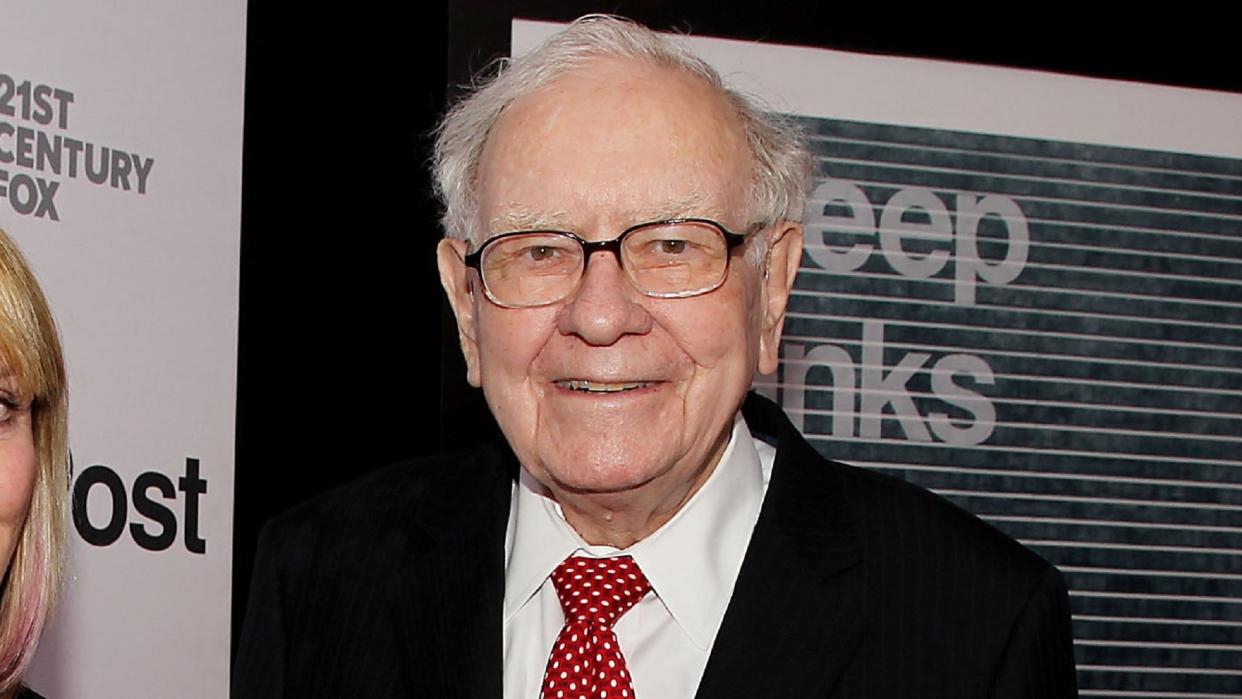

What’s Next for Warren Buffett and Berkshire Now That ‘Investing Genius’ Charlie Munger Has Passed?

Charlie Munger — Warren’s Buffett’s right-hand man, Berkshire Hathaway vice chairman and billionaire investor — died on Nov. 28 at the age of 99.

See: 5 Things Warren Buffett Says To Do Before a Recession Hits

Warren Buffett’s Advice to Investors: ‘Incredible Period’ for America’s Economy is Ending

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett, CEO of Berkshire Hathaway, said in a press release.

Munger helped the Oracle of Omaha broaden his investment horizons — encouraging him to not only look for value investments, but to consider buying good companies at a fair price. A prime example was the purchase of See’s Candies, said Robert R. Johnson, PhD, CFA, CAIA and professor of finance at the Heider College of Business, Creighton University. Johnson has been a Berkshire Hathaway shareholder since the early 1980s, and has also attended most Berkshire Hathaway Annual meetings since then.

Johnson observed that Munger will be best remembered as “half of the best investment duo in history.”

Also: 12 Unrecognizable Signs of Wealth

Charlie Munger Remembered By Financial Experts

“Charlie has taught me a lot about valuing businesses and about human nature,” Buffett said in 2008, according to ABC.

Scores of financial experts believe they owe a huge debt to Munger’s vision and guidance.

Jim Falbe — managing principal of Saguaro Capital Management, a value fund — said Munger didn’t just transform Buffett’s thinking, he transformed the philosophies held by value investors the world over.

“We owe him a huge debt of gratitude,” Falbe said.

Meanwhile, Munger’s advice on disciplined decision-making, building in a margin of safety and long-term value creation “may seem like simple ideas, but they were seminal ideas for value investors and are also excellent advice for business owners,” according to Jeremy Foster, chairman of Calque.

Berkshire Hathaway’s operating earnings totaled $10.761 billion last quarter, 40.6% higher than the number from the same quarter a year ago, per CNBC. And Berkshire held a record level of cash at the end of September — $157.2 billion.

What Does Charlie Munger’s Passing Mean for Buffett and Berkshire?

Cathy Seifert, director of CFRA Research, said Berkshire Hathaway shareholders will not be directly negatively impacted by Munger’s passing, as they have benefited from his years of wisdom — “and the straightforward, often unvarnished opinions and counsel he typically offered up in his signature frank style.”

This sentiment was also echoed by Johnson, who said that as a Berkshire shareholder, he is not the least bit concerned about the ramifications of Munger’s passing as it pertains to the holding company.

“Ajit Jain, Ted Weschler and Todd Combs will carry on the Berkshire way,” he said. “Charlie’s passing will, however, change the annual meeting forever, as it truly was the Warren and Charlie show and was unlike any other.”

Jain is vice chairman of insurance operations for Berkshire Hathaway, while Weschler and Combs are investment managers.

In addition, Greg Abel — CEO of Berkshire Hathaway Energy — is widely viewed as Buffett’s successor after Buffett praised him (and inadvertently said as much) at the 2021 annual shareholder meeting.

Not All Experts Agree

Other experts argue that Munger’s passing will represent a critical moment for Berkshire shareholders.

Peter C. Earle, economist with the American Institute for Economic Research, said it’s now time for either Abel or Jain to step up.

“Buffett worked with Munger for well over six decades. However sharp Abel or Jain are, it will be difficult if not outright impossible to develop the kind of personal synergies that the two founders had,” said Earle. “Whether that’s bad for BRK shareholders or introduces new forms of complementarity will take a few quarters to see.”

As Earle argued, Munger was the straight man to Buffett’s occasionally visionary nature.

“As information has become more digitized and cheaper, value plays have been harder to come by,” he said, adding that one of the keys to Berkshire Hathaway’s success over the last few decades was their moving beyond a pure value investment framework — a move which occurred at Munger’s recommendation.

The book “Poor Richard’s Almanack” — a collection of speeches and talks by Munger, compiled by Peter D. Kaufman — also became an investing advice bible.

“From 1733 to 1758, Ben Franklin dispensed useful and timeless advice through Poor Richard’s Almanack. Among the virtues extolled were thrift, duty, hard work, and simplicity. Subsequently, two centuries went by during which Ben’s thoughts on these subjects were regarded as the last word. Then Charlie Munger stepped forth,” Buffett wrote in the foreword.

More From GOBankingRates

11 Signs You're Struggling Financially -- and 3 Ways To Get Back on Track

11 Uncommon Investments That Can Actually Make You A Lot of Money

This article originally appeared on GOBankingRates.com: What’s Next for Warren Buffett and Berkshire Now That ‘Investing Genius’ Charlie Munger Has Passed?