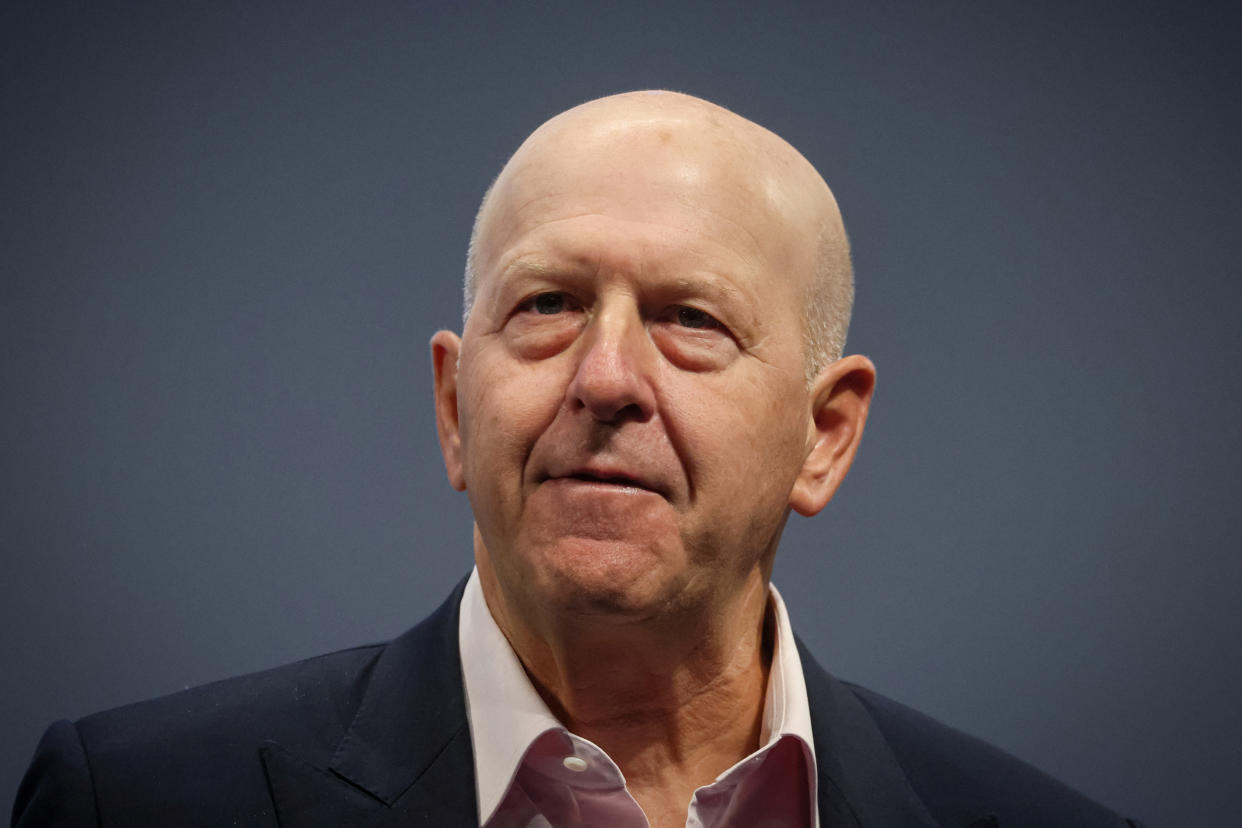

The pressure on Goldman CEO David Solomon is not letting up in 2024

David Solomon endured his most challenging year as CEO in 2023, and the pressure on the Goldman Sachs (GS) CEO is not letting up in 2024.

Two prominent proxy advisory firms are advising stockholders to cast votes this month that would limit the power of Solomon, with results due to be tallied at the company’s annual meeting on April 24.

The proposal that garnered a stamp of approval from Institutional Shareholder Services (ISS) and Glass, Lewis & Co. would split the CEO and chairman roles, both currently occupied by Solomon. A similar proposal last year did not pass, winning only 16% of votes.

"Shareholders would benefit from more independent oversight," ISS wrote in a report, citing "missteps and steep losses” associated with a push into consumer banking that "seem to have trickled into further human capital issues."

Glass Lewis is separately suggesting that stockholders also vote against Goldman’s executive pay plan due to a "significant disconnect between pay and performance." ISS provided "cautionary support" for the executive pay plan.

Solomon’s 2023 compensation rose 24% — to $31 million — despite a profit decline of the same amount.

Not only is that up from the $25 million he was awarded in 2022, it is more than his rivals Brian Moynihan, Charles Scharf, and Jane Fraser made at Bank of America (BAC) and Wells Fargo (WFC), and Citigroup (C).

Only JPMorgan Chase (JPM) CEO Jamie Dimon and outgoing Morgan Stanley (MS) CEO James Gorman were awarded more for their 2023 performance.

Other top executives at Goldman, including COO John Waldron, also saw their pay rise. Waldron’s cash bonus went up 30% to $11.26 million.

Recommendations from ISS and Glass Lewis carry a lot of weight with some stockholders, although many of the largest investors in American companies have their own teams that evaluate such proposals.

Goldman's largest stockholders are Vanguard, BlackRock (BLK), and State Street (STT).

The compensation increase for Solomon was a sign that board support for Solomon had perhaps solidified after he spent much of 2023 attempting a tricky retrenchment from consumer lending while focusing the firm on its core strengths of trading, asset management, and investment banking.

Its full-year net income of $8.52 billion was the worst mark for Goldman since 2019, Solomon's first full year in charge, as dealmaking also slowed across Wall Street. The firm did, however, post a sizable gain in the fourth quarter as equities trading and wealth management rose.

A lot is in flux at Goldman as key executives depart, raising new questions about the race to eventually succeed Solomon.

One surprise exit in 2024 is Jim Esposito, who had been co-head of Goldman’s global banking and markets division and is leaving after nearly three decades. Esposito had been viewed on Wall Street as among the possible successors to Solomon.

Another recent departure in March was Stephanie Cohen, global head of its platform solutions division.

Even the board of Goldman is changing. This year, ex-Goldman CFO David Viniar was appointed as the board’s lead director to replace Adebayo Ogunlesi, who announced he would step down after selling his infrastructure investment company to BlackRock.

Solomon has one more chance before the company’s annual meeting to show investors he is turning things around. Goldman will report its first quarter earnings on April 15.

Year to date, the stock is up by roughly 5%. Since Solomon was named CEO in October 2018, its stock has risen 83%.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance