One chart explains why 2022 was so grim for Wall Street bankers: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Wednesday, January 18, 2023

Today's newsletter is by Myles Udland, Head of News at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Read this and more market news on the go with Yahoo Finance App.

Goldman Sachs' (GS) quarterly results posted Tuesday served as the final marker of a year investment bankers won't soon want to remember.

The biggest brand name in the banking world reported fourth-quarter earnings per share that fell 69% from a year ago and full-year per share earnings that were off 49% from 2021. Revenue in Goldman's flagship investment banking unit fell 48% for the full year.

On a conference call on Tuesday, Goldman CEO David Solomon said: "Simply said, our quarter was disappointing and our business mix proved particularly challenging. These results are not what we aspire to deliver to shareholders."

These results come after the bank laid off 6% of its workers last week in the sharpest reaction the industry has seen yet amid a dealmaking slowdown resulting from the most aggressive interest rate hikes from the Federal Reserve in a generation.

Goldman Sachs shares fell 6.4% on Tuesday.

Now, like any industry, talk to five executives in the banking world, and you'll get 10 different views on the environment, economy, and client demand.

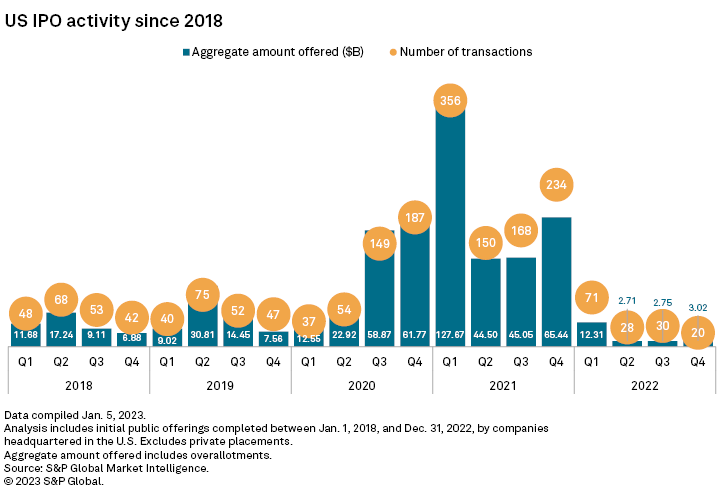

But the challenges facing Wall Street dealmakers last year were straightforward, and the following chart from S&P Global Market Intelligence that hit our inbox early Tuesday sums up the story in a clean image.

In the U.S., IPO activity in the fourth quarter of 2022 was down 92% from the same period last year.

For the full year, deal volumes fell 86% — to 149 IPOs in 2022 from 908 IPOs launched in 2021. The number of IPOs completed in the entirety of 2022 wouldn't have matched the quarterly tally during any three-month stretch of the prior year.

And while the IPO market is the easiest pocket of the investment banking world to track, results from Wall Street's banks this quarter suggest this area of the market was not alone in seeing volumes plummet.

As Bloomberg reported last week, the leveraged loan market also ground to a halt in 2022 after a bumper year in 2021. As Richard Zogheb, global head of debt capital markets at Citi, told Bloomberg: "The dislocation is more pronounced and longer lasting than anything since the Great Financial Crisis."

Slowdowns in cyclical businesses like banking are, of course, part of this or any economic cycle.

Rising interest rates make borrowing money for anything — a house, a car, a corporate takeover — more expensive. Which means prospective buyers either pay more or move on. On Wall Street, the preference last year was clear.

But the challenges facing the banking world sting doubly this time around given the frenetic state of the business just two years ago.

In the spring of 2021, readers might recall, junior bankers at Goldman Sachs complained of "inhumane" conditions as teams were pushed to the brink to service the glut of deals that flooded markets as the economy reopened aggressively and interest rates were pinned to the floor.

As a result, junior staff got a raise.

At the time, Solomon responded to these complaints by saying: "We've always been a pay-for-performance organization. We are performing."

Now, Solomon is spinning a different story.

And it's not hard to see why.

What to Watch Today

Economy

7:00 a.m. ET: MBA Mortgage Applications, week ended Jan. 13 (1.2% during prior week)

8:30 a.m. ET: New York Fed Services Business Activity, January (-17.5 during prior month)

8:30 a.m. ET: Retail Sales Advance, month-over-month, December (-0.9% expected, -0.6% during prior month)

8:30 a.m. ET: Retail Sales Excluding Autos, month-over-month, December (-0.5% expected, -0.2% during prior month)

8:30 a.m. ET: Retail Sales Excluding Autos and Gas, month-over-month, December (0.0% expected, -0.2% during prior month)

8:30 a.m. ET: Retail Sales Control Group, December (-0.3% expected, -0.2% during prior month)

8:30 a.m. ET: PPI Final Demand, month-over-month, December (-0.1% expected, 0.3% during prior month)

8:30 a.m. ET: PPI Excluding Food and Energy, month-over-month, December (0.1% expected, 0.4% during prior month)

8:30 a.m. ET: PPI Excluding Food, Energy, and Trade, month-over-month, December (0.2% expected, 0.3% during prior month)

8:30 a.m. ET: PPI Final Demand, year-over-year, December (6.8% expected, 7.4% during prior month)

8:30 a.m. ET: PPI Excluding Food and Energy, year-over-year, December (5.6% expected, 6.2% during prior month)

8:30 a.m. ET: PPI Excluding Food, Energy, and Trade, year-over-year, December (4.6% expected, 4.9% during prior month)

9:15 a.m. ET: Industrial Production, month-over-month, December (-0.1% expected, -0.2% during prior month)

9:15 a.m. ET: Manufacturing (SIC) Production, December (-0.2% expected, -0.6% during prior month)

9:15 a.m. ET: Capacity Utilization, December (79.5% expected, 79.7% during prior month)

9:15 a.m. ET: Business Inventories, November (0.4% expected, 0.3% during prior month)

10:00 a.m. ET: NAHB Housing Market Index, January (31 expected, 31 during prior month)

2:00 p.m. ET: Federal Reserve Releases Beige Book

4:00 p.m. ET: Net Long-Term TIC Flows, November ($67.8 billion)

4:00 p.m. ET: Total Net TIC Flows, November ($179.9 billion)

Earnings

Charles Schwab (SCHW), Discover Financial Services (DFS), PNC Financial Services (PNC), Kinder Morgan (KMI), J.B. Hunt Transport Services (JBHT), First Horizon Corp. (FHN), Alcoa (AA), Wintrust Financial (WTFC), H.B. Fuller Company (FUL), Prologis (PLD)

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube