NYCB CEO predicts a 'clear path to profitability' after disclosing first-quarter loss

Troubled regional lender New York Community Bancorp (NYCB) lost $327 million in the first quarter, but its stock soared as a new CEO outlined a "clear path to profitability over the following two years."

The net loss was due in part to an increase in provisions set aside for future loan losses. Those increased to $315 million, compared with $170 million in the same year-ago period.

They were, however, down from $552 million in the fourth quarter.

NYCB is a big lender to office buildings and rent-regulated apartment complexes, especially in New York City. With $112 billion in assets, it is one of the country's top 30 banks.

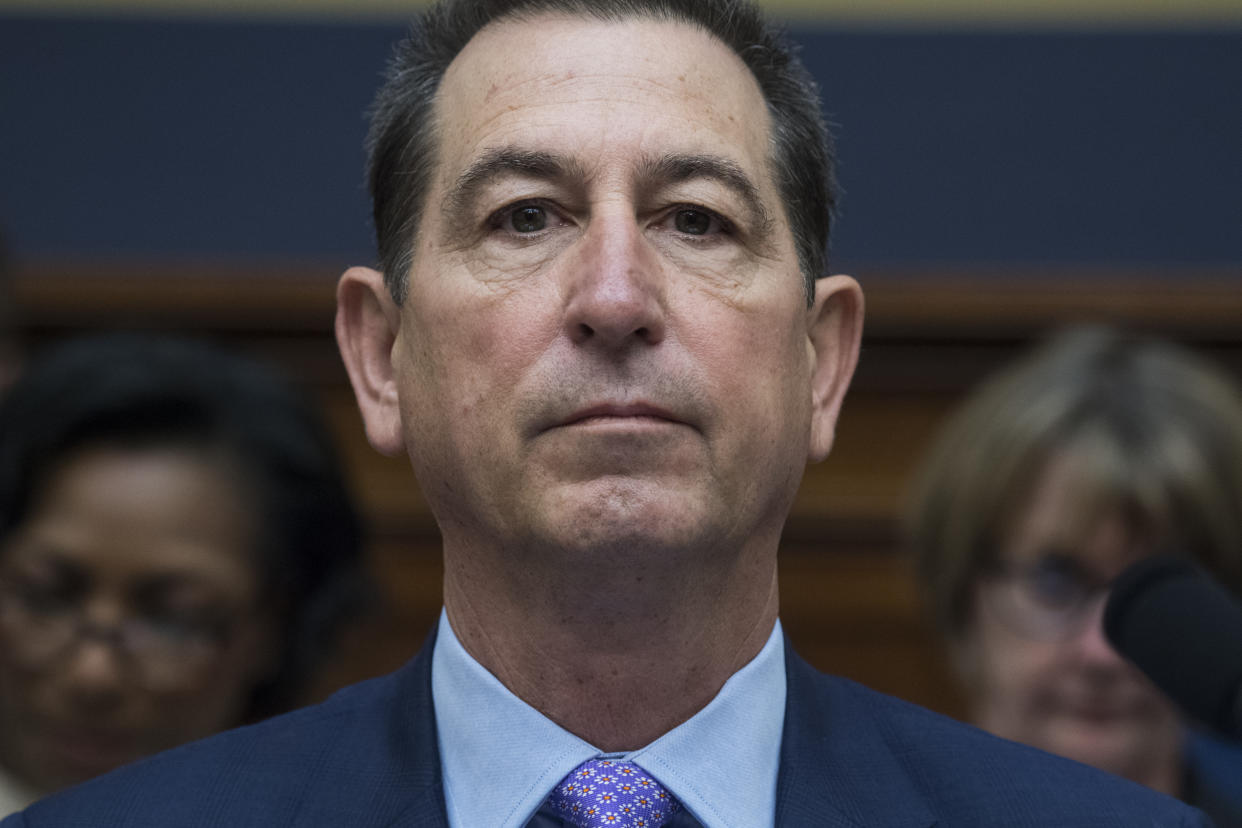

Its stock has fallen 67% since the beginning of 2024, but it rose 28% Wednesday after CEO Joseph Otting pledged NYCB would achieve "significantly higher profitability and higher capital levels" by 2026.

"While this year will be a transitional year for the company, we have a clear path to profitability over the following two years," he said in a release.

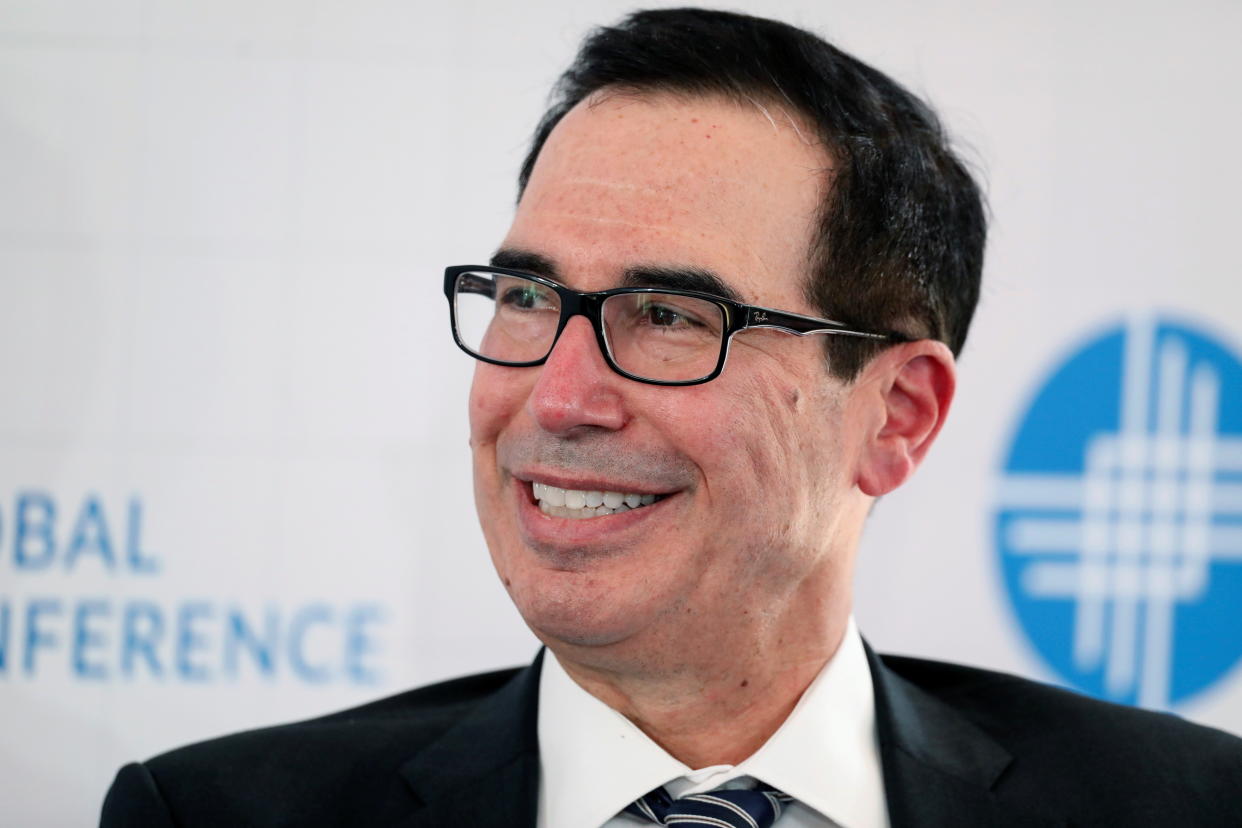

Otting, the former acting Comptroller of the Currency, leads a new team put in place this spring following a $1 billion infusion from a group that includes former Treasury Secretary Steven Mnuchin.

The infusion and executive reshuffling were attempts to restore stability to a big regional lender that began wobbling on Jan. 31 when it surprised analysts by slashing its dividend and setting aside more for loan losses.

The turmoil intensified after it disclosed weaknesses in its internal controls, and a tenfold increase in its fourth quarter loss to $2.7 billion.

Its struggle intensified new fears that mounting commercial real estate weaknesses could ripple through other banks.

It also came roughly one year after the fall of Silicon Valley Bank and Signature Bank, seizures in March of 2023 that triggered widespread panic among depositors.

NYCB served as a rescuer during that chaos, acquiring $38.4 billion of Signature Bank’s assets from US regulators.

But that deal pushed its own assets above $100 billion, a key threshold that created more challenges for NYCB in the form of tighter standards from regulators.

As NYCB tried to regain its footing during the first quarter of 2024, its deposits dropped by nearly $7 billion, going from $81.5 billion to $74.8 billion. This spring its bank also began offering a 5.55% annual yielding CD account, one of the highest such deposit rates in the country.

"We have looked to the CD market for some recent funding needs," said CFO Craig Gifford.

But Gifford said the "traction" on the 5.55% CD is "not so large as to move our margin" and "not driving an overall wholesale repricing of our deposit book."

NYCB made it clear Wednesday there were other challenges still in front of it, including more loan loss provisions and challenges among its borrowers.

It wrote off $81 million in bad loans during the first quarter that Gifford said was due "principally" to "a couple of office loans."

In a presentation, the bank estimated that earnings per share on a diluted basis will be -$0.50 to -$0.55 in 2024 due in part to setting aside as much as $800 million for future loan losses — before turning positive in 2025.

Gifford said the forecast for loan loss provisions for the remainder of the year incorporates expected struggles of commercial real estate borrowers as they wrestle with interest rates that are expected to remain elevated for some time.

He did not share an expected number for charge-offs for the remainder of 2024.

"I think that we'll see a ramping of charge-offs over the next couple of quarters," he added.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance