Here’s who will pay for Biden’s student loan cancellations

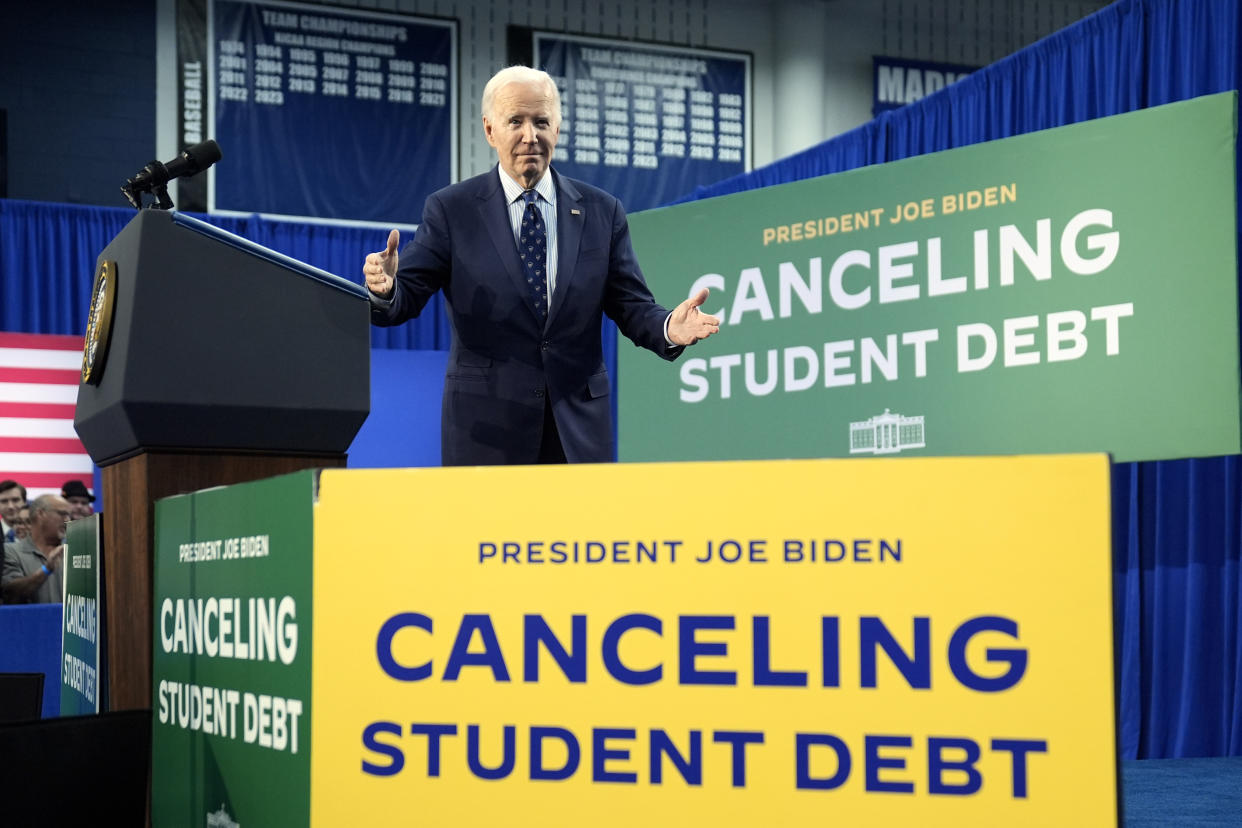

President Biden is trying again to cancel student loan debt for up to 25 million borrowers after the Supreme Court killed his first effort to do so last year. The new plan draws on a different legal justification, which Biden officials hope will be better able to survive inevitable court challenges.

If the plan holds, the government will write down the student loan balances for the majority of Americans who hold them by $5,000 to $20,000. For some, that will entail the full amount of their loans. Economists expect the lower debt load on millions of consumers to boost spending and economic growth (and, possibly, inflation).

But the money isn’t free. Sure, it’s government money, which doesn’t seem completely real, but by canceling debt payments the government forgoes future revenue, which adds to annual deficits and the total national debt. Future taxpayers will essentially pay the bill.

All told, Biden's debt-cancellation plans will cost the government $559 billion in foregone revenue over the coming decade, according to analysis from the Penn Wharton Budget Model. Biden is proposing no new revenue to cover the cost, which means it goes straight on top of the pile of what America owes to its creditors.

As a portion of the total national debt, $559 billion isn't all that much — just 1.6% of all federal borrowing. But if treated as a single program, $559 billion is a ton of money, even by Washington's inflated standards. If Congress tried to pass a benefits package of that magnitude, there would be a huge fight and pronouncements from one side or the other that it’s completely unaffordable. Packages of that size only get passed when there’s an emergency such as COVID or one party controls all the branches of government and has the power to ignore the other party.

As a point of comparison, the 2022 Inflation Reduction Act included measures that would reduce annual deficits by about $275 billion over a decade. Biden bragged about that at the time. But now, Biden's student debt cancellation will completely wipe out those savings and add an additional $284 billion of debt besides.

Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.

There’s an important reason Biden is trying to cut student debt by regulatory and executive action: Congress won’t do it through legislation. Even when Biden’s Democrats controlled both houses of Congress during his first two years in office, there wasn’t a serious effort to pass legislation canceling student debt. The votes just weren’t there. Republicans will never get behind the idea, and even many Democrats acknowledge there are better uses of taxpayer dollars than student debt relief.

In federal aid programs, the best bang for the buck typically comes from programs that target those who need it most, such as young children in low-income families, working parents, or older workers struggling with healthcare costs. Student debt relief, by contrast, tends to benefit people with a college degree or some college education, who are typically in the top 60% of the national income distribution. There’s no corresponding aid for high school grads who chose not to go to college or for students who worked their way through college instead of taking on debt.

Another problem: With no corresponding reforms to the sprawling student debt program, loan cancellation will basically serve as a one-time windfall for a cohort lucky enough to fall inside the qualification parameters. It won’t apply to future debt or to debt previous borrowers already paid off.

In an analysis of Biden’s first debt-relief program, the Committee for a Responsible Federal Budget estimated that after a one-time cancellation of about $500 billion of debt, the total amount of outstanding student debt would return to the prior level of $1.6 trillion within five years. What then? More debt relief, on a rolling basis?

Still, Biden pledged he would give student debt cancellation a shot when he was campaigning in 2020, and now that he’s running for reelection, he needs something to show for it. Republicans will attack Biden for the giveaway, with the fusty Wall Street Journal editorial page describing Biden’s plan as a “lawless” effort “essentially turning college into an open-ended, taxpayer-financed entitlement.”

Republicans, for their part, are no stewards of fiscal probity, either. They’re hoping that if Donald Trump wins the presidency, he’ll cut business taxes and extend individual tax cuts that expire at the end of 2025 and mostly benefit the wealthy. Everybody cares about the mushrooming national debt, except when it interferes with what they need to do to get elected.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Read the latest financial and business news from Yahoo Finance