Oklahoma City business is booming. So why isn't the OKC warehouse market?

The warehouse boom was good while it lasted, for developers and owners. After losing air last year, the industrial property market, with its first vacancy increase in more than five years, although tiny, is adjusting to inflation, and rising interest rates and construction costs.

That's according to OKC commercial real estate brokerage Price Edwards & Co.'s latest Industrial Market Report, which looks at multitenant warehouses, those leased to more than one user.

"The upcoming year will be crucial as we attempt to shift our focus from a slow 2023," according to the report by broker Chris Roberts with assistance from brokers Danny Rivera, Andrew Holder and Mark Patton.

Overall industrial vacancy ticked up from 5.42% to 6.21% the past year, the firm reported. Considering the economic headwinds of inflation, higher interest and building costs, "the market should celebrate this modest change," the report said.

OKC is still booming, so why isn't its warehouse market still booming?

How can OKC be booming and the warehouse boom not be?

"This was a product of the overall U.S. economy and not something specific to OKC," Roberts said. "Inflationary issues had a large effect on businesses, which deters movement/expansion and relocation. ... But in the big picture, OKC is still a great industrial market and getting better, just at a slower pace than in years past."

He added, "Early signs are showing 2024 to be a much more active market. With all the new Class A buildings being delivered, the hope is some great tenants and good-paying jobs will be soon to follow."

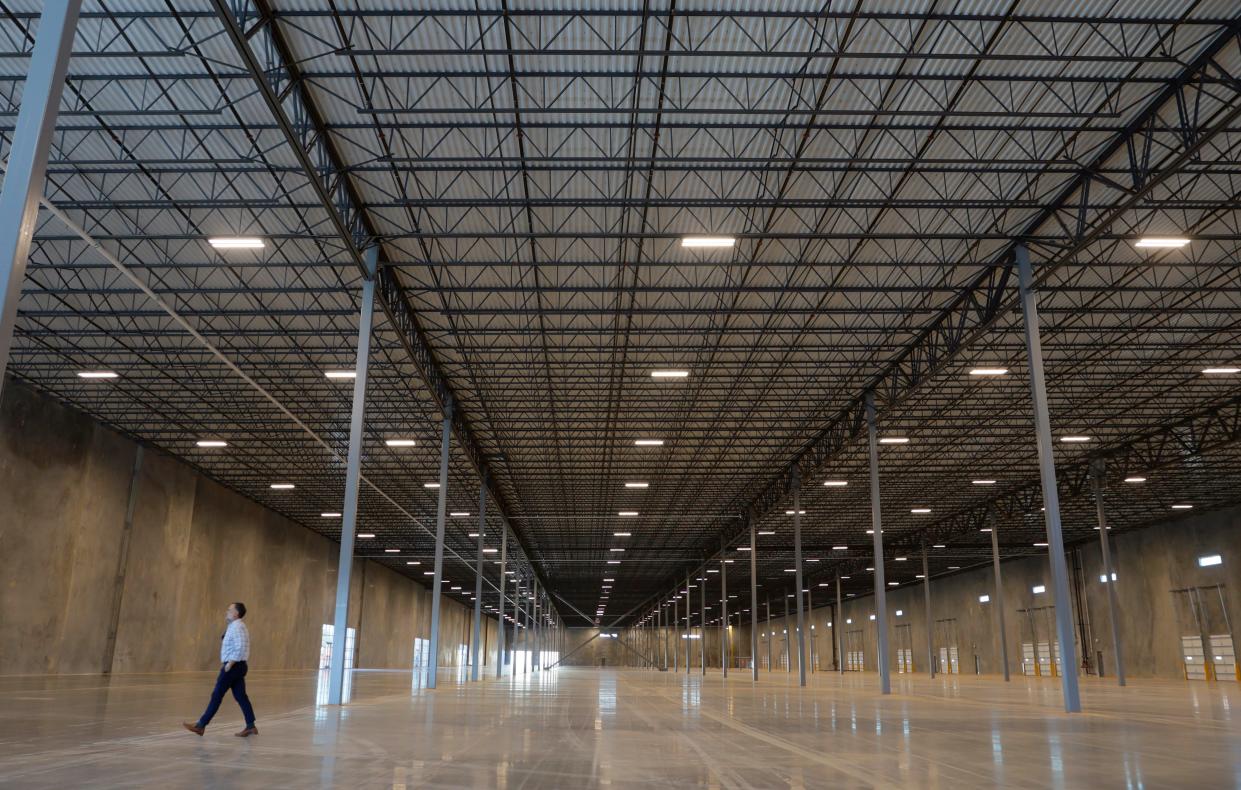

RELATED: An open house at a warehouse: an uncommon site in Oklahoma City, as industrial boom eases

Warehouse construction: What a difference a pandemic makes

"Tenant caution" and weakness in the retail sector, with store chain after chain filing for bankruptcy protection or downsizing, weakened the demand for warehouse-distribution space, which had caused a generational hike in industrial construction the past several years.

"With the upcoming election it will be interesting to see if tenants will remain cautious or feel positive enough about the economy to take on expansion. Tenant demand seems to be improving in early 2024, fueled by rising spending among consumers," Price Edwards reported.

Timeline of OKC's warehouse building boom

Just two years ago, OKC, along with the rest of the country, was binging on betting on big new warehouses built on speculation, meaning with no tenants lined up. Demand fueled by online shopping, which spiked early during the COVID-19 pandemic, remained high.

By the spring of 2023, out-of-state investors were still coming to Oklahoma City and building warehouses totaling hundreds of thousands of feet of space. That's the timing of timing. E-commerce had already started to level off, along with companies' transportation logistics and shipping needs.

By last November, one of the developers, TriStar Properties in St. Louis, held a rare warehouse open house to show other OKC brokers one of two 228,000-square-foot warehouses just finishing up at 9500 W Reno Ave.

In 2024, warehouse users are turning from expansion to efficiency

By the first of 2024, the boom was over, companies were shifting "from expansion to efficiency within their supply chain networks," warehouse employment was falling, and layoffs loomed, according to industry publication SupplyChainDive. Locally, in late April, all of that space at 9500 W Reno was still empty.

"Operating costs and efficiencies weren’t as scrutinized during the yearslong supply chain tumult sparked by the COVID-19 pandemic, as companies focused on keeping up with red-hot demand," the publication reported. "They’ve since reconsidered that approach.

"Businesses are taking a closer look at their operations and assessing where they can increase efficiency while cutting expenses, leading to job cuts and adjustments to network footprints."

OKC is still attractive to industrial users looking to locate or expand

The local market is still in good shape, though, and Oklahoma City is still attractive to companies with warehouse needs that are looking to come here or expand, said Brett Price, senior managing director and industrial property specialist at Newmark Robinson Park.

The firm handles leasing for OKC 577, a master-planned industrial park at Interstate 240 and S Eastern Avenue looking for tenants for buildings up to 2 million square feet. There is demand for it all over the long term, he said.

For years, Oklahoma City "struggled due to lack of available Class A options," Price said. "In the past 12 months we have seen the largest number of deliveries of Class A space in recent history. Pre-COVID, it took approximately 12 months to absorb new construction. During COVID, we were fortunate to lease several buildings prior to completion, which was new for our market.

"We have returned to pre-COVID absorption timelines, but now we have more product to offer tenants. For every space we currently have on the market, we have at least one prospect, and several prospects for some spaces. These prospects are both new to market and existing companies looking to expand."

RELATED: What's up with all the new warehouses built by out-of-state developers in OKC?

Price said he doesn't expect much new speculative construction until interest rates ease.

"This could mean we don’t have any new spec projects start for 9 to 12 months. If that happens, we won’t have any new spec product delivered until late 2025 at the earliest. If current leasing activity persists during that time, we will again be faced with limited Class A options for tenants looking in the market."

Bulk warehouse, service warehouse, and flex warehouse stats in OKC

The Price Edwards report covers only multitenant, investment-grade industrial buildings with at least 35,000 square feet of space, classified by design, intended use, and clear ceiling height, in three categories: bulk warehouse with at least 24 feet of clearance height; service warehouse with 18 to 23 feet of height; and flex warehouse, which are usually 18 feet, but can include newer buildings with higher clearance.

Here are the firm's assessments of each category:

Flex warehouse: "Retail warehousing/distribution, hybrids in the service sector, or any mix of these may be applicable. ... The market corrected itself to a decent (vacancy) of 5.67% last year and climbed somewhat again in 2023 to 6.43%, taking into account the sharp decline from a recent market high of 15.63% in 2018 to a market low of 3.42% in mid-2022. The companies in the larger industries make up a significant portion of these spaces, and these numbers ought to be steady if Oklahoma City keeps drawing in new companies to our state."

Bulk warehouse: "The bulk warehouse market continues to outpace all other asset classes of multitenant industrial products. This asset type is the only one that had a decreased vacancy compared to its 2022 number. Overall market vacancy rates for bulk warehouses eased to 4.33% from 5.31% year over year. This decline can mostly be credited by the southwest submarket, which decreased vacancy from 2.58% to nearly 0% year over year." Southwest OKC has 80% of all warehousing in the city.

Service warehouse: "The largest shift in vacancy was observed in service warehouses, which comprise older buildings and those with intermediate clear heights. The ... vacancy rate rose moderately from 5.45% to 8.85% in the previous year. ... We anticipate that more tenants will consider service warehouses as a way to mitigate the consequences of inflation."

Sign Up:Weekly newsletter Real Estate with Richard Mize

Senior Business Writer Richard Mize has covered housing, construction, commercial real estate and related topics for the newspaper and Oklahoman.com since 1999. Contact him at rmize@oklahoman.com. Sign up for his weekly newsletter, Real Estate with Richard Mize. You can support Richard's work, and that of his colleagues, by purchasing a digital subscription to The Oklahoman. Right now, you can get 6 months of subscriber-only access for $1.

This article originally appeared on Oklahoman: OKC warehouse market takes a breather after a boom and high interest