Air Products (APD) Up 14% in 6 Months: What's Driving the Stock?

Air Products and Chemicals, Inc.’s APD shares have gained 13.6% over the past six months. The company has also outperformed its industry’s decline of 3.2% over the same time frame. It has also topped the S&P 500’s roughly 5.8% decline over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) company.

Image Source: Zacks Investment Research

What’s Aiding APD?

Air Products is benefiting from investments in high-return projects, new business deals, acquisitions and productivity initiatives. It remains committed to its gasification strategy and is executing its growth projects. These projects are expected to be accretive to earnings and cash flows. The company has a total available capacity to deploy (over fiscal 2018-2027) around $35 billion in high-return investments aimed at creating significant shareholder value. It has already spent or committed roughly 73% of the capacity.

The company is also boosting productivity to improve its cost structure. It is seeing the positive impacts of its productivity actions. Benefits from additional productivity and cost improvement programs are likely to support its margins moving ahead. Air Products also has been benefiting from higher pricing. Higher merchant demand is also driving its volumes.

Air Products also remains committed to maximize returns to shareholders leveraging strong balance sheet and cash flows. The company, earlier this year, increased its quarterly dividend by 8% to $1.62 per share from $1.50 per share. This marked the 40th straight year of dividend increase. The company expects to pay more than $1.4 billion of dividend to shareholders in 2022.

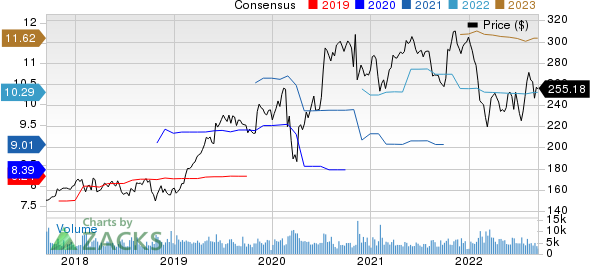

Earnings estimates for Air Products have also been going up over the past two months. The Zacks Consensus Estimate for fiscal 2022 has increased around 0.4%. The consensus estimate for the fourth quarter of fiscal 2022 has also been revised 1.1% upward over the same time frame.

Air Products, on its fiscal third-quarter call, said that it continues to expect fiscal 2022 adjusted earnings per share (EPS) of $10.20-$10.40, indicating 14% growth from the prior-year’s adjusted EPS. For the fourth quarter of fiscal 2022, the company expects adjusted EPS in the range of $2.68-$2.88, suggesting a rise of 7-15% from fourth-quarter fiscal 2021 adjusted EPS.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Daqo New Energy Corp. DQ and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle, sporting a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 425.3% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 63.7% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 61% in a year.

Daqo New Energy, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 177.5% for the current year. The consensus estimate for DQ's earnings for the current year has been revised 9.8% upward in the past 60 days.

Daqo New Energy’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 10.8%. DQ has gained around 4% over a year.

Sociedad has a projected earnings growth rate of 530.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 18.8% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 55% in a year. The company carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research