Biden's student loan forgiveness plan faces a Supreme Court decision. Here's where things stand.

The future of President Biden’s student loan forgiveness program remains in question as the government prepares to defend its legality before the Supreme Court.

Next month, the high court will hear arguments in two federal cases challenging the legality of the debt-relief program. The first case is a lawsuit challenging the plan by a group of six Republican-led states that believe the Department of Education is exceeding its authority. The second is a lawsuit in Texas from two individuals who did not fully qualify for the relief and want to eliminate the entire program.

Last week, the Justice Department argued in its first brief defending the policy before the Supreme Court that the White House’s efforts to absolve many Americans of much or all of their student debt are “reasonable” and “fall squarely within the plain text” of the law.

Meanwhile, Biden’s program will remain on hold, due to a federal injunction, until the legal issues are resolved.

The student debt relief program

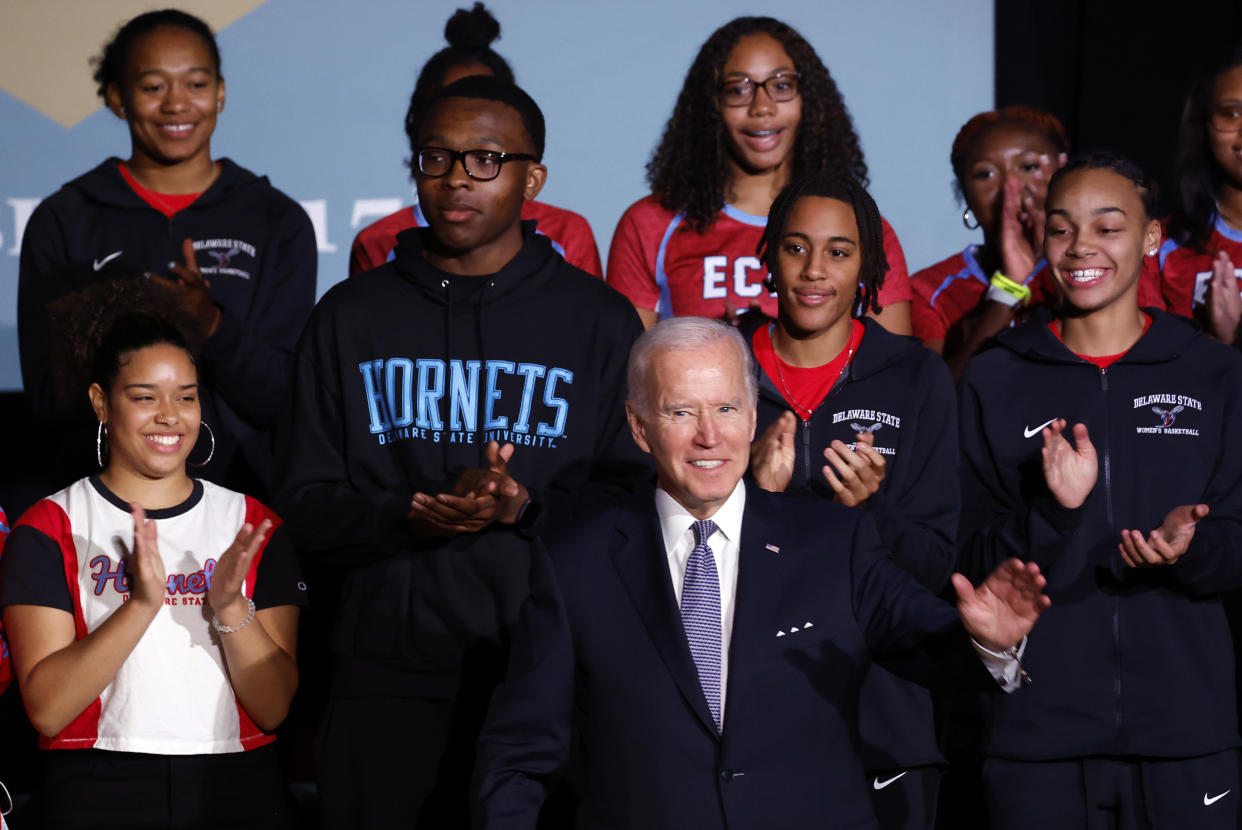

Biden, following through on a campaign promise, announced the debt-relief program on Aug. 24, 2022, pointing to the Higher Education Relief Opportunities for Students (HEROES) Act as the basis for his executive authority to forgive student loans — in particular, a provision that allows the Education Department to waive or modify federal student loan programs in order to ensure that recipients of student financial assistance are not placed in a worse position financially because of a national emergency, such as the coronavirus pandemic.

There is precedent for the use of the HEROES Act in response to the pandemic, said Dan Urman, a law professor at Northeastern University, who pointed to the current pause on student debt payments.

“To be fair — pausing and canceling are not the same thing,” Urman said, “but I would say we’re talking about a degree of difference.”

Legal challenges

On Sept. 29, GOP-led states Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina filed a lawsuit — Biden v. Nebraska — in the Eastern Missouri District Court challenging the debt-relief program.

The states assert that the program represents a violation of the separation of powers and the Administrative Procedure Act — which establishes uniform procedures for rulemaking on the part of federal agencies — arguing that it exceeds the Department of Education’s authority and is arbitrary and capricious.

The Eastern Missouri District Court dismissed the case in October, ruling that the states weren’t able to establish that they had standing — the legal right to sue — and that therefore the court lacked the jurisdiction to hear the case, though it emphasized that the states presented “important and significant challenges” to the debt-relief program and that “standing in no way depends upon the merits of the [states’] contention that the particular conduct is illegal.”

Following a petition to the Eighth Circuit Court of Appeals, however, the states obtained an injunction on the program on Nov. 14, placing the program in limbo, as “the merits of the appeal before [the court] involve substantial questions of law which remain to be resolved.”

A three-judge panel from the Eighth Circuit — two of whom were appointed by Donald Trump and the other by George Bush — found that at least one state, Missouri, does have standing, based on financial harm that would be suffered by the Missouri Higher Education Loan Authority, a federal student loan servicer established by the General Assembly of Missouri that possesses financial connections to the state.

Separately, on Oct. 10, two individuals who did not fully qualify for the debt-relief program filed a lawsuit in the Northern Texas District Court, Department of Education v. Brown, seeking to vacate the program in its entirety.

The individuals, backed by conservative advocacy group the Job Creators Network Foundation, asserted that the White House made arbitrary decisions regarding who would qualify for the debt-relief program and how much of their debt would be relieved.

The plaintiffs argued that they have standing due to their inability to voice their disagreement with the program through a formal notice-and-comment rule-making process required by the Administrative Procedure Act.

Urman questioned this argument, noting that the HEROES Act includes a “very specific waiver of notice and comment procedures.”

On Nov. 10, District Court Judge Mark Pittman — another Trump appointee — issued a decision in favor of the plaintiffs, determining that the debt-relief program was “an unconstitutional exercise of Congress’s legislative power and must be vacated.”

On Dec. 1, the Supreme Court, following a request from Solicitor General Elizabeth Prelogar, agreed to hear the case, though it left in place the hold on the debt-relief program. The high court’s order — just half a page — didn’t provide any reasoning, saying only that it would “establish a briefing schedule that will allow the case to be argued” in February.

In its November decision, the Northern Texas District Court determined that this pausing and canceling are different enough to require clear authorization from Congress — a ruling that Mark Kantrowitz, an expert on student financial aid and student loans, believes poses the largest problem for the White House.

The high court will likely push back on the government’s interpretation of the HEROES Act, Kantrowitz said, “because the HEROES Act does not explicitly authorize forgiveness.”