An Ohio man says a $400K gift his late wife left their adult kids teaches them 'the wrong lesson.' Here's where Dave Ramsey thinks he "screwed up" — and how you can avoid the same mistake

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Estate planning already a long, complicated process — but it can get even more difficult when someone tries to change the plan after the beneficiaries have already received their share.

According to a USA Today survey of Americans aged 18 to 42, the majority (68%) of respondents said they’d already received or expected to receive an inheritance. On average, inheritors expected to receive $320,000 — and a lot can go wrong when reality doesn't match those expectations.

Don't miss

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

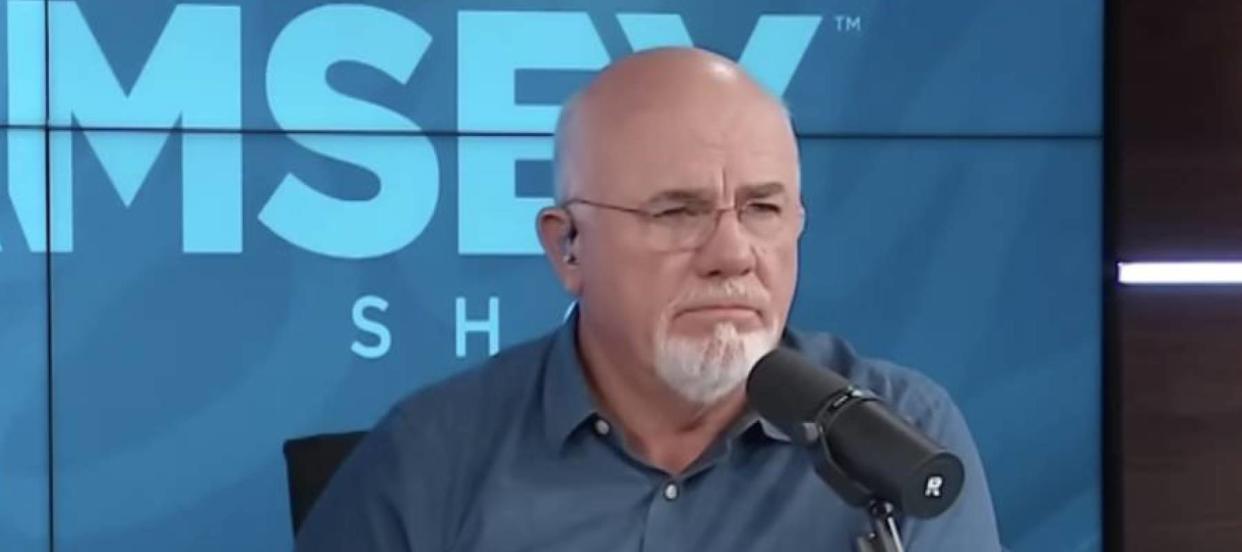

Nevertheless, Jeff from Toledo, Ohio is determined to retrieve a $400,000 gift his late wife left their two adult children. “I feel like it’s teaching them the wrong message and they’re getting a windfall at a very young age,” he said during an episode of The Ramsey Show.

However, Dave Ramsey was quick to let him know he thought it was too late to reconsider since the deed had already been signed. “I think they got the money, dude,” he told Jeff. “I think you screwed up.”

Here’s why Ramsey thinks pursuing the monetary gift could ultimately ruin Jeff’s relationship with his kids — and what you can do to avoid falling out with family while securing your financial legacy.

Leaving a legacy

According to a USA Today survey of Americans aged 18 to 42, the majority (68%) of respondents said they’d already received or expected to receive an inheritance.

Jeff revealed that his wife, who battled ovarian cancer, was also keen to “leave a legacy” for their two children.

When she passed away nearly two years ago, she left their 18-year-old daughter and 21-year-old son with a combined 50% stake (25% each) in the property.

This method effectively makes adult kids co-owners of the house, and such arrangements leave plenty of room for disputes, as Jeff could attest. Ramsey believes pursuing this further could put Jeff in a “relationship hole.”

With SBLI, you can purchase both whole and term life insurance, and they can tailor your policy to suit your personal requirements and financial goals.

SBLI can help you protect your family's financial future with the support of professional advice, a simple online claims process and no medical exams required for term insurance.

SBLI is a great way to get comprehensive coverage and avoid the disputes like the one Jeff’s family is facing.

Read more: Jeff Bezos convinced his siblings to invest $10K each in Amazon and now their stake is worth over $1B — how to build your fortune without help from family

Avoid conflict, call a professional

Wrangling over estates can often lead to family disputes and broken relationships. A study from LegalShield found that 58% of Americans have experienced conflict due to lack of estate planning and that’s no surprise given what that money can do for the loved ones you leave it to.

About 76% of those surveyed by USA Today planned to invest the money or put it into a savings account, while 40% planned to use it to pay off debts.

With so much at stake, bringing in a professional assist you in retirement and estate planning can help alleviate conflict and better prepare you to live your golden years that you want to.

WiserAdvisor is an online platform that connects users with vetted financial advisors based on their unique needs.

Sometimes it’s best for you and your family to let a trusted professional to help you navigate things like saving for retirement and making sure your money — and your legacy — is secure.

All you have to do is answer a few questions about your financial goals. Then WiserAdvisor will match you with FINRA/SEC registered financial advisers best suited to help you develop a plan to achieve them.

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

'We're looking at a downsized America': Kevin O'Leary warns any new house, car you enjoy will be significantly 'smaller' — what he means and how to protect yourself in 2024

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.