Options Traders Target Workhorse Stock Amid "Meme Stock" Frenzy

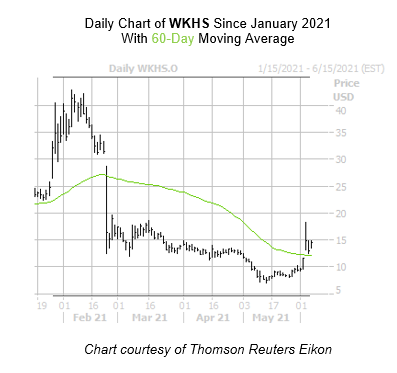

While it hasn't been at the forefront of the latest "meme stock" craze, tech concern Workhorse Group Inc (NASDAQ:WKHS) is popping today, last seen up 11.2% to trade at $14.51 at last check. The security ditched penny stock territory one year ago culminating in a Feb. 4 record high of $42.96. Since then though, Workhorse stock has carved out a channel of lower lows. Thanks to today's bull gap, WKHS is pacing for its third consecutive close above the 60-day moving average, and now boasts a whopping 355% year-over-year lead.

Options traders are taking note of today's pop, with volume running at double what's typically seen at this point. More specifically, 115,000 calls and 24,000 puts have exchanged hands so far. The most active of these options is the weekly 6/11 15-strike call, followed by the 20-strike call in the same series, with new positions being opened at the former.

An unwinding of short interest could push WKHS even higher, as there's ample pent-up buying power. In fact, short interest has jumped 23.5% over the last tow reporting periods, and the 47.54 million shares sold short represent a whopping 72.6% of the stock's available float.

Lastly, the security's Schaeffer's Volatility Scorecard (SVS) ranks at 82 out of 100. This is great for options buyers, as it implies the stock tends to outperform volatility expectations.