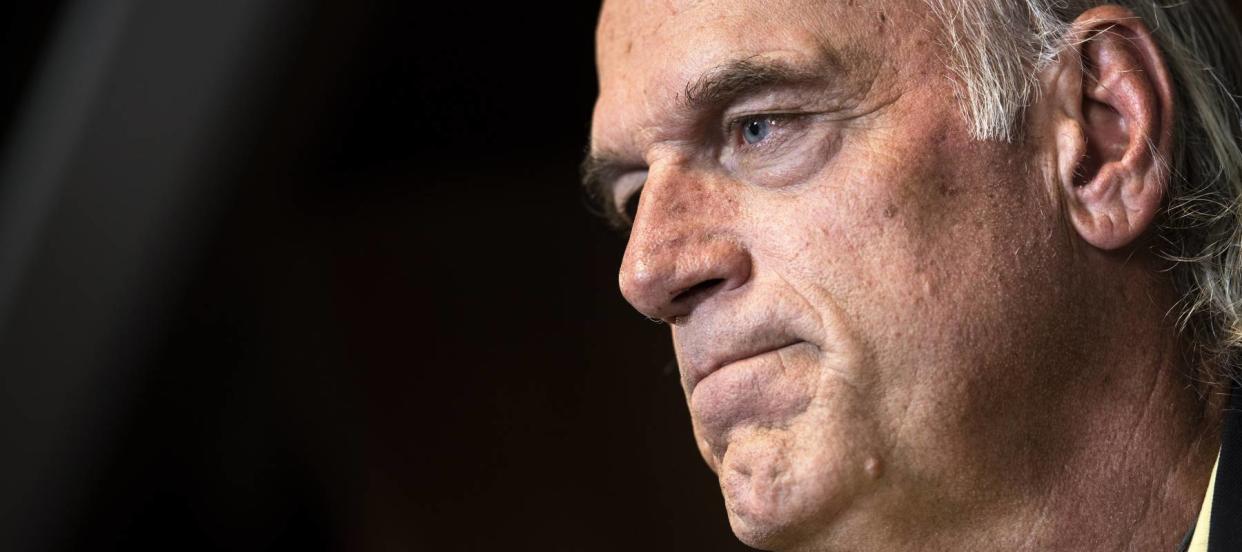

'There should not be one billionaire in America': Jesse Ventura slams the elite, saying nobody works hard enough to earn billions of dollars — how to make your money work for you instead

Jesse Ventura, the former governor of Minnesota, had tongues wagging after he stated his belief that “there should not be one billionaire in America” earlier this year at Steel City Con.

The 72-year-old explained that his views were shaped by his personal experience working a wide range of jobs.

Before serving as governor from 1999-2003, he was a professional wrestler and actor. But, he said, the jobs that "were physically the most demanding, and mentally the most difficult that I ever did, paid me the least amount of money."

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

One of the toughest experiences he had was going through the Basic Underwater Demolition/SEALS training program for the Navy.

“I challenge any billionaire to put up with six weeks of that at $62 every two weeks,” he said at the Pennsylvania conference in April.

Before joining the Navy, Ventura says he had a job with the Minnesota Highway Department making a “couple of bucks above minimum wage” where he worked four 10-hour days a week.

“And guess what I did? I ran the 80-pound jackhammer,” he said. “I challenge any billionaire to run the jackhammer for 40 hours for one week and then tell me he works harder than that.”

In his opinion, no one works hard enough to justify making billions of dollars. These comments highlight a disconnect between hard work and compensation. The most labor-intensive and time-consuming jobs are not necessarily the best paid.

If making money is unrelated to hard work, why put your money to work instead? Here are two ways to take advantage of your capital to generate passive income.

Dividend stocks

Investing in stocks is a rather passive way to make money. You fund your account, buy a stock and (if you picked the right one) the stock gains value over time without the need for you to lift a finger. To make this even more attractive, some stocks offer you cash payments simply for holding them.

Blue-chip stocks often pay high dividend yields. For example, AT&T currently offers to pay out 7% of its share price, and Pfizer offers 5% along with its Dividend Reinvestment Plan, which lets you compound wealth at an accelerated pace.

With enough time and capital, you could create a sustainable source of passive income from dividends alone. High-yield dividend stocks can allow you to fund your lifestyle with the rewards of a thriving economy, and the strategy requires no physical labor at all.

Read more: Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Inflation-protected bond ETFs

Bonds are looking more attractive now that the central bank has raised interest rates. The yield on a 10-year U.S. Treasury is comfortably above 4% right now, significantly higher than the sub-1% yield in 2020. The Treasury yield is also much higher than the S&P 500’s average dividend yield of around 1.6%.

Simply put, you can earn a higher income by lending money to the U.S. government for 10 years (a strategy widely considered to be nearly risk-free) than by investing in America’s 500 largest public companies.

Inflation complicates this a little. That’s because companies in the S&P 500 can raise prices and boost dividends in line with inflation, but the payout on most government bonds is static regardless of economic conditions. With inflation at 3.7% right now, this is a genuine concern.

However, some bonds have payouts linked to inflation. Treasury Inflation-Protected Securities are U.S. sovereign bonds pegged to the Consumer Price Index. In other words, the payout on these bonds is periodically adjusted according to the cost of living.

Funds like the iShares TIPS Bond ETF (exchange-traded fund) could give you access to this stream of passive income.

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Rising prices are throwing off Americans' retirement plans — here's how to get your savings back on track

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.