Market Minute: Stocks Start from Record Highs; Big-Bank Profits Soar

Last month's summer swoon seems like ancient history, and two top banks post earnings. Those and more are what's making business news Friday.

The Dow industrials (^DJI) rallied 169 points Thursday, soaring back into record territory. It's the Dow's 24th record this year, but the first since late May. The S&P 500 (^GPSC) also roared to an all-time high, and the Nasdaq (^IXIC) surged 57 points. It's the Nasdaq's 11th gain in the past 12 sessions.

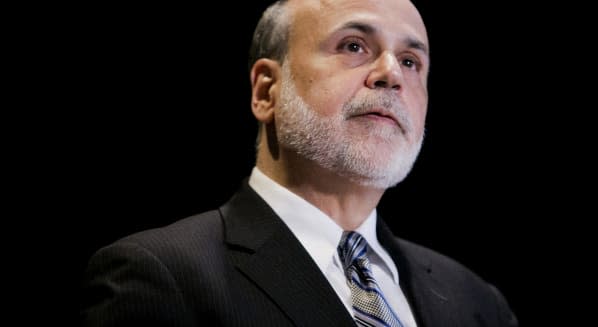

That rally was sparked by comments from Federal Reserve Chairman Ben Bernanke about maintaining the central bank's low interest rate policy. But Friday, attention focuses on banks of a different kind. JPMorgan Chase (JPM) and Wells Fargo (WFC) are out with second quarter earnings.

JPMorgan's net rose 31 percent, topping expectations, led by strong gains in credit card transactions. Wells Fargo, the biggest U.S. mortgage lender, reported a 20 percent rise in second-quarter profit. Its net income rose to 98 cents a share from 82 cents a share in the year-ago quarter.

Many analysts expect the financial sector will post the best earnings growth in the second quarter.

H&R Block (HRB) is getting out the banking business, in order to avoid falling under the regulatory thumb of the Fed. The tax preparation firm is selling its banking unit to Republic Bank.

Two of the market's hottest stocks closed above $900 a share Thursday. Google's (GOOG) stock is at $920 a share; Priceline at $910. Priceline (PCLN) shares have soared more than $100 in less than three weeks.

The brokerage firm Jefferies has lowered its rating on Pfizer (PFE) and Bristol-Myers Squibb (BMY) to "hold" from "buy."

Carl Icahn is upping the ante in his battle with Dell (DELL). The billionaire investor told Bloomberg he'll raise his offer for the computer maker today, as he tries to pressure Chairman Michael Dell to sweeten his go-private bid.

Sprint Nextel (S) is lowering the cost of its plan for unlimited data, calling and texting to $80 a month -- a savings of $30. Verizon Wireless (VZ, VOD) and AT&T (T) have been trying to limit access to their unlimited plans.

And Aveo Pharmaceuticals (AVEO) is set to tumble. The company says it received a subpoena from the Securities and Exchange Commission demanding documents related to the company's drug to treat renal cell carcinoma.

-Produced by Drew Trachtenberg

%Gallery-193406%