Spinoffs Roundup: These Companies Could Unlock Value in 2020

Some spinoffs can unlock the true value of businesses by allowing them to focus on their niches better than being part of a bulkier multi-faceted corporation allows. On the other hand, some spinoffs are made by the parent companies to shed dead weight, help get rid of legal liabilities or satisfy regulatory requirements in order to be cleared for a merger or acquisition. A spinoff is certainly no guarantee of success or failure in and of itself, as a lot depends on why the spinoff was made and whether its collection of assets and operations works well together.

So far in 2020, there have been five major spinoffs from publicly traded companies, according to the GuruFocus Spinoff List: Madison Square Garden Entertainment Corp. (NYSE:MSGE), Carrier Global Corp. (NYSE:CARR), Otis Worldwide Corp. (NYSE:OTIS), Arconic Corp. (NYSE:ARNC) and Brookfield Infrastructure Corp. (NYSE:BIPC). Let's take a look at why these companies were spun off from their parent companies, what their business operations consist of and how likely they are to unlock value for shareholders.

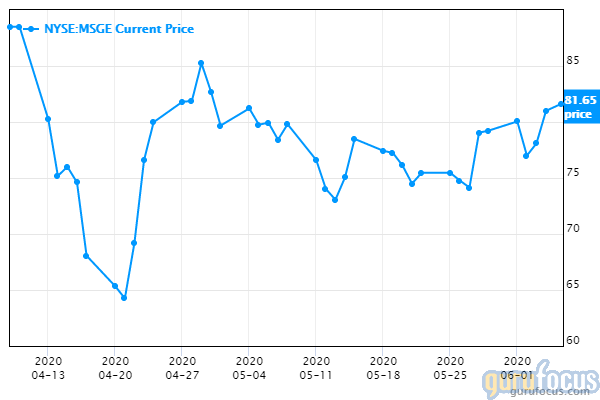

Madison Square Garden Entertainment

Madison Square Garden Entertainment Corp. was spun off from Madison Square Garden Sports Corp. (NYSE:MSGS) on April 20. The parent company owns a collection of sports teams, including the New York Rangers, as well as a couple of performance centers.

Prior to the spinoff, the company, which traded under the MSG ticker, was a world leader in both live sports and entertainment experiences. It has now effectively divided the two businesses, with the live sports remaining with the original company and the entertainment assets forming the new company.

"The company continues to believe that the proposed separation of the sports and entertainment businesses would enable shareholders to more clearly evaluate each company's assets and future prospects," MSG said in a statement when the split was announced.

Since the spinoff, the share price of the entertainment company has declined approximately 7.75% to trade around $81.65 for a market cap of $2 billion on June 5.

The entertainment company includes existing venues Madison Square Garden, Hulu Theatre, Radio City Music Hall, Beacon Theatre and Chicago Theatre, as well as new venues in London and Las Vegas.

This seems to be a fairly clean and simple split, with a business that consisted of two divisions dividing into separate entities. According to statements from the company's executives, the decision to split was made to "unlock value" and prompt a higher market value for both companies than the one they were able to achieve as one entity.

Following Blue Harbor Group's calculation of the value of the Knicks and Rangers at $7.2 billion, the company's entire market cap was trading at a 10% discount to the purchase value of the two sports teams alone, indicating significant undervaluation.

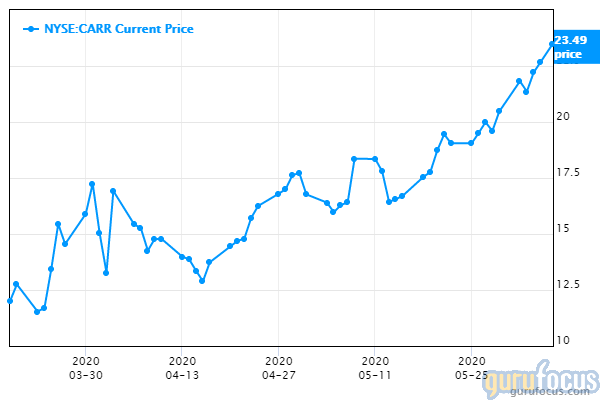

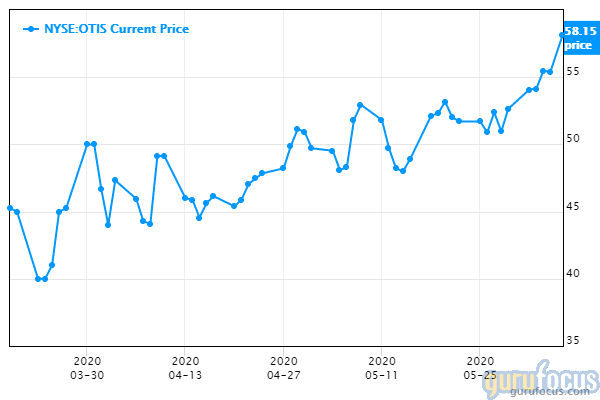

Carrier and Otis

On April 3, Raytheon and United Technologies successfully closed their merger, forming Raytheon Technologies Corp. (NYSE:RTX). The new company began trading on April 3. Directly preceding the merger, United Technologies spun off Carrier and Otis into separate companies, both of which have been added to the S&P 500.

The purpose of spinning off Carrier and Otis was three-fold. Primarily, Raytheon and United Technologies sought to narrow their focus and concentrate on defense, which made up by far the majority of their businesses. The decision to spin off the two businesses seemed to be a natural part of that process, as United Technologies did not prioritize their growth and thought they would be more profitable as independent companies.

"We are taking another important step in the transformation of UTC and the establishment of two independent companies that are leaders in their respective industries with attractive investment profiles," United Technologies Chairman and CEO Gregory Hayes said when the spinoffs were announced. "As standalone public companies, Carrier and Otis are each well-positioned to drive sustained growth and innovation, with more focused business strategies that will enable them to maximize value for their customers and shareowners."

Carrier Global is widely recognized as one of the largest and most reputable HVAC providers in the world, with a presence in the Americas, Europe, Asia Pacific and the Middle East and Africa regions. The market for HVAC is expected to grow to $130 billion by the end of 2020, primarily due to increasing demand in developing countries as well as developed European countries that have seen unprecedented heat waves in recent years.

Since the spinoff, the share price of Carrier Global has risen approximately 95.91% to trade around $23.51 per share for a market cap of $20.49 billion on June 5.

Otis Worldwide is one of the leading global names in the elevators business. Without enough focus on its growth, Otis, which had the highest return on capital of United Technologies' businesses, lost market share to Kone (OHEL:KNEBV) in China. Some businesses are better off as a pure play, and this is likely to be the case with Otis. The strong intangible value of its brand name, which has a 160-year history, is the number one name in elevator safety brakes, which will help drive its growth as an independent company.

Since the spinoff, the shares price of Otis Worldwide has risen approximately 33.38% to trade around $58.30 for a market cap of $25.21 billion on June 5.

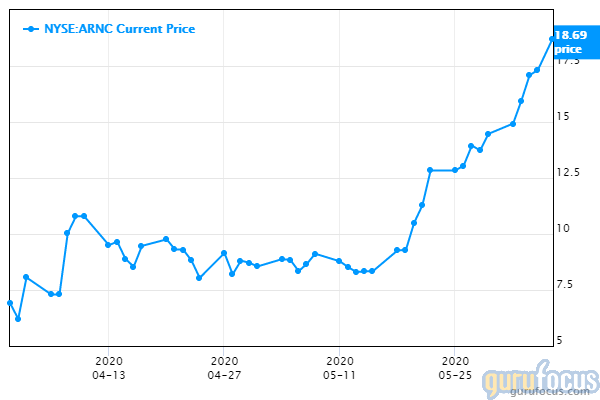

Arconic

The April 1 spinoff of Arconic was a little unusual in that the "parent" company, Arconic Inc., chose to rename itself Howmet Aerospace Inc. (NYSE:HWM) and trade under a new ticker while having its "child" company keep the Arconic name and trade under its old ticker.

The company has a long history dating back to 1926. It has been renamed several times following mergers, acquisitions and spinoffs. The Howmet name appeared in 1965 and marked a transition from a mining company to a manufacturer of precision metals products. Howmet became part of Alcoa in 2000, and Alcoa was renamed Arconic in 2016 when the company shed some of its mining operations.

Howmet consists of the engines, engineered structures, fastening systems and forged wheels operations, while the new Arconic consists of global rolled products, aluminum extrusions and building and construction systems.

Since the spinoff, the share price of Arconic has increased 170.08% to trade around $18.69 for a market cap of $2.04 billion on June 5.

The spinoff was announced after the parent company turned down a $15 billion takeover proposal from Apollo Global Management (APO) in early 2019. After Arconic Inc. separated, Howmet Aerospace collected $700 million from Arconic Corp. and used both this cash and $600 billion in internally generated revenue to pay off $1.3 billion in debt, prompting Fitch to upgrade its credit score.

Thus, it seems this was a restructuring benefited Howmet a little more. Business is likely to continue as usual for both industrial products companies, as the spinoff does not result in higher niche concentration.

Brookfield Infrastructure

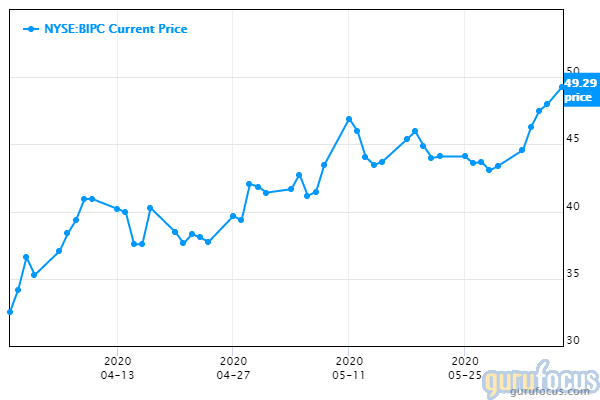

Brookfield Infrastructure split off from its parent company, Brookfield Infrastructure Partners LP (NYSE:BIP), on March 31. The unit split transaction did nothing to alter business operations or cash flows; it was purely a change to the number of shares outstanding.

"We are excited to be launching this new offering to investors, providing an alternative way to access our globally diversified portfolio of high-quality infrastructure assets," said Sam Pollock, the CEO of Brookfield Infrastructure. "We see many potential benefits in establishing BIPC, including expanding our investor base, broader index inclusion and tax advantages for some investors."

Brookfield Infrastructure is a global infrastructure company that owns and operates utilities, transport, energy and data infrastructure across the Americas, Asia Pacific and Europe. As noted above, the spinoff will have no effect on the company's normal operations.

Management hopes that the split will attract new investors as well as provide investors with the flexibility to allocate their capital to a more specific portfolio of assets. The move seems likely to benefit those who were already invested in the company, but it will only have an effect on market valuation, not the underlying assets.

Since the spinoff, the share price of Brookfield Infrastructure has risen 51.47% to around $49.29 for a market cap of $2.28 billion on June 5.

Conclusion

There are many different reasons as to why companies choose to spin off parts of their business. Some of them are beneficial to shareholders, some make no change to the underlying business and others could indicate the ditching of unprofitable assets or a move to pay off debt.

A look at the companies that have spun off so far in 2020 reveals that Madison Square Garden Entertainment, Otis and Carrier will result in concentration of core businesses, which could unlock their potential. Business will likely continue as usual at Arconic aside from a restructuring of management and slightly more debt, while Brookfield Infrastructure will remain effectively unchanged.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.