'One of the biggest rip offs ever': Dave Ramsey gets heated about adjustable-rate mortgages, saying banks are pulling a 'bait-and-switch' on you — here's why

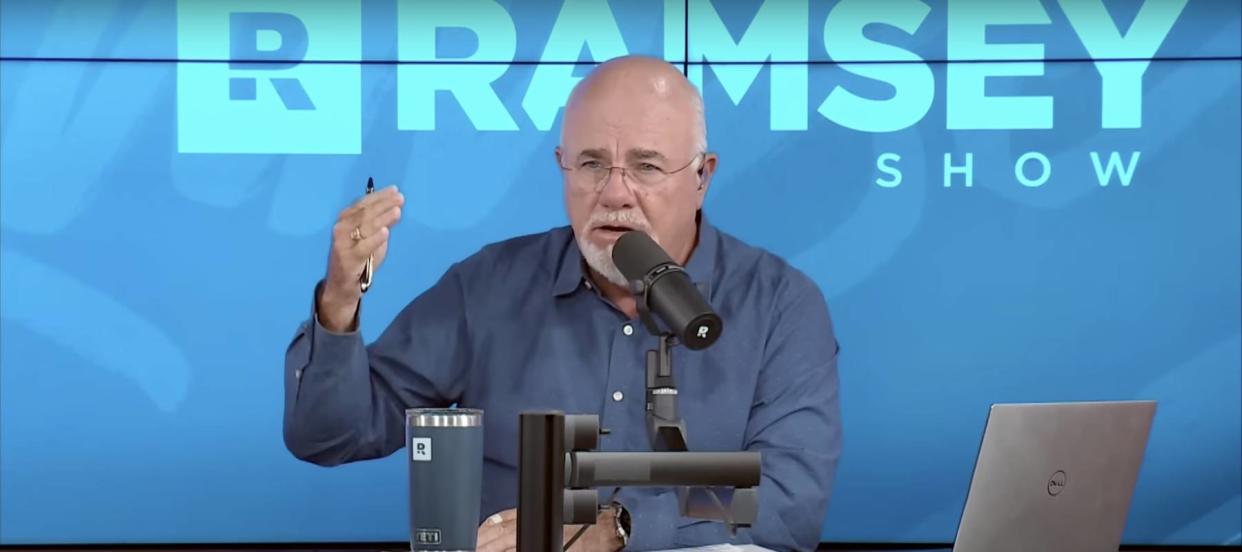

Personal finance expert Dave Ramsey doesn’t seem pleased with an apparent rise in the popularity of adjustable-rate mortgages (ARMs).

On a recent episode of The Ramsey Show, the radio host described these loans as a sneaky trap that resembled more a “ticket to foreclosure” than a ticket to homeownership.

Don't miss

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Here’s why ARMs may be getting more popular, and why Ramsey advises potential homebuyers to stay away from these sometimes tantalizing financial instruments.

Rising rates

Interest rates have skyrocketed in recent months. The Federal Reserve recently raised its benchmark interest rate to 5.5%, the highest level in 22 years. Consequently, the average 30-year fixed mortgage rate is now roughly 7.6%. That creates difficulty for young, first-time homebuyers and families with modest incomes who may not be able to afford payments, or qualify for mortgages in the first place.

The situation may have driven some potential homebuyers to desperation, away from the consistency of fixed-rate mortgages, where the interest rate can stay the same for the life of the loan, toward much more volatile ARMs, where the rate is tied to an index and can go up or down after a certain number of years.

A recent survey by Rocket Mortgage found that 43.1% of respondents would consider an ARM to get their foot on the property ladder. Among respondents who were currently seeking to purchase their first home, 65.4% said they would consider an ARM.

ARMs generally have initial lower rates than 30-year fixed rate mortgages, which could be one of the reasons why buyers find them appealing. Some buyers might also be speculating lower interest rates in the future, which could be another reason for the popularity of these products.

But Ramsey believes banks employ a sneaky trick to make these ARM terms less favorable to buyers.

Read more: 'It's going to be ugly': This CEO issued a dire warning about U.S. real estate, saying areas will be 'destroyed' — but he still likes 1 niche

Tricky terms

ARMs can adjust upward quickly when benchmark rates go up but move down slowly when the Fed announces rate cuts.

“Your mortgage is adjusted based on an index [plus] a spread over that index,” Ramsey explained. “But when you start your mortgage, they move you in on a bait-and-switch. The index is already higher than the rate you would have today … Since the index is cheated up, rates would have to go down in order [for your rate to remain the same at the time of renewal].”

Given how slowly rates tend to move up or down, Ramsey says it’s nearly a guarantee your adjustable mortgage will increase upon first renewal.

“Adjustable-rate mortgages are one of the biggest rip offs ever to come along,” he said.

If the Fed continues to raise rates, as has been the case in recent history, adjustable-rate mortgages can easily grow beyond affordability. Homeowners who fall behind on their payments risk defaulting on their mortgage and subsequently foreclosure on the property.

Ramsey’s experience

Ramsey’s opinion on ARMs is based on first-hand experience selling real estate. He describes how banks and financial institutions faced a crisis in the 1980s, when interest rates surged to 17% and loan books were full of fixed-rate mortgages.

Effectively, banks had to pay higher rates to savers but were stuck receiving lower payments from borrowers, who had locked in their rates for 30 years.

Several lenders went bankrupt during this period, which came to be known as the “savings and loans crisis.” In the aftermath of the crisis, Ramsey says, banks decided to protect themselves by creating new mortgages with adjustable rates.

“It transfers the risk from the lender [to the borrower] and ensures that the lender is always going to make money,” he said. “It doesn’t have anything to do … with helping prospective buyers. Bullcrap!”

He continued his rant: “One thing you can count on is banks protecting banks. It’s what they do and they’ve been good at it for a long time. That’s why their furniture is nicer than yours; that’s why their building is bigger than yours. It’s not an accident.”

What to read next

Americans are paying nearly 40% more on home insurance compared to 12 years ago — here's how to spend less on peace of mind

A 50-year-old Mom on Reddit emptied her daughter's college fund to keep her Malibu dream house — the teen is 'furious.' 4 tips to retire comfortably without raiding your kid's account

Owning real estate for passive income is one of the biggest myths in investing — but here is 1 simple way to really make it work

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.