Over 610,000 more college students will qualify for crucial grants after key changes to financial aid form

Hundreds of thousands more students will qualify for federal need-based grants — thanks to changes to a key college financial aid form this year.

More than 610,000 students will become newly eligible for Pell Grants under the revised Free Application for Federal Student Aid (FAFSA) form that will be released by Dec. 31, according to data released Wednesday from the White House and Department of Education. Another 1.5 million will be able to receive the maximum Pell Grant award as a result of the FAFSA changes.

Read more: Your complete guide to FAFSA for the 2023-2024 school year

The changes are another effort by the Biden administration to expand access to higher education in an affordable way.

"Pell Grants are a critical lifeline for millions of students and families to attend college or career school and pursue the American dream," said Federal Student Aid COO Richard Cordray said in a press statement. "We are deeply committed to making sure students from all backgrounds can easily apply for and receive the federal student aid they need through the better FAFSA form."

FAFSA is how students apply for financial aid such as the Pell Grant and federal student loans.

"To qualify for financial aid — grants, scholarships, work study, and loans — financial aid offices need to know how much it's going to cost a family to go to college and how much financial need there is and it all starts with the FAFSA," Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators, previously told Yahoo Finance Live (video above).

Normally, the FAFSA is available in October for students and families to fill out, but it is undergoing a major redesign as part of the bipartisan FUTURE Act and FAFSA Simplification Act, which is why it won’t be available until December this year.

One of the most significant changes is moving from the expected family contribution need analysis formula to a student aid index to determine eligibility for federal student aid, linking family size and the federal poverty level.

Under the new student aid index need analysis formula, it removes the number of family members in college from the calculation and implements separate eligibility determination criteria for Pell Grants. This means that some students can have a negative student aid index number, indicating that they have a significant need, something that was not addressed in the previous versions.

"The student aid index is the back office number to determine eligibility for Pell Grants and state scholarships," James Kvaal, undersecretary for the Department of Education, told Yahoo Finance on Wednesday. Additionally, the revised form "will be much easier for families to complete in as little as 10 minutes."

One reason is because applicants will be able to automatically share their parents’ tax information imported from the Internal Revenue Service to ensure accuracy.

Applicants also will only have to answer around 26 FAFSA questions, depending on their individual circumstances, with others having as few as 18 questions. That's way down from the 103 questions on the 2023–24 FAFSA form, according to the press release.

"Most students apply for FAFSA in January and February, and are encouraged to get it done early to allow colleges to distribute financial aid letters in March," Kvaal said. "When selecting a school, families should focus on the net price of attending college after scholarships and grants are applied."

"Usually, the emphasis tends to be on tuition, but living expenses can be a bigger part of costs," he added. "It’s also important for families to understand the differences between scholarships and loans as they are considering financial aid awards."

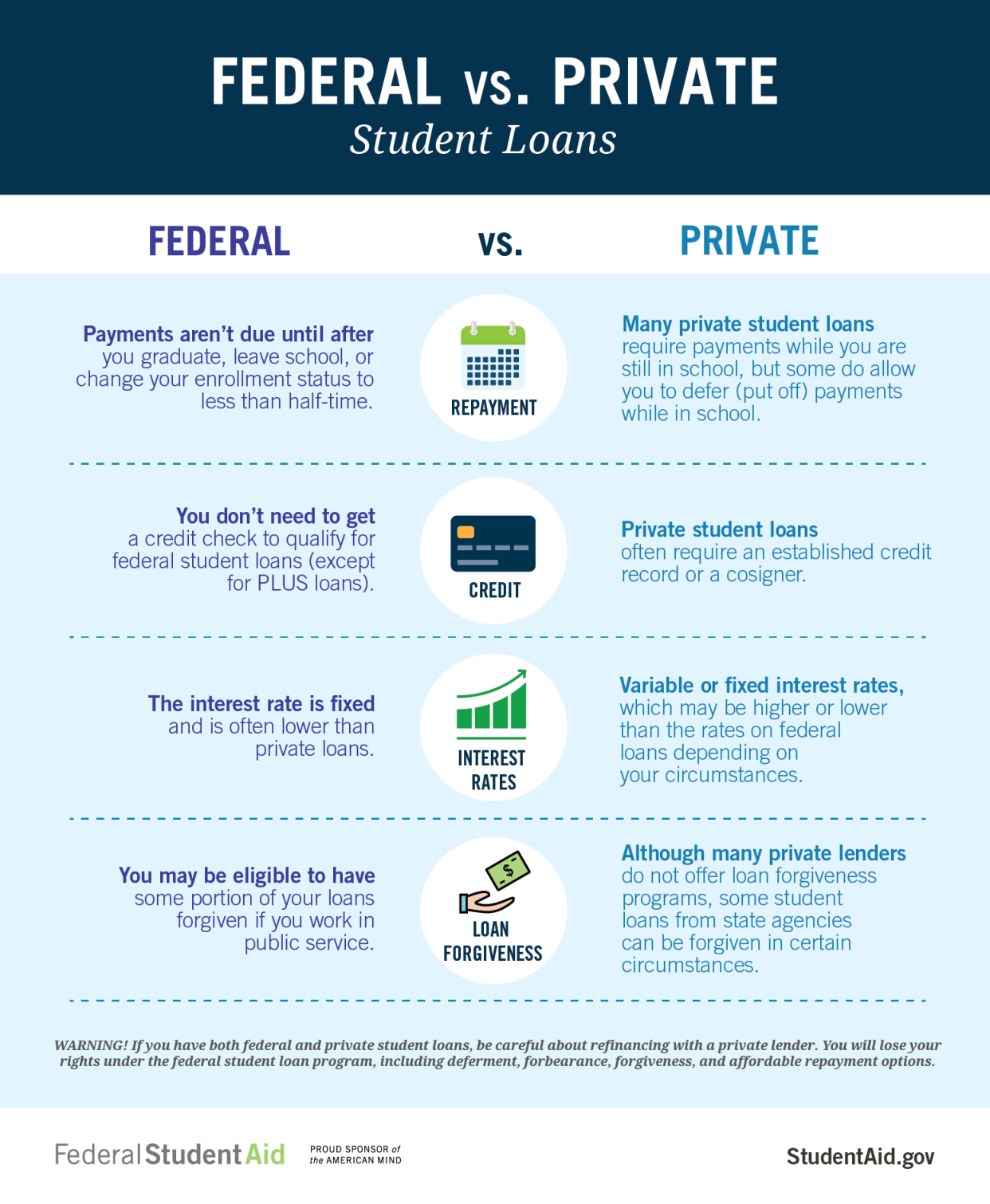

Scholarships and grants do not need to be repaid. Loans, on the other hand, must be repaid and with interest. Also, the terms and conditions for federal student loans are different from private loans.

Read more: Private vs. federal student loan: Which is best for you?

Students and parents can familiarize themselves with the new changes by viewing the revised Federal Student Aid Estimator.

Early decision applicants should talk to their prospective school about how financial aid awards will be determined in light of the delayed FAFSA.

Counselors and educators can use the Better FAFSA Better Future digital toolkit to assist students and families as they prepare for the release of the new FAFSA application.

"The Biden-Harris Administration’s implementation of the Bipartisan FAFSA Simplification Act modernizes an archaic system, simplifies the form, and improves access for underserved students — representing the most significant overhaul of the federal financial aid application since the Reagan era," US Secretary of Education Miguel Cardona said in a press statement. "These bold changes will ultimately put affordable higher education within reach of more Americans."

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government.

Follow her on Twitter @writesronda Read the latest personal finance trends and news from Yahoo Finance. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn