Investors in Immatics (NASDAQ:IMTX) have made a return of 18% over the past year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Immatics N.V. (NASDAQ:IMTX) share price is up 18%, but that's less than the broader market return. Immatics hasn't been listed for long, so it's still not clear if it is a long term winner.

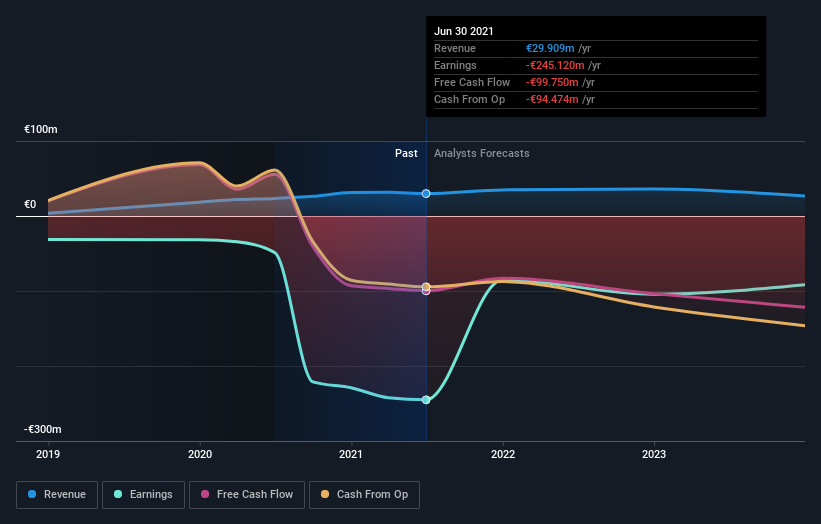

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Immatics

Immatics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Immatics grew its revenue by 28% last year. That's a fairly respectable growth rate. The share price gain of 18% in that time is better than nothing, but far from outlandish Its possible that shareholders had expected higher growth. But this one could be a worth watching - a maiden profit would likely catch the market's attention.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Immatics' financial health with this free report on its balance sheet.

A Different Perspective

Immatics shareholders have gained 18% for the year. The bad news is that's no better than the average market return, which was roughly 32%. That's a lot better than the more recent three month gain of 3.5%, implying that share price has plateaued recently, for now. It's not uncommon to see a company's share price between updates to shareholders. It's always interesting to track share price performance over the longer term. But to understand Immatics better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Immatics you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.