Elevance Health: Choose Predictably

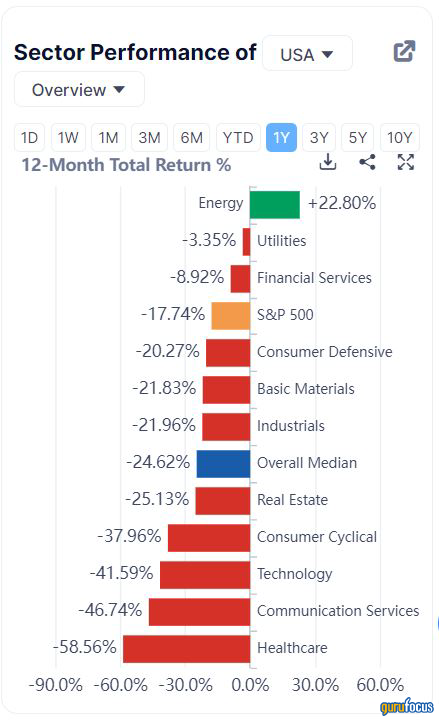

Over the last year, the S&P 500 Index has lost nearly 18%. Every sector, save energy, is lower over that period of time. No sector, however, is worse off than the health care sector, which has lost a staggering 58.6%.

That being the case, there are some names within this sector that have performed very well. One such name is Elevance Health Inc. (NYSE:ELV), formerly known as Anthem Inc.

Elevance Health is a leading provider of health care benefits and has more than 47 million members under its plans. These plans are provided through such channels as individual plans, commercial, Medicaid and Medicare. More than half of annual sales come from governmental sources, with commercial accounting for a third and individual comprising the remainder.

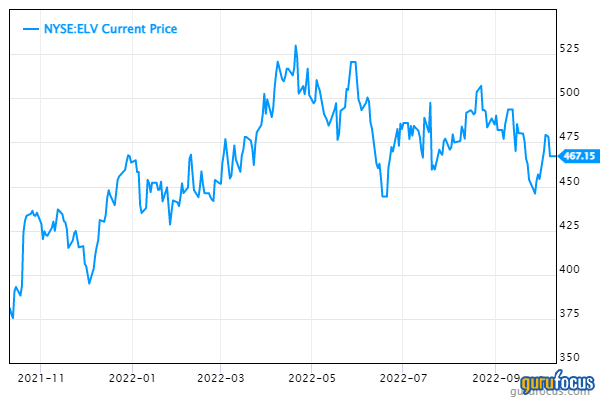

The last year has seen a wide range in the share price as the stock has a high of $533.68 and a low of $370. Shares of the $112 billion company have returned nearly 24% over the last 12 months and sit close to 11% off the 52-week high.

Consistently improving fundamentals

Elevance Health last reported quarterly earnings on June 28. Revenue for the second quarter grew nearly 16% to $38.5 billion, topping Wall Street analysts expectations by $430 million. Adjusted earnings per share of $8.04 were ahead of the $7.03 the company produced in the prior year and 30 cents better than anticipated.

The company had gains in almost all areas of its business. Total premiums improved 16% to $33.1 billion while product revenue increased 17% to $3.6 billion. Breaking down results further, revenue for Government Business was up almost 19%, IngenioRx grew 13.7% and Commercial & Specialty gained 10.6%.

Total membership was up slightly more than 6% to 47.1 million, with Government Business higher by 11% and Commercial & Specialty Business up 3.8%.

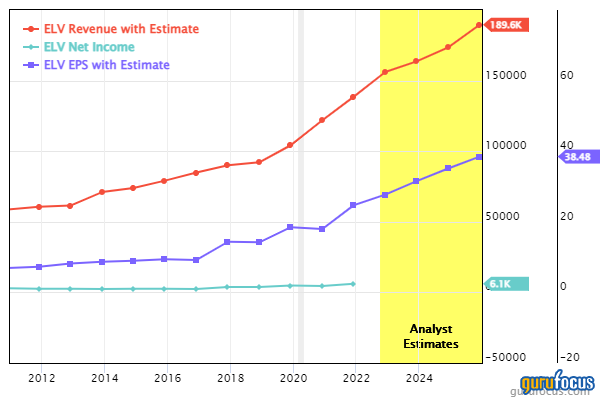

Elevance provided revised guidance for 2022, with leadership now expecting adjusted earnings per share of at least $28.70, up from prior guidance of $28.40. If achieved, this would represent a 10.5% improvement from 2021. This is not too far off the companys compound annual growth rate of 13.7% over the last decade, according to Value Line.

Strengthening results likely is not a surprise to those that follow the company as growth on both the top and bottom line has trended upward over the last 15 years, which is why Elevance Health received five out of five stars for its predictability rank.

Elevance Healths balance sheet at the end of the quarter was in a strong position with total assets of $100.9 billion, total current assets of $53.7 billion and cash and cash equivalents of $6.5 billion. This compares to total liabilities of $65 billion, total current liabilities of $39.3 billion, long-term debt of $21.2 billion and current debt of $2.2 billion.

Dividend analysis

Elevance Health has raised its dividend for 12 consecutive years. Over the last decade, the dividend had a CAGR of 16.4%, just ahead of earnings growth.

The stock has rarely been a high-yielding name.

That trend holds true today, as the stock yields 1.1%. This is below the five-year average yield of 1.3%, but the difference is likely due to the 144% gain that Elevance Health has experienced during this period of time; a solid trade-off as far as investors are concered.

The good news for shareholders is the dividend is likely safe. The company should distribute $5.12 of earnings per share in 2022, which equates to a projected payout ratio of 18% using leaderships guidance for the year. This is just below the average payout ratio of 20% since 2012.

Valuation analysis

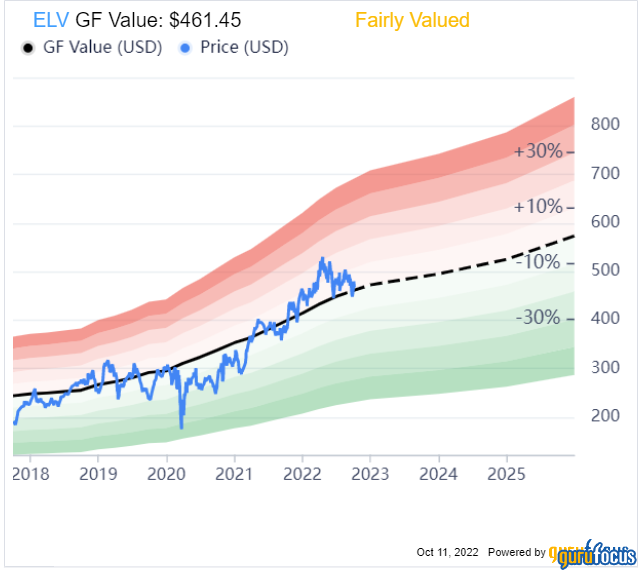

Elevance Health currently trades at $470.56, giving the stock a forward price-earnings ratio of 16.4 using guidance for the year. This compares to the 10-year average price-earnings ratio of 13.5, making the stock mildly overvalued on a historical basis.

However, the GF Value Line suggests the stock is fairly valued based on historical ratios, past financial performance and analysts future earnings projections.

Elevance Health has a GF Value of $461.58, resulting in a price-to-GF Value ratio of 1.02. This implies the stock is overvalued by 2% even after its recent outperformance. Shares earn a rating of fairly valued from GuruFocus.

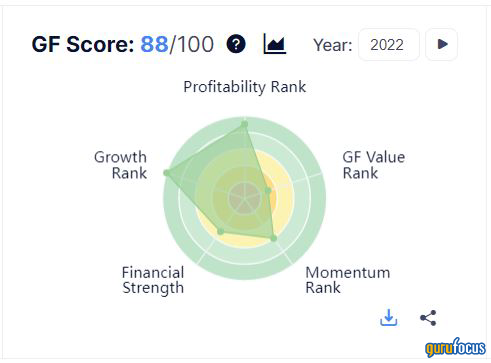

The company has a solid GF Score of 88 out of 100, implying is has good performance potential going forward.

Growth is Elevance Health's best score, where the company receives a perfect 10 out of 10, driven by revenue and earnings growth rates that top the majority of the companies in the health care plans industry. It should be noted there are just 15 companies in this industry, but Elevance Health still outranks the majority on most metrics.

One area where the company has middle-of-the-road expectations is future revenue and earnings growth rates. Morningstar Inc. (NASDAQ:MORN) analysts project revenue and earnings growth of 11.5% and 6.7%, respectively, over the next three-to-five-years. This is still within the normal long-term ranges for the company even if the projected growth rates rank in the middle of peers.

Elevance Health has a strong showing on profitability rank, where it scores a 9 out of 10. This score is driven by return on equity and return on assets that are expanding and besting nearly two-thirds of peers. On the other hand, the net margin is in decline from prior years, but is still one of the companys best showings over the last decade.

Financial strength is rated 5 out of 10, largely due to long-term debt growing over the past 10 years. Despite this, the interest coverage is manageable and at the best level in the last decade for the company. Elevance Health also has a Piotrsoki F-score of 8 out of 9, suggesting the financial condition is very healthy. Lastly, the return on invested of capital of 8.9% versus its weighted average cost of capital of 7.5% indicates the company is generating value from its investments in its business.

Final thoughts

Elevance Health has easily topped its own sector and the S&P 500 over the last year. This has occurred because the company has seen healthy growth for both revenue and earnings per share, a trend that has played out over the long term. As a result, Elevance Health has a perfect five-star rating for predictability.

While the stocks yield is on the low side, the growth rate has been in the mid-teens since 2012 and the payout ratio is extremely low. Shares are trading above their average historical multiple, but are fairly valued on an intrinsic basis. The GF Score also points to good performance in future years.

Investors looking for a health care name performing at a high level and still trading with a reasonable valuation may find Elevance Health an attractive investment option given its predictability over the last 10 to 15 years.

This article first appeared on GuruFocus.