Are you owed a federal tax refund from 2020? Time is ticking to claim it

The clock is ticking for 31,400 Ohioans who are a owed a nice chunk of money from the federal government.

All they have to do is file a 2020 federal tax return to claim a median refund of $909.

The deadline for filing a 2020 return is May 17. Failing to do so means that the federal government will keep the money.

Nationwide, 940,000 people are owed about $1 billion. That's a median refund of $932.

Taxpayers usually have three years to file and claim a refund, according to the IRS.

Many of the people owed money likely were students, part-time workers and others with little income who may not have filed a return.

Taxpayers interested in learning if they have a refund or other individual information from the IRS such as balances or payments must first create an IRS account.

Normally, the deadline is the April tax filing deadline − April 15 this year − but taxpayers are being given more time this year because the IRS delayed the 2020 filing deadline due to the pandemic.

Claiming 2020 refund lead to more money

In addition to a refund, many low- and moderate-income workers may be eligible for the Earned Income Tax Credit. For 2020, that credit was worth as much as $6,660.

The IRS reminds taxpayers seeking a 2020 refund that their checks could be withheld if they have not filed tax returns for 2021 and '22. Also, any refund will be applied to any amount still owed to the IRS or a state tax agency or may be used to offset unpaid child support and past due federal debts, such as student loans.

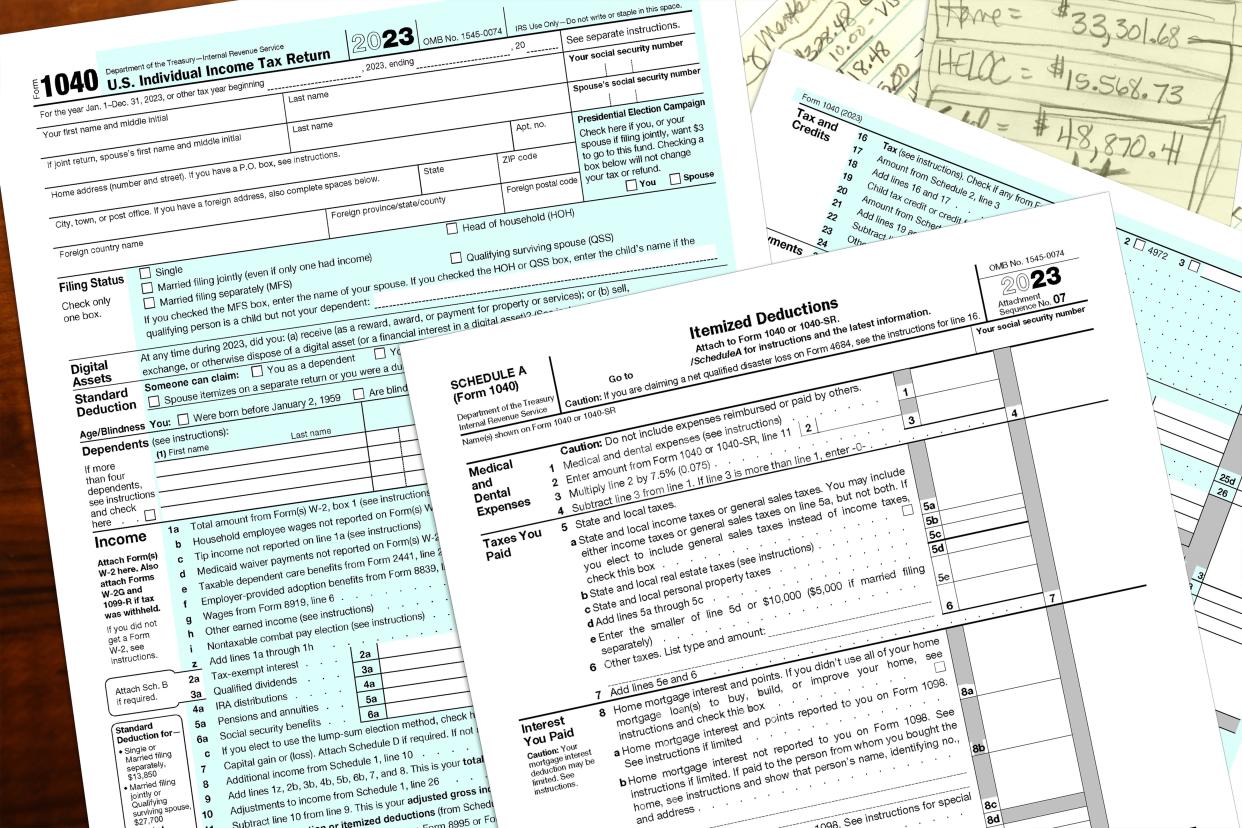

Current and prior year tax forms (such as the tax year 2020 Forms 1040 and 1040-SR) and instructions are available on the IRS.gov Forms and Publications page or by calling toll-free 800-TAX-FORM (800-829-3676).

What to do if you want to file a 2020 return

Taxpayers can request tax documents such as Forms W-2, 1098, 1099 or 5498 from their employer or bank.

If that doesn't work, they can order a free wage and income transcript at IRS.gov, using the Get Transcript Online. The IRS says this is the best option for many taxpayers.

Another option is for people to file Form 4506-T with the IRS to request a "wage and income transcript" that provides data received by the IRS such as Forms W-2, 1099, 1098, Form 5498 and IRA contribution information.

This should provide enough information to file a return, but the IRS warns it can take several weeks to get the information and other options should be tried first.

mawilliams@dispatch.com

@BizMarkWilliams

This article originally appeared on The Columbus Dispatch: Are you among 31,000 Ohioans owned an average of $900 in tax refunds?