need to rise to make sure the economy doesn’t overheat.

See: Interest Rates May Need to Go Up – Yellen’s Comments And How They Affect You

Find: How Should Your Budget Change With Increasing Inflation?

As prices have risen in almost every major consumer sector, it could be argued that the overheating has already taken place.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Prices Surge 5% as Inflation Rises with No End in Sight – May’s Consumer Price Index, By the Numbers