This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

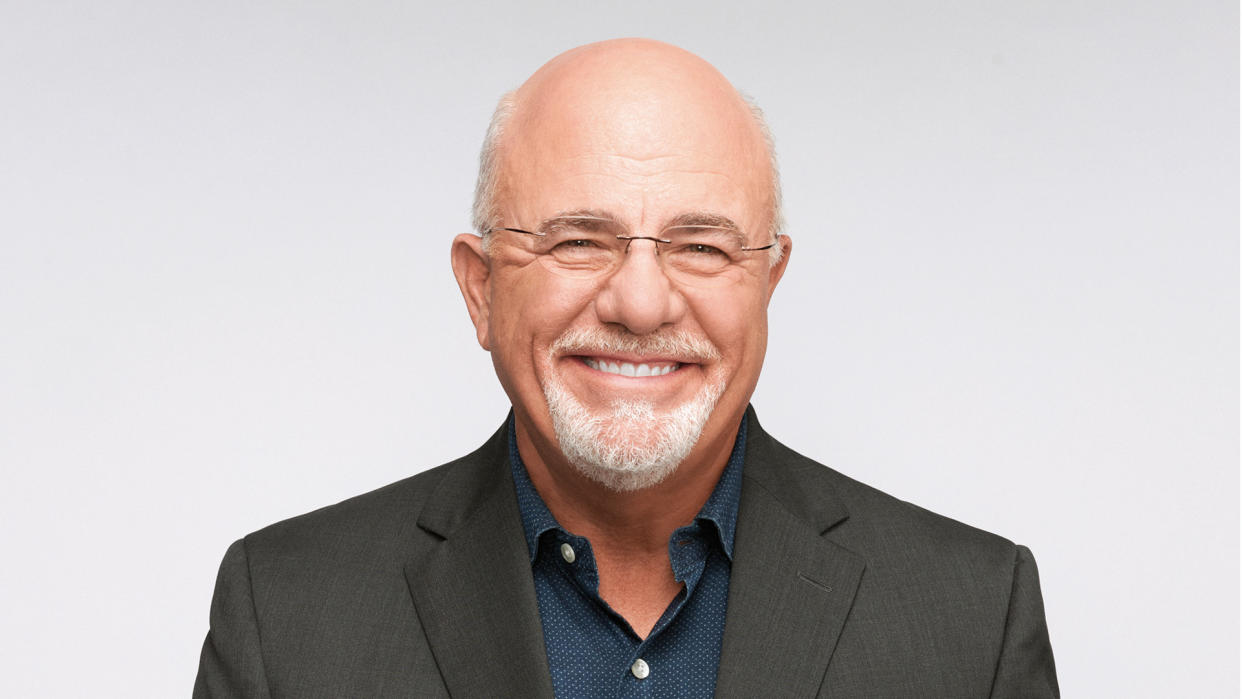

Dave Ramsey doesn’t like debt. However, there’s one kind of debt he says to avoid more than any other. In his own words, tax debt “terrifies” Ramsey.

Find Out: You Can Get These 3 Debts Canceled Forever

Read More: Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

“It’s the only kind of debt that terrifies me for our clients. It terrifies me,” Ramsey told a caller on his radio show in 2021. “Because I’ve seen what the ‘KGB’ does to people when they want to get rough.”

His radio co-host Jade Warshaw expanded on the reasoning in a recent Ramsey Solutions blog post.

“If you owe the IRS any money, you need to take care of that first — even if it isn’t your smallest debt,” she wrote. “Why? Because the government has the power to make your life pretty miserable until you pay up, and they can even take money straight out of your paycheck. So, make sure you’re all squared away with Uncle Sam before you attack the rest of your debt.”

Of course, these words of wisdom won’t be much help if you currently have tax debt. This can feel stressful and scary, but you’re not alone.

In fiscal year 2022, the IRS collected more than $98.4 billion in unpaid assessments on returns filed with additional taxes due. The agency also assessed nearly $23.9 billion in additional taxes for returns not filed in a timely basis and collected nearly $2.3 billion from delinquent returns.

If you owe money to the IRS, it’s time to make a plan to repay it.

4 Ways To Get Out of Tax Debt

Here are a few options for getting out of tax debt:

File Your Taxes

When you know you can’t pay the bill, you might try to rationalize that it makes sense to not file a tax return. The thing is, you can’t hide from the IRS.

Failing to file your tax return will ultimately cost you even more money. The failure-to-file penalty is typically 5% of the tax owed each month or part of a month that your loan is late — with a maximum penalty of 25%.

If you wait to file until your return is more than 60 days late, you’ll face another minimum penalty for late filing. For tax returns filed in 2023, this is the lesser of $450 or 100% of taxes owed.

Be Aware: The 7 Worst Things You Can Do If You Owe the IRS

Work Out a Payment Plan

You might be able to work directly with the IRS to repay your tax debt. The IRS recommends requesting a payment plan if you believe you’ll be able to settle your debt in full within an extended timeframe.

Keep in mind that your balance will be subject to interest and a monthly late payment penalty. However, you’ll be able to avoid accumulating additional interest and penalties, offset future refunds and any issues regarding approval for loans.

If you apply for a short-term payment plan, you’ll need to repay your tax debt within 180 days. You can also opt for a long-term payment plan, which will allow you to repay your debt in installments.

File an Offer in Compromise

It’s possible your tax liability is more than you can reasonably be expected to pay. If this is the case, requesting an offer in compromise could be a good move.

You’re eligible to apply if you’ve filed all required tax returns and made all required estimated payments, aren’t in an active bankruptcy proceeding, have a valid extension for a current year return — if you’re applying for a current year — are an employer and made tax deposits for the current and past two quarters before applying.

As part of the application process, the IRS will examine your ability to pay your tax debt, income, expenses and asset equity.

You will need to pay both a nonrefundable $205 application fee and a nonrefundable initial payment. The latter will vary based on your offer and your preferred payment option.

If you opt for a lump sum cash payment, you’ll submit an initial payment of 20% of the total offer amount. Alternatively, you can choose the periodic payment plan, which will require you to submit your initial payment.

But as Ramsey likes to point out, the acceptance rate for an offer in compromise is relatively low.

In fiscal year 2022, taxpayers submitted 36,022 offers in compromise to settle existing tax liabilities for less than the amount owed. Only 37% — 13,165 — of these were accepted, garnering more than $234.3 million.

Work With a Trusted Tax Professional

Hiring a debt relief company to assist with your tax debt can be a good idea. Since these professionals do this for a living, they should be able to help you find the best way to settle your debt, and they can often help reduce the total amount you pay. Some tax resolution companies, such as Tax Relief Advocates, will offer a free consultation to go over your situation.

Whether you’re working with a certified public accountant, enrolled agent, attorney or other professional, the IRS recommends doing your homework before hiring anyone. This includes checking their qualifications and history, asking about any service fees and always carefully reviewing all paperwork before signing.

Ultimately, having tax debt isn’t fun, but the sooner you settle it, the better. Trying to hide from it will only make things worse, so face it head-on and eliminate it once and for all.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey