Obamacare Websites Crash on Day 1, plus 5 More Things You'll Want to Know Today

Here's a quick rundown from the world of business and economics this morning: the things you need to know, and some you'll just want to know.

Yes, the big news today is the government shutdown. But you aren't living under a rock in the back of a cave on Fiji, so we'll assume you know the basic situation in Washington, and get to the things you may have missed.

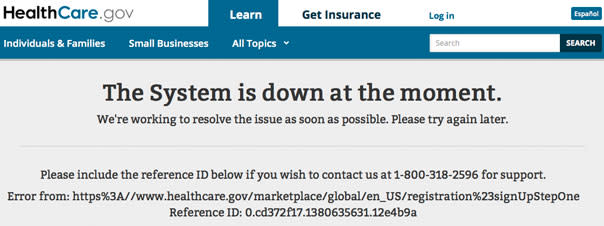

• Funny thing about Obamacare, the item at the heart of all the nonsense in Washington: The health insurance exchanges created under the Affordable Care Act opened for business today, and people have started hitting the websites. Only one problem: The Obamacare websites weren't working. As of 9:30 a.m., Healthcare.gov informed us: "The System is down at the moment. We're working to resolve the issue as soon as possible. Please try again later."

(Update, 10:45 a.m.: The main healthcare.gov site was still not fixed, but they were working on it.)

(Update 11:05 a.m.: Looks like the main HealthCare.gov site is up and working. See, even when it's officially closed, your government can get things accomplished. But if you're still having problems accessing your state site or the federal site, give us a shout in the comments below, or on Twitter, @dailyfinance. We'd love to know.)

(Update: 2:10 p.m.: Boy, do our readers have a lot to say about this! But the key point we're seeing: No, it's still not working properly. When we look, it's back to that "Please Wait," too many people trying to access the site at once message, and a DailyFinance reader who says he runs a Florida insurance agency says he and his staff have been trying all day to get a single person signed up through the system, to no avail.)

• Lately, it seems like every week brings a new agreement from a big Wall Street bank to pay out hundreds of millions of dollars for its malfeasance around the financial crisis -- usually without ever admitting any wrongdoing. On deck today: Wells Fargo, which has agreed to settle with Freddie Mac for $869 million over -- you guessed it -- toxic mortgages from the Bubble Era.

• The government is closed for business, but business is open. And in past moments of Washington dysfunction, the stock market has usually done just fine. However, some companies -- like these 20 -- are disproportionately exposed to the government, which means the shutdown is likely to cost them big time.

%VIRTUAL-article-sponsoredlinks%• If you're still using Microsoft's (MSFT) Windows XP operating system, take note: After April 8, 2014, Microsoft will no longer provide technical support for XP. So, no more patches for glitches, no more security updates to fight off the latest virus. That means it's probably time to upgrade to at least Windows 7 -- if your computer is powerful enough to run it. It may just be time to start considering new hardware, too.

• Warren Buffett's Berkshire Hathaway (BRK-A) invested $5 billion in Goldman Sachs (GS) back in 2008, when the bank really needed it, and for that money, he also got the right to buy another $5 billion in shares later at $115 per share. They tweaked the deal a bit in March: He's now just going to get the value of his profit in stock, without having to invest another dime. And how big a profit is that? With Goldman at around $159 a share, the Oracle of Omaha just got $2.15 billion. An oracle indeed.

• And finally: Remember back before Google (GOOG) totally conquered search? Well, Blippex may be the first truly transformative search engine since Google. Conceived of as "the Wikipedia of Search," Blippex builds its results based on data gathered from its users (with scrupulous attention to privacy, we're assured), which makes them quite different from Google's. And possibly, more interesting and useful.