Can I Pay a Credit Card Bill With Cash?

While many people use cash less often today, you can still use it to pay a credit card bill at some ATMs and retail locations or by using mail technique (money orders; no $20s in the envelope).

You might want to pay your credit card in cash if you work in a cash-based business, or a relative hands you an envelope of $20 bills as a birthday gift. It’s good to know that you can pay your plastic with that money at some ATMs and retail locations or by sending a money order.

When Should I Pay My Credit Card Bill?

Before diving into ways to pay your credit card bill, consider gaining some knowledge about the billing cycle so you can better understand how and when to pay a credit card bill.

A credit card’s billing cycle is the time between two statement closing dates. This period is usually anywhere from 28 to 31 days.

Another important tidbit about credit cards: A grace period for a credit card exists between the end of the statement closing date and your credit card payment due date. During a grace period, you aren’t charged any interest.

You always want to pay your credit card bill (at least the minimum payment) by your payment due date — for good reasons that you’ll learn about next.

Why You Should Pay Your Credit Card Bill on Time

As mentioned, you should always pay your credit card bill by the payment due date to avoid negatively impacting your credit score. Here’s what you need to now:

Payment history is usually the largest single contributor to your credit score at 35%. Your score may dip if you fall behind on your credit card payments.

If you continue being late paying your credit card, your account could enter delinquency and then default. After you’ve defaulted on a credit card, your card will likely go to collections, which can seriously injure your credit score.

If you can manage to pay your credit card on time and in full, you won’t owe any interest charges. So those purchases you put on your card won’t cost anything in interest.

A sober truth: Americans dole out an average of $120 billion in credit card interest fees a year. Paying off your balance in full each cycle puts your share of that money back into your pocket.

Why You Should Pay Your Credit Card Early

You’ll carry a lower balance when you pay your credit card before the due date. This means more available credit, which reduces your credit utilization ratio. (That’s the percentage of your credit limit that your current balance accounts for.) And the lower your credit utilization, the better.

Your payment history gets reported to the credit bureaus, and a lower credit utilization figure could help build your credit score.

If you’re carrying a balance, you’re charged interest daily on your balance. So, a lower balance by making an early payment means you’ll be paying less on interest fees.

Another reason why it’s a good idea to pay your credit card before the payment date is that it increases your available credit. If you were planning to make a major purchase on your card, you’ll usually have to spend within the credit available.

How Can I Pay My Credit Card Bill?

There are several main ways you can pay your credit card bill. Take a closer look at your options here.

Online Payments

Many credit card networks and companies offer the option to pay online. You can do this either through the card’s mobile app or by logging on to your account on your computer.

To make sure you’re always on top of your payments, you can opt for auto payment, which you may see called autopay. You can link a bank account, which sets you up for recurring monthly payments. You can choose whether you want to pay the minimum, full, or custom amounts each month. That way, you won’t have to quibble over whether you’ll remember to pay your bills. You just want to be sure you have enough money in your account to cover that payment so you can avoid the headache and fees that overdraft can trigger.

Over the Phone

Another way to pay your credit card bill is to call the number on the back of your credit card (or look for the customer service number online) and make a payment over the phone. Usually, this is an automated service, and you provide your bank routing and account number.

While this is a fairly convenient way to make a credit card payment, it’s easy to forget a payment due date and let it slip. There may also be a surcharge for paying this way.

By Mail

If you get paper credit card statements in the mail, you can also send payment via a check. Should you decide to go this route, you’ll need to be sure the check arrives to the credit card issuer before the cutoff time. It needs to arrive by 5pm the day it’s due or be deemed late.

With Cash

Yes, when your credit card bill is due, it’s entirely possible to pay using cash. If you’re wondering how you can pay a credit card with cash, there are typically three ways:

By making a cash payment through an ATM. You probably can only do so at the credit card issuer’s ATM. You select the option to send cash, then deposit the money at the ATM.

In-person, provided the credit card issue has physical branches.

By sending a money order (this is the secure mail technique alluded to above; don’t put cash in the mail).

Can You Pay a Credit Card With Another Credit Card?

Typically, you can’t use a credit card to pay off another credit card. In other words, you can’t link your credit card and make an online payment, nor can you swipe a credit card to make an in-person payment.

However, with a balance transfer, you move the balance from one card to another, usually to save on interest. In this way, you are technically using a new credit card to nix the balance from an older card, then paying the balance on the new card. This might be helpful if you are paying off a large credit card bill.

Another option could be getting a cash advance on one credit card to pay another. This, however, will usually involve a high interest rate and fees, so proceed with caution.

Should You Carry a Balance on Your Credit Card?

Carrying a balance means shouldering interest fees. Plus, you’re increasing your credit utilization, which can reduce your score. In a perfect world, you should aim to pay off your balance in full each billing cycle.

However, if you need to carry a balance on your credit card, make it a top priority to make the minimum payments and pay on time, all the time. Getting that bill paid on time, as noted above, can help build your credit.

When Do You Receive Your Credit Card Bill?

If you get paper statements, you can expect to receive your credit card statement at least 21 days before your bill is due. This is legally required of credit card issuers. In some cases, they might send you your bill before the 21-day mark.

If you opt for paperless statements, you can view your bill as soon as the billing cycle ends. Downloading your credit card bill from your card issuer’s app at the end of a billing period is also an option — and can be the most convenient one.

Tips for Paying Credit Card Bills

Staying on top of your credit card bill is an important part of your financial life. Credit card debt carries high interest in most situations and can spiral upward if you aren’t diligent about monitoring and paying your balance.

Set up autopay. The easiest way to make sure you pay your credit card on time is to set up automated credit card payments. You only need to do it once, and you can choose either to make the minimum payment, pay your monthly statement balance in full, or pick a specific amount.

Monitor your accounts. Mistakes can and do happen. To make sure there are no errors or fraudulent activity, comb through your transactions regularly. When looking over your statements, besides transactions you should see any refunds, credits, fees, your minimum payment, and how much of your balance remains.

Document cash payments. If you do decide to pay with cash, remember to get a receipt and make sure the payment shows up on your credit card statement.

Always pay on time. Make it a top priority to stay on top of your credit card bills. If you’re struggling to keep up, consider reaching out to your credit card issuer and seeing if they’re able to move your payment due date or temporarily lower your minimum monthly payment.

Make early payments. You can also break up your credit card payments in chunks, and pay a portion before your due date. This will increase your available credit limit, and lower your credit usage, which can help your credit. Plus, you’ll be paying less on interest. One method you can try is the 15/3 credit card payment method. You split your credit card payment in half. Then, you pay half 15 days before the due date, and the remaining half three days before. For example, your bill is due on the 24th of the month. And this month’s balance is $700. In this case, you pay $350 on the 9th of the month, and the other $350 on the 21st of the month. This can help you knock down your debt faster plus lower your credit utilization.

Make more than the minimum payment. To pay off your debt quicker and cut down on how much interest you pay, aim to pay more than your minimum. If you receive a tax refund or a work bonus, lucky you! When wondering what to do with a windfall, why not commit to putting at least part of it toward your credit card payments?

Take action if your credit card debt is getting too high. If you are struggling to pay off your debt or even the minimum due, it can be a wise move to look into such options as a balance transfer credit card, which will give you a period or no or low interest to play catch-up; using a lower-interest personal loan to pay off the card’s balance; or working with a nonprofit, well-regarded credit counseling agency to find solutions.

The Takeaway

It is possible to pay a credit card bill with cash. To do so, you will likely want to find the card issuer’s ATMs or branches, or you could use a money order. That said, whenever dealing with high-interest credit card debt, it’s wise to educate yourself about how the billing cycles and due dates work, so you can pay off the debt as well as possible and avoid snowballing interest charges. That can help protect your financial status.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

More from MediaFeed:

The Average Credit Card Debt by State

Millions of Americans continue to struggle with credit card debt. The average credit card debt in America is $5,982 as of July 2023, according to a new report from TransUnion®.Out of the 50 states, Alaska has the highest average credit card debt ($7,394), while Wisconsin has the lowest average ($4,843), data show.More than 6 million cardholders are at least 30 days past due on a minimum payment, according to TransUnion’s credit card delinquency data.Your credit card balance is your credit card debt. Making transactions on your credit card is a liability that eventually needs to be repaid. Below we highlight the average credit card debt in all 50 states and explain why making minimum payments each billing cycle may not be right for you.

Damir Khabirov / iStock

Consumer credit card debt in the United States exceeds $1 trillion as of the second quarter (Q2) of 2023, according to the Federal Reserve Bank of New York.The average American credit card debt increased to $5,982 in July 2023 (it was $5,932 in June 2023 and $5,350 in July 2022), according to TransUnion, a nationwide credit bureau.Credit card debt can be costly if you’re paying interest charges. The average interest rate on credit cards is 22.16% as of Q2 2023, according to preliminary Federal Reserve data on credit card accounts assessed interest. (Learn more atHow Many Credit Cards Should I Have?).

TransUnion publishes U.S. credit card debt data every month in all 50 states and the District of Columbia. We’re tracking the data as it becomes available and then ranking the average credit card debt by state in descending order using TransUnion’s recent industry snapshot (July 2023):

The nation’s capital is not a state, but the District of Columbia has one of the highest average credit card debt balances in the United States. The average credit card debt in Washington, D.C., stands at $7,022 per consumer as of July.

Alaska is the largest state in the country in terms of its geographical boundaries (586,412 square miles). It also leads all 50 states with the highest average credit card debt in the nation. Cardholders in Alaska have an average credit card balance of $7,394 as of July.

Hawaii sports tropical climate and active volcanoes. This state of islands in the Pacific is also known for its relatively high average credit card debt. Consumers in the Aloha State have an average credit card balance of $6,720 as of July.

Maryland sits south of the Mason-Dixon line. This Old Line State has a relatively high credit card debt in the USA. The average credit card debt in Maryland stands at $6,650 per consumer as of July.

Nevada may have some issues with gambling debt. This predominantly desert and semiarid state also ranks high in credit card debt. The average credit card debt in Nevada is $6,529 per consumer as of July.

New Jersey is the most densely populated state in the United States. The Garden State also has a high average credit card debt. Cardholders in New Jersey have an average credit card balance of $6,526 as of July.

Virginia enjoys close proximity to the nation’s capital in a region locally nicknamed DMV (District of Columbia, Maryland, and Virginia). Similar to Maryland and Washington, D.C., consumers in the Old Dominion state carry a relatively high average credit card debt in America. Virginia’s average credit card debt stands at $6,523 per consumer as of July.

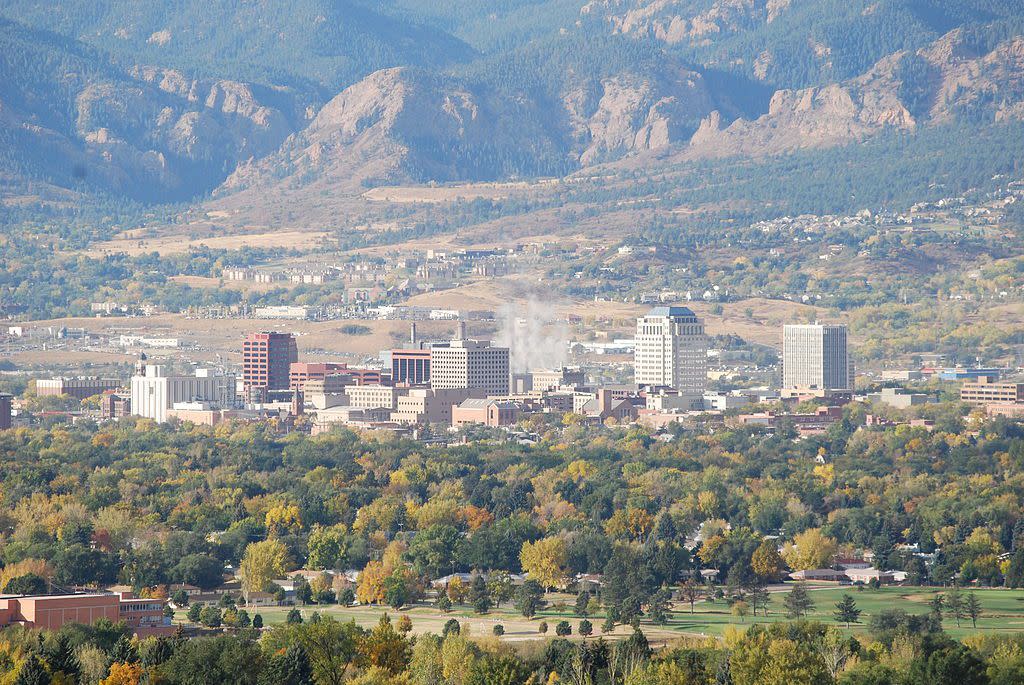

Colorado hosts a large stretch of the Rocky Mountains. The Centennial State also hosts a large amount of credit card debt per consumer. The average credit card debt in Colorado is $6,450 per cardholder as of July.

Texas is one of the largest states in the nation in terms of its geographical boundaries and population. The Lone Star State also has a relatively high average credit card debt in the U.S. The average credit card debt in Texas is $6,397 per consumer as of July.

Nicknamed the Constitution State, Connecticut has the highest average credit card debt in New England. What is the average credit card debt in Connecticut? It’s $6,386 per consumer as of July.

California is the most populous state in the nation with more than 38.9 million people as of Jan. 1, 2023. The Golden State also has one of the highest amounts of credit card debt per consumer. The average credit card debt in California is $6,368 per cardholder as of July.

Georgia produces tons of agricultural goods, but the Peach State also has a relatively high level of credit card debt. The average credit card debt in Georgia is $6,347 per consumer as of July.

Florida is one of the largest states in the nation in terms of population and economic activity. The Sunshine State has more than 22 million residents and a gross domestic product (GDP) of nearly $1.4 trillion as of 2022. The average credit card debt in Florida is $6,336 per consumer as of July.

Washington state borders the Canadian province of British Columbia and carries a relatively high amount of credit card debt per consumer. The average credit card debt in Washington is $6,331 per cardholder as of July.

New York remains one of the largest states in the nation despite its recent decline in population. The average credit card debt in New York is $6,224 per consumer as of July.

Arizona welcomes domestic and international tourism with its Grand Canyon natural landmark and desert climate. The average credit card debt in Arizona is $6,083 per consumer as of July.

Delaware is a relatively small state in terms of its geographical boundaries and population. The First State, however, is one of the bigger states in terms of average credit card debt. The average credit card debt in Delaware is $6,044 per consumer as of July.

Wyoming has the smallest population in the nation (fewer than 600,000 people). But this Mountain West state has a relatively high amount of credit card debt per consumer. The average credit card debt in Wyoming is $5,931 per cardholder as of July.

Massachusetts rests in the heart of New England. The Bay State also has a relatively high amount of credit card debt per consumer. The average credit card debt in Massachusetts is $5,927 per cardholder as of July.

Illinois enjoys its reputation as the Land of Lincoln. This Midwestern state also has a relatively high amount of credit card debt per consumer. The average credit card debt in Illinois is $5,916 per cardholder as of July.

New Hampshire represents one of the smaller states but has a high amount of credit card debt per consumer. The average credit card balance in New Hampshire is $5,888 per cardholder as of July.

Utah has the Great Salt Lake and a smaller average credit card debt than most of the states it borders. The average credit card debt in Utah is $5,834 per consumer as of July.

Oregon carries a lower level of credit card debt per consumer than most of the states it borders. The average credit card debt in Oregon is $5,820 per cardholder as of July.

South Carolina is known for its coastline and beaches. The Palmetto State shares a border with Georgia but has a much smaller scale of credit card debt on average. The average credit card debt in South Carolina is $5,816 per consumer as of July.

North Carolina is known for its colleges, universities, and military bases, among other things. (The Tar Heel State has several state-based student loan forgiveness programs.) The average credit card debt in North Carolina is $5,757 per consumer as of July.

Rhode Island is the smallest state in the country in terms of its geographical area (1,214 square miles). The average credit card debt in Rhode Island is $5,747 per consumer as of July.

Oklahoma is located in the middle of the 48 contiguous states. The Sooner State is also at or near the middle of the pack regarding average credit card debt in America. The average credit card debt in Oklahoma is $5,737 per consumer as of July.

Louisiana sits along the Gulf Coast in the South. The Pelican State is also known as the Creole State and the Sugar State. The average credit card debt in Louisiana is $5,713 per consumer as of July.

Nicknamed the Keystone State, Pennsylvania has a lower amount of credit card debt per consumer compared with its Mid-Atlantic neighbors of New York and New Jersey. The average credit card debt in Pennsylvania is $5,612 per cardholder as of July.

Idaho is nicknamed the Gem State and is known for its potatoes. Average credit card debt per consumer in Idaho is one of the lowest in the Mountain West region. The average credit card balance in Idaho is $5,548 per cardholder as of July.

Well-known for its country music scene, Tennessee has a lower credit card debt per consumer than most of the 50 states. The average credit card balance in Tennessee is $5,516 per cardholder as of July.

Minnesota became the North Star State because of its geographical location in the country’s heartland. The average credit card debt in Minnesota is $5,481 per consumer as of July.

North Dakota has multiple nicknames, including the Flickertail State, Sioux State, and the Peace Garden State. The average credit card debt in North Dakota is $5,471 per consumer as of July.

New Mexico has a lower credit card debt per consumer than each of the neighboring states surrounding it. The average credit card debt in New Mexico is $5,466 per cardholder as of July.

Kansas markets itself as the Sunflower State. The average credit card balance in Kansas is $5,449 per consumer as of July.

Montana is known as America’s Treasure State and Big Sky Country. Montana also has the lowest average credit card debt in the Mountain West region. The average credit card balance in Montana hovers at $5,447 per cardholder as of July.

Missouri is not just any state — it’s the Show Me State. The average credit card debt in Missouri is $5,397 per consumer as of July.

Alabama enjoys a coastline along the Gulf Coast. Known as the Cotton State, Alabama is also known for peanuts. The average credit card debt in Alabama is $5,396 per consumer as of July.

Maine has relatively low credit card debt per consumer compared with other New England states. The Pine Tree State also has among the lowest credit card debt per consumer along the East Coast. The average credit card balance in Maine is $5,369 per cardholder as of July.

Michigan hosts several manufacturers of popular car makes and models. It’s also known as the Wolverine State and the Great Lake State. The average credit card debt in Michigan is $5,353 per consumer as of July.

South Dakota hosts the famous Mount Rushmore National Memorial. The average credit card debt in South Dakota is $5,277 per consumer as of July.

Ohio serves 11.8 million residents as of 2022, making Ohio one of the most populous states in the nation. The Buckeye State also has among the lowest credit card debt per consumer in the United States. The average credit card debt in Ohio is $5,267 per cardholder as of July.

Vermont is known as the Green Mountain State. The average credit card debt in Vermont is $5,259 per consumer as of July.

Arkansas — dubbed the Natural State because of its wildlife, bodies of water, and preserved open space — is a Southern state with a relatively low level of credit card debt per consumer. The average credit card debt in Arkansas is $5,210 per cardholder as of July.

Mississippi is one of the poorest states in the nation, but the cost of living in the Magnolia State is also among the lowest nationwide. The average credit card debt in Mississippi is $5,208 per consumer as of July.

Nebraska produces 81.6% of the nation’s great northern beans as of 2022, according to federal data. The average credit card debt balance in Nebraska is $5,180 per consumer as of July.

Indiana is America’s Hoosier State. The average credit card debt in Indiana is $5,125 per consumer as of July — one of the lowest in the nation.

Kentucky has a relatively low level of credit card debt per consumer. The average credit card debt in Kentucky is $5,088 per cardholder as of July.

West Virginia remains one of the few states that may pay you to move there if you work from home. The average credit card debt in West Virginia is $5,062 per consumer as of July.

Iowa ranks first in the nation in the production of corn for grain. The average credit card debt in Iowa is $4,958 per consumer as of July.

Wisconsin remains the largest cheese producer in the nation, and consumers in America’s Dairyland have the lowest average credit card balances nationwide. The average credit card debt in Wisconsin is $4,843 per cardholder as of July.

csfotoimages/istockphoto

You can find out your credit card balance by reading your credit card statement. Your credit card balance matters because it’s your unpaid credit card debt that you are expected to repay as fast or as slow as you wish.

The slowest way to pay down credit card debt is to make minimum payments each billing cycle. The fastest way to pay down credit card debt is to pay the full statement balance each billing cycle.

Cardholders with a credit card grace period may avoid interest charges on new purchases by paying the statement balance in full each billing cycle.The annual percentage rate (APR) on a credit card can be quite high compared with other consumer lending products. If you make minimum payments each billing cycle, it could take years to pay off the debt and the interest charges could be costly in particular.

How much credit card debt does the average American have? The average American credit card balance is $5,844 per consumer as of May 2023, according to TransUnion data.

Barbara Lorena Vergara/istockphoto

In general, leaving a small balance on your credit card is not the best idea if your goal is to build credit without incurring interest charges.Carrying a small balance may not be right for you if you can afford to pay off your statement balance each billing cycle. Unless you have a 0% introductory APR, you may face interest charges if you pay less than the statement balance.

How To Avoid Credit Card Interest

If your credit card has a grace period, you may avoid credit card interest charges by paying your statement balance in full each billing cycle. You may also want to avoid credit card cash advance transactions if you’re trying to avoid credit card interest charges. (Learn more at Should You Cancel Unused Credit Cards?).

Farknot_Architect/istockphoto

Consumers in all risk tiers use credit cards to buy goods and services. Credit card debt exists across all risk scores, but cardholders with bad credit are more likely to experience serious delinquency.According to TransUnion’s credit card debt data by risk tier (July 2023):

- 18.55% of subprime cardholders fell 90+ days past due

- 1.21% of near prime cardholders fell 90+ days past due

- 0.19% of prime cardholders fell 90+ days past due

- 0.01% of prime plus cardholders fell 90+ days past due

- 0% of super prime cardholders fell 90+ days past due

While it’s interesting to learn the average credit card debt in the U.S., it doesn’t help you much when you’re struggling to pay down your own credit card debt.

Most credit cards are unsecured without collateral. This means credit card account holders typically are not required to make a security deposit. Failing to pay and defaulting on your credit card bills can severely damage your credit.

When you make transactions on a credit card, the transaction activity represents an unpaid debt that you’ll eventually have to repay as fast or as slow as you wish. If you’re facing credit card debt challenges, below we highlight some ways you may manage your debt.

fizkes/istockphoto

Here are three tips that may help you reduce credit card debt:

1. Using Balance Transfer Credit Cards

Some credit card issuers offer new applicants 0% introductory APR financing on balance transfers. This enables you to transfer existing credit card debt to a new card and gives you a break from incurring interest charges. And when you transfer balances from multiple cards, you’re consolidating your debt as well, which can make it easier to stay on top of payments since you’ll have just one instead of multiple.

Promotional APR offers last a minimum of six months and can extend up to 21 months. Just note that you may incur a balance transfer fee, which is typically 3% to 5% of the amount transferred. With the way credit cards work usually, the balance transfer fee is added to the balance of the new account.

The key to utilizing a balance transfer credit card is to pay a portion of your remaining balance each month before you resume swiping at places accepting credit card payments. This ensures that you have the entire balance paid off by the time the promotional rate expires and the standard rate resumes.

fizkes/istockphoto

Another option to pay off credit card debt is to use a personal loan to consolidate debt. Personal loans are typically installment loans with fixed monthly payments and a fixed repayment schedule. Approval typically is based on your personal credit history and credit score.

If you have good or excellent credit (661+ VantageScore® 4.0), you might be able to qualify for a loan with a lower interest rate than your current credit cards have. When you receive funding from a personal loan, you can use it to pay off your credit card debt, which may have higher interest rates — especially if your APR is above the average credit card interest rate.

You could also look for a credit counseling service that can offer advice on how to manage your credit card debt and pay it off. There are nonprofit credit counselors who can help you to choose from one of many possible solutions, such as credit card debt forgiveness.

Credit counseling can also offer general financial education, such as explanations of important credit card definitions and tips on budgeting. Counseling can take place in person, online, or over the phone. You may be able to find nonprofit credit counseling services through a university, military base, credit union, or housing authority.

Beware that some vendors may not be legitimate credit counselors. The U.S. Department of Justice maintains a list of approved credit counseling agencies by state. Most of the reputable credit counseling agencies are nonprofit organizations that offer services at local offices, online, or on the phone, according to the Federal Trade Commission.

Whether you have a large or small amount of credit card debt, paying that balance off as soon as possible may reduce or eliminate your interest costs. When choosing a credit card, consider the card’s standard interest rate, as well as any promotional financing offered on new purchases, balance transfers, or both.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at here. Liz Young is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at here.