Older mortgage applicants are more likely to be rejected, study finds

The older you get, the weaker your chances are at getting approved for a refinance on your mortgage, according to a new study.

Rejection rates spiked the most after borrowers crossed 70 and were most common among men, according to a brief from the Center for Retirement Research at Boston College that summarized a Federal Reserve Bank of Philadelphia study analyzing 5 million single-borrower loan applications for a refinance from 2018-2020.

The findings are an important consideration for Americans who may need to tap their home equity later in life using a cash-out refinance or want to take advantage of better mortgage rates to get a lower monthly payment.

“Taken at face value, age appears to be an equally important correlate of mortgage application outcomes as race and ethnicity,” Natee Amornsiripanitch, the study’s author and a senior financial economist at the Philadelphia Fed, wrote in the brief. “Overall, the results suggest that older individuals systematically face higher barriers to mortgage access.”

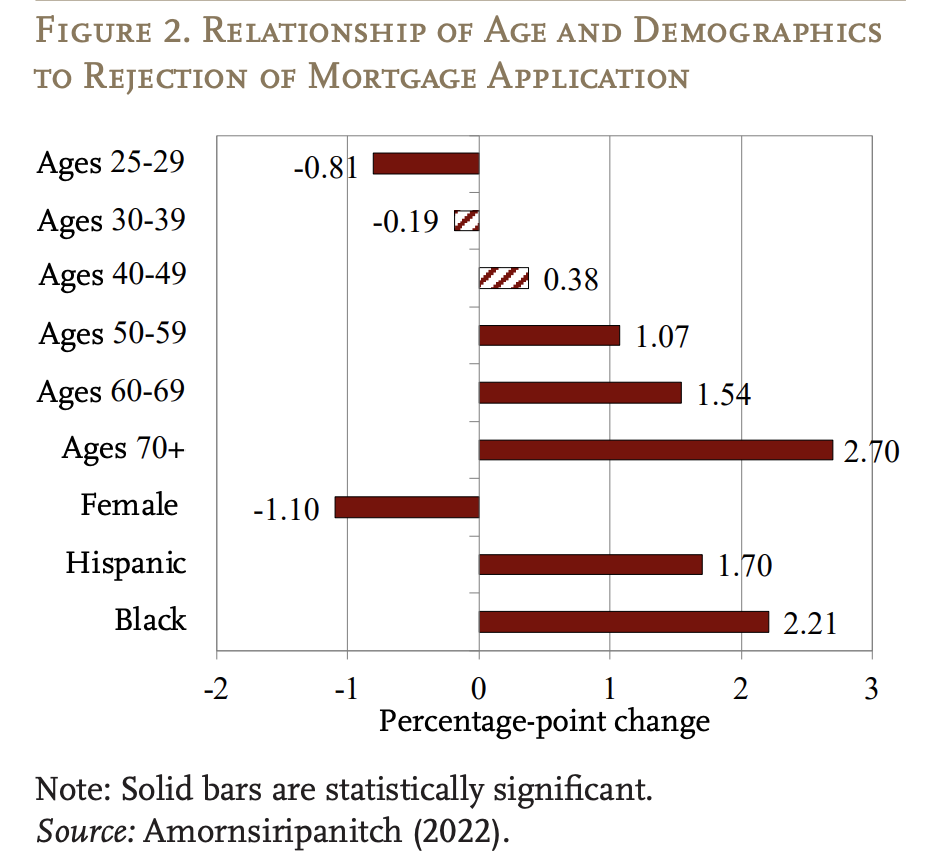

Borrowers are more likely to get rejected as they grow older, regardless of the type of mortgage loan they applied for, the study found. Applications for the three oldest age groups were one to three percentage points more likely to be rejected than younger borrowers.

For instance, the rejection rate for mortgage applicants between the ages of 50 and 59 was 1.07 percentage points higher than those between 18 and 24. The rate was 1.54 percentage points higher for folks between 60 and 69 and 2.7 percentage points higher for applicants over 70.

Overall, the rejection rate across all borrowers was 17.5%.

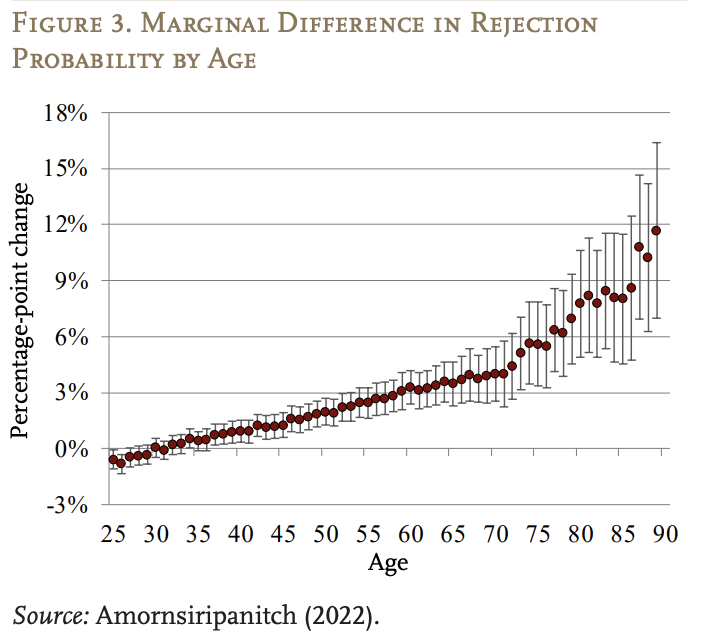

The study also found that rejection rates accelerated every year after the age of 70, spiking to 12% by the age of 90. The findings also concluded that rejection rates among women increased at a slower pace compared with men, likely because women tend to live longer.

According to the study, older applicants are more likely to be rejected due to insufficient collateral, which could be interpreted as being driven by age-related mortality risk.

Insufficient collateral — meaning applicants didn’t haven’t enough equity on their existing property to take out the desired loan — accounted for 50% to 70% of the age-related rejections, according to the study.

Borrowers had insufficient collateral when the appraised value of the property was too low compared with the requested loan amount. This impacted older applicants, who may not have the time or energy to maintain their properties relative to younger borrowers.

“Insufficient collateral is also consistent with older applicants who are forced to carry a mortgage into retirement being more financially distressed, as they may lack the funds to pay for adequate maintenance,” the study found.

Increased mortality risk also plays a role.

The rate of rejections also significantly increased each year after the age of 70. The study noted that having a borrower die could be “costly to the lender” increasing the likelihood of the loan being paid off early or entering foreclosure. This also explained why women’s borrowing risk accelerated at a slower rate compared with men as they aged.

Mortality risk also could play into the collateral equation.

"The insufficient collateral explanation could be interpreted as lenders requiring the borrower to put up more collateral as age-related mortality risk increases," according to the brief.

According to the Consumer Financial Protection Bureau, creditors aren’t allowed to deny your loan application based on age alone.

“As far as being denied due to age, that is patently illegal," Jason Sharon, owner of Home Loans Inc. told Yahoo Finance.

However, the study's results don't necessarily mean that lenders are violating fair lending legislation, the brief said, noting the results don't prove causality. Additionally, "the regulations allow the consideration of a borrower’s age in credit decisions under some circumstances."

For instance, a lender can consider an applicant’s career and length of time to retirement to figure out if their income will support the mortgage payment.

"Regardless of the reason, however, it is important for older individuals to know that they are more likely to be denied credit," the brief concluded.

According to Sharon, older applicants often have better credit and equity – making it easier for them to navigate a refinance or new purchase. However, being on a fixed income can present its own set of hurdles when a lender evaluates an applicant's debt-to-income ratio and whether additional assets will be needed as collateral.

According to Sean Dycus, a real estate agent in South Carolina, some lenders may view a fixed income as a risk of defaulting down the line.

“My dad [and mom]'s Social Security [together] each month is like $7,000. The bank would totally give them money for a second spot, it just depends,” Dycus said. “Are you one of these retirees or elderly people that have a mortgage in place already where you're paying $1,800 a month and your [Social] Security's only $4,000? That matrix, the numbers don't make sense for the lender.”

To improve their chances of getting qualified, older applicants should talk first with a mortgage consultant to determine if their credit score needs work or if any existing equity can be converted to cash.

“I love older applicants,” Sharon said. “Fixed income is so much easier to verify and calculate than any other type. Of course, if a person is living off of Social Security alone, they will not qualify. That is not what Social Security was designed to do.”

Editor's correction: This story corrects an earlier version that erroneously said the study looked at mortgage and refinances. The study only looked at refinances. It also clarifies that increased mortality risk could be a reason, but is not necessarily a reason for rejections.

Gabriella is a personal finance reporter at Yahoo Finance. Follow her on Twitter @__gabriellacruz.

Read the latest personal finance trends and news from Yahoo Finance.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.