What Is Net Worth and How Do You Calculate It?

When you hear media reports that a celebrity is “worth” millions or billions of dollars, that worth refers to the individual’s net worth, which is a measure of wealth. Everyone has a net worth, and knowing what yours is gives you a clear picture of your financial health and can help you set goals for the future.

See: How To Build Your Savings From Scratch

What, Exactly, Does Net Worth Mean?

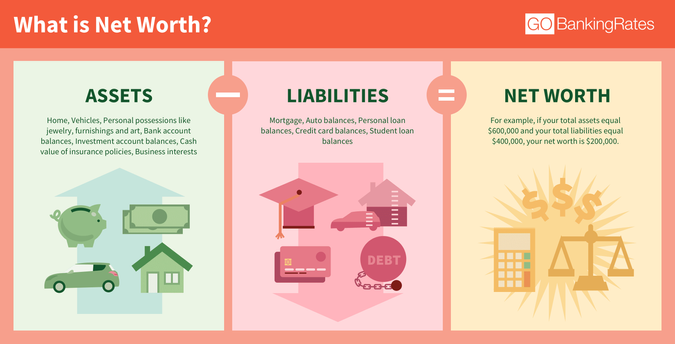

Your net worth is the net value of your assets. You calculate it by subtracting your liabilities from your assets.

What Are Assets?

Assets are everything you own that has value. They add to your net worth.

Assets include cash and cash equivalents such as:

Bank account balances

Investment account balances, including individual retirement and 401(k) balances and the balances of any other brokerage accounts

Cash value of insurance products such as whole life policies and annuities

Material possessions also count as assets. The value of your home, cars, jewelry, household items, sports and hobby equipment and collectibles — basically anything you own that you could sell for cash — all add to your net worth.

What Are Liabilities?

Liabilities are funds you owe, and as such, they reduce your net worth. Credit card balances and the balances owed on your mortgage, car loans, personal loans and student loans are all liabilities. So are rent, taxes, utility bills and other expenses you haven’t yet paid.

Why It’s Important To Know Your Net Worth

Many people use income as a barometer of how they’re doing financially, but outside of the context of debt and other obligations, income can be deceiving. “You could look like you’re worth a million bucks. But in reality, everything you own could be leveraged or have a loan associated with it,” Douglas Boneparth, president and founder of Bone Fide Wealth, told CNBC’s Make It.

Net worth, on the other hand, paints a more complete picture of your wealth because it shows the relationship between income and spending. That information is vital for assessing your financial health as well as for setting goals and following your progress toward reaching them.

How To Calculate Your Net Worth

Calculating your net worth is a three-step process. Although the formula is a simple one, you’ll need the total value of your assets and liabilities to do it.

Net Worth = Assets - Liabilities

For example, if your total assets equal $600,000 and your total liabilities equal $400,000, your net worth is $200,000.

Step 1: Calculate Your Assets

Assets include cash, accounts that hold cash equivalents, and any real estate and personal property you own that could be sold for cash. Here’s how to calculate their value.

List how much cash you have on hand.

List all your bank and investment accounts and their balances. These are some of the types of accounts you might have:

Checking account

Savings accounts, including money market

Certificate of deposit

College savings plan

ABLE account

Pension (vested portion)

Retirement accounts such as IRAs and 401(k)s

Investment accounts

Life insurance and annuities with cash value

Next, list any property you own along with an estimate of each item’s resale value. Include:

Real estate

Vehicles

Boats and recreational vehicles

Jewelry

Antiques

Collectibles

Electronics

Furnishings

Sports and hobby equipment

Tally up the account balances and the value of your property to get your total assets.

Step 2: Calculate Your Liabilities

Liabilities are money you owe, and they include debt and unpaid expenses. Here’s how to calculate them:

List your debts and the amount owed on each. Common debts include:

Credit card balances

Layaway and “buy now, pay later” balances

Loan balances, including:

Mortgage

Home equity, including home equity line of credit

Personal

Auto

Student

Cash owed to family and friends

Next, list your unpaid bills and the amount due on each, including:

Taxes

Medical and dental bills

Utilities

Phone

TV/internet

Household repairs and improvements

Tally up your debts and unpaid bills to get your total liabilities.

Step 3: Subtract Liabilities From Assets

Once you’ve figured out the total value of your assets and the total value of your liabilities, subtract the liabilities from the assets. You’ll see one of three outcomes, as described by the Federal Deposit Insurance Corp.:

Positive net worth: If there’s money left over after you’ve subtracted your liabilities from your assets, you have a positive net worth, meaning you own more than you owe. You can cover all of your liabilities and still have assets to spare.

Zero net worth: If subtracting the liabilities brings the value of your assets to $0, you have zero net worth. That means you have enough assets to cover all of your liabilities, but if forced to do that, you’d have nothing left over.

Negative net worth: If subtracting liabilities from your assets leaves you with a negative number, you have a negative net worth. That means you owe more than you own — in other words, your finances are in the red.

How Can I Increase My Net Worth?

Just two variables affect net worth: assets and liabilities. So increasing your net worth requires increasing your assets and/or reducing your liabilities.

One of the quickest ways to increase net worth is to increase your income and invest the money or use it to purchase assets that increase in value. Working more hours at your current job, if you’re an hourly employee, finding a better-paying job and starting a side hustle are three ways to increase your income.

Keep in mind that retirement accounts make up the largest percentage of assets (36.2%) held by U.S. households, followed by home equity (27.8%) and stocks and mutual funds (8.3%), according to the most recent Census Bureau report on household wealth. Putting extra income toward retirement savings, a home purchase and securities investments could be an effective strategy for increasing your net worth over time.

Another good use of your extra cash is to reduce your liabilities by paying down debt. Credit card debt can be especially damaging to your net worth. Unlike a mortgage loan, which finances an appreciating asset, and student loans for an education likely to result in higher earnings, credit card debt is “bad” debt that typically pays for depreciating assets. So not only do you pay high interest on the items you charge, but you also lose money as the items lose value.

Takeaway

Net worth tends to increase with age, peaking at $326,700 for Americans ages 70 to 74 before dropping off. But you don’t have to wait years or decades for your net worth to grow. Reducing debt while you focus on saving for retirement and investing in securities and homeownership will put your finances in the black faster and provide you with a safety net to ride out unexpected setbacks.

This article originally appeared on GOBankingRates.com: What Is Net Worth and How Do You Calculate It?