Now That It's Soared 876%, Is It Too Late to Buy Carvana Stock?

One of the most intriguing case studies in the capital markets over the last couple of years is Carvana (NYSE: CVNA).

The automobile industry got rocked during the peak of the pandemic as manufacturing and production became strained. Furthermore, working from home became common, with fewer people commuting to an office each day. As a result, the used car market witnessed a renaissance as people chose to trade in their vehicles -- and Carvana was a major beneficiary of this trend.

With shares up 876% in just the last year, some investors may think it's too late to scoop up some shares. Let's explore the investment prospects of Carvana and assess if now is good opportunity to buy the stock.

Carvana's story is unconventional, and...

Almost everything about Carvana is unorthodox. It's a used-car retailer, similar to CarMax. But Carvana brought e-commerce to the automobile market.

Instead of going to a dealership and speaking with a sales rep, consumers can buy cars straight from Carvana's online platform. Oh, and if you're wondering where you can find Carvana's inventory, you won't see their cars sitting in a parking lot waiting to be test-driven. The company stores its cars inside massive vending machines.

While this may all sound unconventional, the business model resonates with consumers. In today's world, shoppers do not want to be inundated with aggressive sales tactics or marketing campaigns. Carvana's approach to buying cars is highly efficient, as it removes a lot of the friction from going to a dealership.

But though tech-enabled services for buying cars might sound appealing, Carvana's business isn't as rosy as you might think.

Image Source: Getty Images.

...the latest chapter is a doozy

Last July, Carvana narrowly avoided bankruptcy after restructuring its debt with creditors. While renegotiating its debt was largely viewed as a good move, the fine print spells a different story.

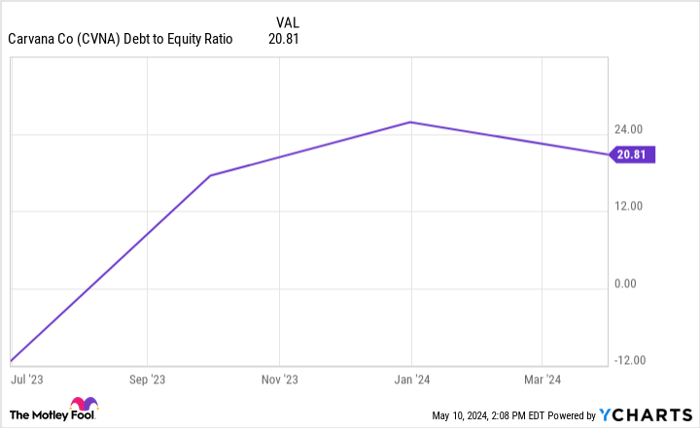

In particular, Carvana's debt was reduced by $1.2 billion. But when you look at the company's income statement, you'll notice that interest expenses were actually higher during the first quarter of 2024 than during the same period last year. While Carvana's debt-to-equity ratio of 20.8 is trending in the right direction, it's still much higher than even a year ago.

CVNA Debt to Equity Ratio data by YCharts

If this wasn't enough to raise your eyebrows, Carvana's first-quarter earnings report was nothing short of a mirage. But that didn't stop investors from pouring into the stock, blasting shares more than 30% higher.

The big reason for the increased buying was that Carvana posted a profit -- Wall Street analysts were expecting the company to burn more money and post a loss. However, as with its seemingly encouraging debt restructuring, there was more than meets the eye in Carvana's latest earnings.

Specifically, the company's reported net income of $49 million is misleading. The reason is that this included an adjustment to the company's fair value of warrants that it owns in another business.

In simple terms, Carvana's profit was due to an accounting procedure as opposed to real, tangible acceleration of the business and improving operating efficiency. This means that the company's positive net income is more of an anomaly, and investors should not expect ongoing profits in the near term.

Carvana stock: investment or trade?

I'll be honest here: I don't see Carvana as a bad company, per se. In fact, I am bullish on its long-term prospects because I think the automobile industry is in desperate need of some technology-driven innovation.

But with that said, I think Carvana is more of a meme stock. The share price is often disconnected from the underlying fundamentals of the business. While there is money to be made in momentum trading, this approach to investing carries outsize risk. Ultimately, Carvana looks like a favorite among day traders rather than among long-term investors.

In my opinion, it is certainly not too late to buy Carvana stock. However, I'd sit on the sidelines for now. It's going to take some time for Carvana to really build an efficient business anchored by accelerating revenue, debt reduction, and profits.

Should you invest $1,000 in Carvana right now?

Before you buy stock in Carvana, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carvana wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CarMax. The Motley Fool has a disclosure policy.