Are You the Next Buffett or Cuban? 6 Signs You Could Become Richer Than You Expect

Only four people in the world are richer than Warren Buffett, and with a $106 billion net worth, the Berkshire Hathaway boss is one of just six people with 12-figure fortunes. Fittingly, the “Oracle of Omaha” saw it coming.

History’s most successful investor is famously quoted as saying, “I always knew I was going to be rich. I don’t think I ever doubted it for a minute.”

Experts: Make These 7 Money Resolutions If You Want To Become Rich on an Average Salary

Grant Cardone: What To Do If You Don’t Have Money

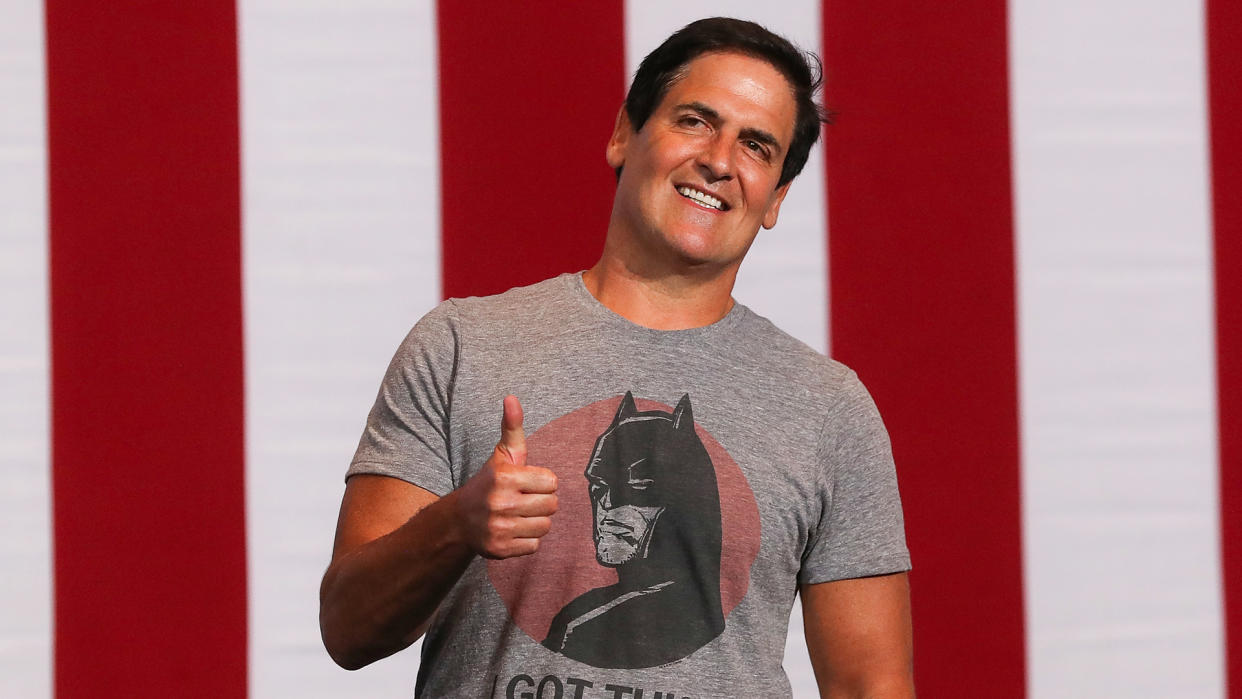

Compared to Buffett, Mark Cuban has a comparatively weensy yet still gargantuan $6 billion net worth. But he didn’t always share Buffett’s self-assuredness.

According to CNBC, the “Shark Tank” star and Dallas Mavericks owner lacked his fellow billionaire’s confidence until his mother taught him to dance when he was 12. Only then did he realize he was a quick learner willing to work hard at developing new skills.

Cuban’s newfound faith in himself led him to earn his first dollars selling coins, stamps and garbage bags door to door as a kid. Soon after, he earned $25 an hour — a king’s ransom for a teenager in the 1980s — to put himself through college. Only then did he know he’d one day be a very wealthy man.

Whether you’re more like Buffett or Cuban, here are some signs that you might be more likely to follow in their footsteps than you think.

Nothing Gets You More Excited Than Watching Your Savings Grow

In a 2008 blog post, Cuban wrote, “Save your money. Save as much money as you possibly can. Every penny you can.” More than a decade and a half later, that’s still the surest path to financial success.

“One key indicator of potential wealth is consistent saving habits, no matter how small,” said Ian Rodda, CFO of Page One Formula, which helps entrepreneurs grow their businesses. “Individuals who prioritize saving, even in minimal amounts, demonstrate a foundational understanding of wealth accumulation that often leads to greater financial success.”

Find: 5 Ways To Earn at Least 5% APY on Your Money (Without Using the Stock Market)

You Invest Above Your Weight

The famously thrifty Buffett has an entire philosophy based not on earning a huge salary so you have a lot to invest, but living frugally so you have something to invest no matter your salary. If your penny-pinching lifestyle gives you as much money to put to work as someone who earns more than you, and you started doing it early in life, you could be following in Buffett’s footsteps without even knowing it.

“Building wealth is fundamentally about spending less than you earn and then investing that difference in investment vehicles that significantly outpace inflation,” said Cody Plante, MBA, an angel investor who works in capital controls for Dartmouth College’s Energy Program. “The key is to do this consistently over time and start as early as possible. Typically, people who are frugal by nature find it easier to engage in these financial habits and can end up with more significant wealth than their peers who might have out-earned them during their working years.”

You’d Rather Go Without Than Go Into Debt

In 2018, CNBC published an article titled “Warren Buffett and Mark Cuban agree: Avoid debt at all costs.” The article chronicled how both billionaires have spent their entire careers railing against the pitfalls of being leveraged by borrowing.

“People definitely can be richer than they expect,” said Debbi King, author of “The ABC’s of Personal Finance: 26 Essential Keys to Winning With Your Money.” “But always spend less than you make. Debt will stymie your wealth-building every time. If you are always coming up short with your bills, you will never have anything to invest in your future.”

You Obsess Over Learning About Money

Cuban and Buffett are both famous information sponges known for pursuing knowledge of all kinds — particularly the kind that makes them smarter with money.

“The world is constantly evolving, and those who adapt and grow tend to find new opportunities to increase their wealth,” said David Rafalovsky, CEO of the financial platform Oxygen and former managing director and CTO of Citi Global Functions. “This might mean learning about financial markets, new technologies, or even improving personal skills that enhance your career prospects.”

You Surround Yourself With Winners, or Aspiring Winners at Least

Buffett once said, “I learned that it pays to hang around with people better than you are because you will float upward a little bit. And if you hang around with people that behave worse than you, pretty soon, you’ll start sliding down the pole. It just works that way.”

Or, as the old expressions goes, tell me who your friends are and I’ll tell you who you are.

“They say you’re the average of the five people you spend the most time with,” said Rafalovsky. “Surrounding yourself with motivated, financially savvy, and positive individuals can have a profound impact on your own financial journey. These people can provide insights, opportunities, and support that you might not find elsewhere.”

You’re Resilient

Like so many self-made millionaires and billionaires, Cuban’s life has been filled with disappointments, defeats and brushes with bankruptcy. If you absorb gut punches and keep on fighting, it might be the surest indicator of all that you’re primed for a wealthy future.

“[The most] important sign is resilience,” said Rafalovsky. “The road to wealth is rarely a straight line. It often involves setbacks and failures. Those who have the grit and determination to learn from these experiences and keep moving forward often find success.”

More From GOBankingRates

I'm a Bank Teller: Here Are 10 Mistakes You Are Making With Your Banking

Use This Checklist To See Whether Your Bank is Costing You a Lot of Money

This article originally appeared on GOBankingRates.com: Are You the Next Buffett or Cuban? 6 Signs You Could Become Richer Than You Expect