10 things before the opening bell

Happy Friday, readers. The new inflation data shows prices are still flying high. Plus, we're sharing stock picks with you from Wedbush, and why history suggests it's time to buy the dip.

Let's get started.

If this was forwarded to you, sign up here. Download Insider's app here.

1. Inflation jumped in February at the fastest pace since 1982. The Consumer Price Index rose 7.9% year-over-year last month, according to data released Thursday. That matched the median forecast, and marked a 0.8% gain month-over-month, accelerating from January's 0.6% leap.

Prices of everything — from food to gas to rent — have all soared. The government's gas-price measure leaped 6.6% through the month, a sharp reversal from the 0.8% decline from the previous month.

But if the Fed raises interest rates next week, things could start to cool. The March 16 policy meeting could kick off the first of several tightening moves which could help tame soaring prices. The US central bank is expected to embark this month on its path of higher interest rates by initiating a 25 basis point hike.

Here's what inflation looked like last month:

Food prices edged 1% higher.

Electricity prices fell 1.1% following January's 4.2% surge, and shelter prices gained 0.5%.

Used cars and trucks saw prices drop by 0.2%, after a 1.5% gain the prior month.

Americans are feeling the pressure at the pump — here's why experts say they should "buckle up" for what comes next.

2. Global shares have pared some of their losses. But the MSCI All-World index is heading for a fifth straight weekly loss, as investors weigh up the damage to the economy from Russia's attack on Ukraine and spiraling inflation. Here's the latest on the markets.

3. On the docket: Total Energy, Wework Inc, and Paratek Pharmaceuticals, all reporting.

4. Wedbush recommends investors to buy these six tech stocks with the sector the most oversold it's been since 2015. While technology stocks have tumbled to start 2022, Wedbush's Dan Ives said it's time to buy the dip. Find out why — and see the full list of picks.

5. The world's top 10 hedge-fund managers made a whopping $19 billion in total last year, according to Institutional Investor. Included on the list were Jim Simons, Ray Dalio, and Ken Griffin. See the full wealth breakdown here.

6. History shows that stock market dips caused by geopolitical turmoil should be "bought, not sold," according to Bank of America. The firm's analysts broke down previous market shocks and found that stocks mostly regained losses within three months. The S&P 500 currently is down about 9% since Russia invaded Ukraine — and BofA advises buying the dip.

7. The Dow could be on the verge of a big shakeup following stock splits from Amazon and Alphabet. Both companies are moving forward with a 20-for-1 stock split ,which will reduce their stock price from the thousands to about $140. Here's what that could mean for the Dow Jones Industrial Average.

8. A 27-year-old who saves the majority of his income and said he's financially free shared which books changed his mindset. "Super saver" Avery Heilbron didn't understand investing until he started self-educating on the topic. His two book choices got him started in property investing and financial independence.

9. Forget "stagflation" — a global recession is now almost inevitable, according to prominent market bear Albert Edwards. He said the war is only going to add to spiking inflation, high energy costs, and that the combination will kick off a global recession. With inflation hitting 40-year highs, Edwards thinks it'll go even higher.

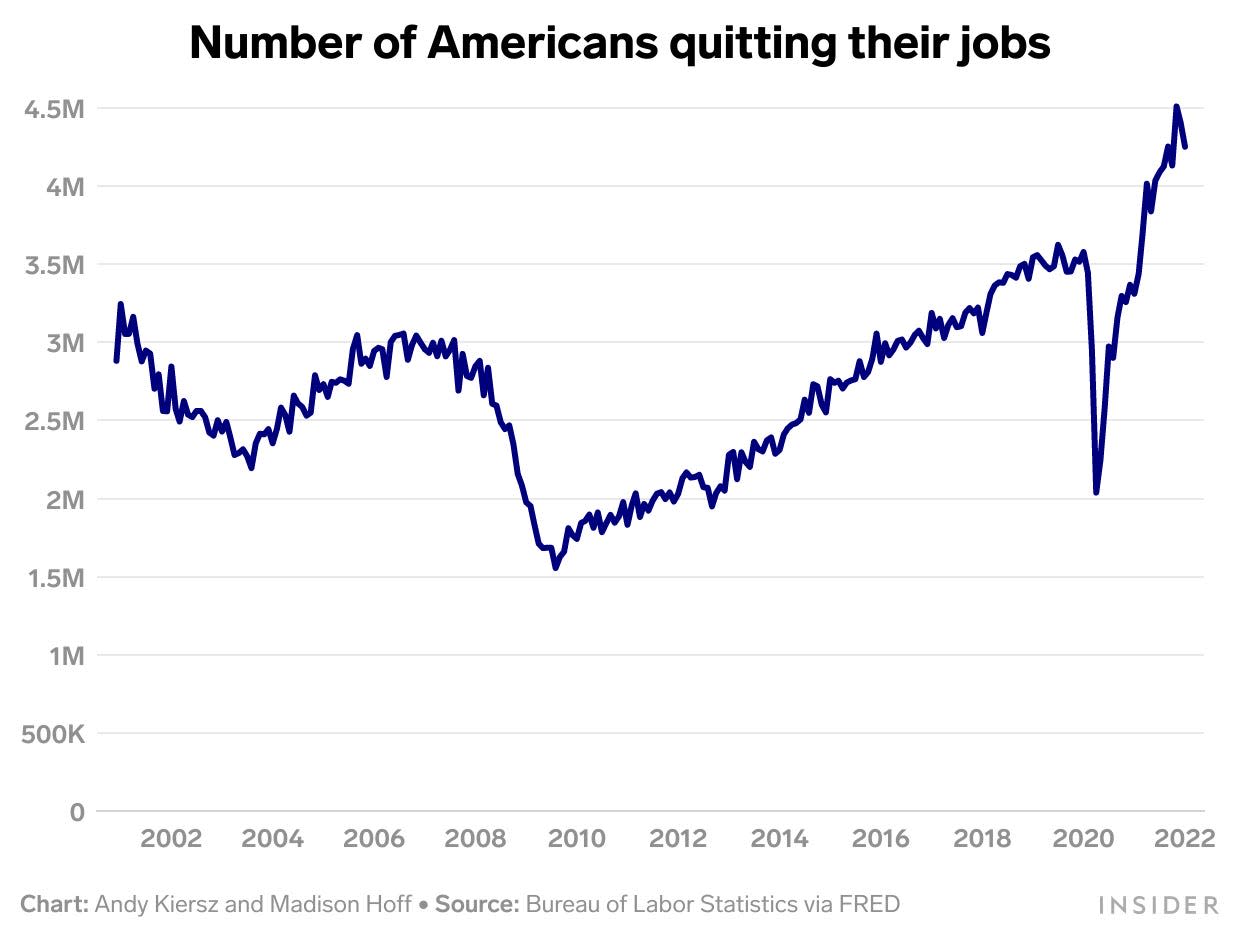

10. More than four million Americans walked out of their jobs in January. The roughly 4.3 million quits marked the eighth straight month that the number hovered near record highs — and they probably won't look normal anytime soon.

Curated by Phil Rosen in New York. (Feedback or tips? Email prosen@insider.com or tweet @philrosenn.)

Read the original article on Business Insider