Options Red-Hot Ahead of Abbott Earnings

The shares of healthcare stock Abbott Laboratories (NYSE:ABT) are up 2.6% at $81.87 just ahead of tomorrow's third-quarter earnings -- due out before the open tomorrow, Oct. 16 -- after the board announced a share buyback plan of up to $3 billion. The company also announced a partnership with Tandem Diabetes Care (TNDM), which has the latter stock higher today, too.

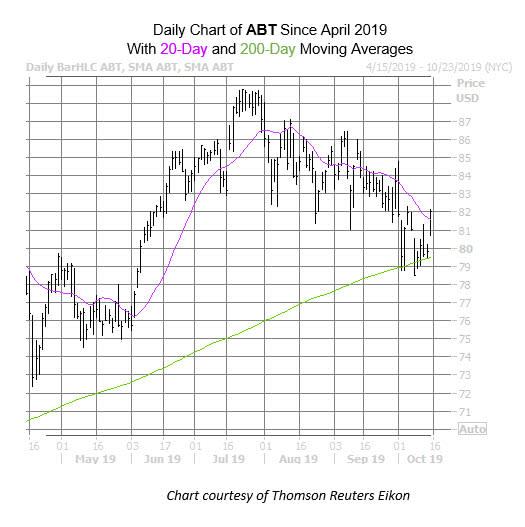

What's more, the equity is set to take over its 20-day moving average for the first time in over a month. Since its late-July, record peak of $88.76, the stock has cooled gradually, touching a four-month low of $78.51 just last week. Since then, however, ABT has found support at its 200-day moving average -- a trendline that's had bullish implications for the equity in the past.

Options players have been extremely bullish ahead of earnings, with 5.74 calls bought for every put on the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the last 10 days -- which sits higher than all other readings from the past year.

That being said, options are running hot today, with 8,778 calls and 4,037 puts across the tape so far -- three times what's typically see at this point. The two most popular positions are the October 81 put, where positions are possibly being sold to open, followed by the October 82 and 83.50 calls.

Abbott's post-earnings moves have been split during the last eight sessions, with the stock averaging a next-day swing of 2.5%, regardless of direction. This time around, the options pits are pricing in a slightly bigger move at 4.6%.