Natural catastrophes have caused $260 billion in damage this year

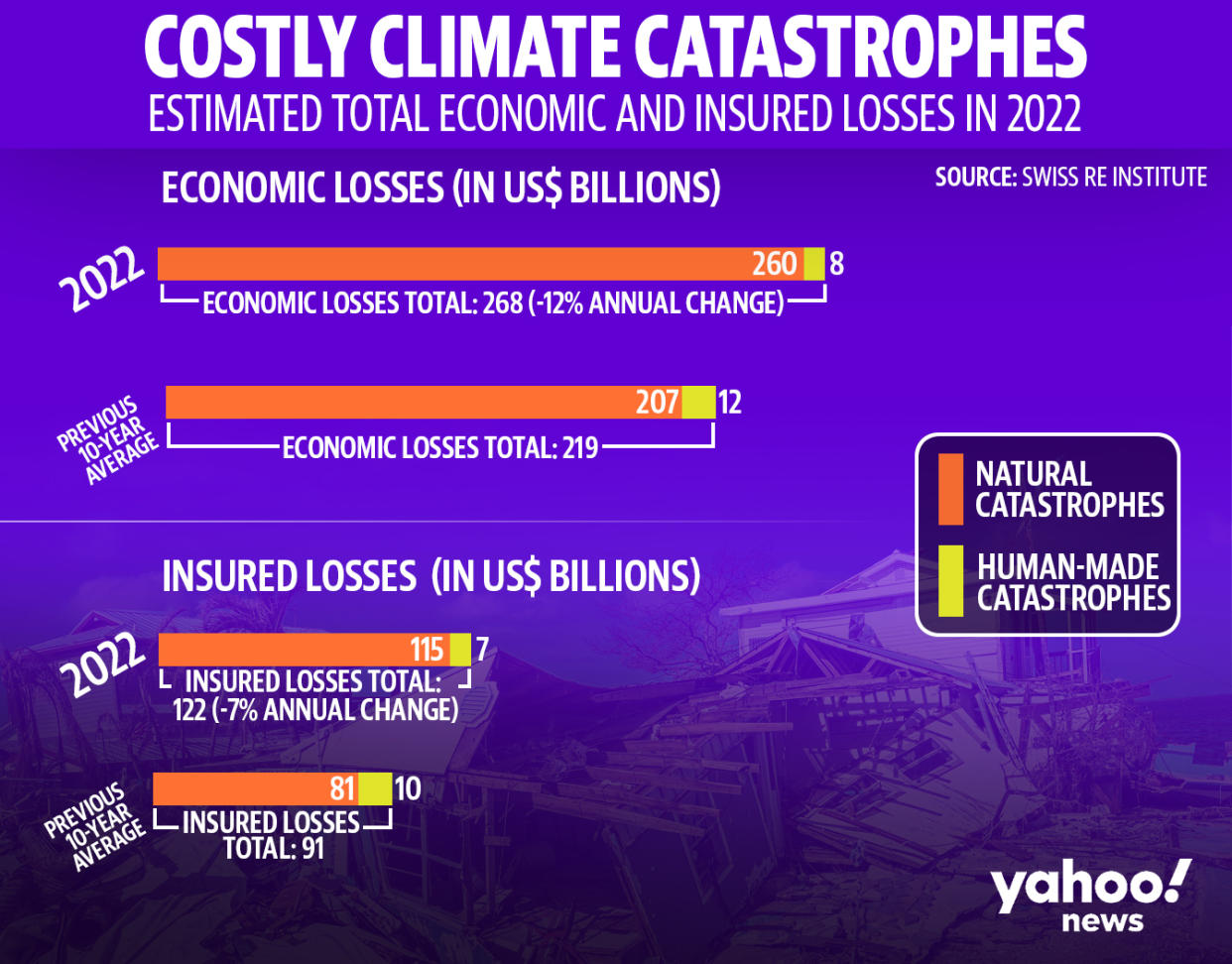

Natural catastrophes including extreme weather events globally have caused an estimated $260 billion in damage so far this year, according to a new study from the Zurich-based reinsurance company Swiss Re. Of those losses, $115 billion were insured, which is 42% higher than the 10-year average of $81 billion in insured losses.

There are several factors influencing that rising cost, including increasing high-end development in vulnerable areas such as oceanfront property and climate change, which is causing more severe heat waves, droughts, hurricanes, rain storms and even tornadoes.

“Extreme weather events have led to high insured losses in 2022, underpinning a risk on the rise and unfolding on every continent,” said Martin Bertogg, head of catastrophe perils at Swiss Re, in the report. “Urban development, wealth accumulation in disaster-prone areas, inflation and climate change are key factors at play, turning extreme weather into ever rising natural catastrophe losses. When Hurricane Andrew struck 30 years ago, a USD 20 billion loss event had never occurred before — now there have been seven such hurricanes in just the past six years.”

The most expensive disaster in 2022 was Hurricane Ian, a Category 4 hurricane that hit Florida’s west coast with a 10-foot storm surge and winds in excess of 140 mph. Swiss Re estimates Ian caused $50 billion to $65 billion in losses, making it the second-most expensive natural disaster for insurers after 2005’s Hurricane Katrina, which devastated Louisiana.

Florida has seen considerable waterfront population growth in recent years, despite being especially vulnerable to rising sea levels, warmer temperatures and the more powerful storms they cause.

This problem for coastal regions is going to get worse as glaciers keep melting. According to the Federal Emergency Management Agency, by the end of this century, climate change will increase the size of U.S. areas with a high flood risk by 55% along U.S. coastlines.

While it is typically strong winds and high storm surges — rather than rainfall — that causes most flooding and other damage in hurricanes, other kinds of storms are growing in severity. By the end of the first week in March, parts of southeastern Australia had already received more than a year’s worth of rainfall. The resulting floods killed 23 people and caused an estimated $4 billion in damages, making it Australia’s most expensive natural disaster to date. Last month, a new series of heavy rains caused flash flooding in the region again.

In one week this summer, three U.S. regions were separately hit with “1-in-1,000-year rains”: Southern Illinois was inundated by 8 to 12 inches of rain in 12 hours, 6 to 10 inches of rain fell in just seven hours in St. Louis, and as much as 14 inches were recorded in eastern Kentucky, causing 39 deaths.

In June, thunderstorms pelted France with large hailstones. The French Insurance Federation estimates that the total insured loss was roughly 4.8 billion Euros ($5 billion) from more than one million claims for the year 2022.

Although the upward trend over time in the frequency and severity of extreme weather events is clear, there are year-to-year variations in cost, due to a variety of factors including how wealthy and populated the areas are where disasters occur. In 2021, natural catastrophes caused $292 billion in damages, including $130 billion in insured losses, so losses actually went down slightly this year.

But the extreme-weather economic damage toll is still way up relative to years before 2021: In 2020, Swiss Re found natural catastrophes caused $190 billion in damage, of which $81 billion was insured. In 2018, those numbers were $133 billion and $50 billion, respectively.

Given that more than half of losses every year are uninsured, there is “a large protection gap across the world,” according to Swiss RE.

The Intergovernmental Panel on Climate Change has noted that the lost economic growth from extreme weather events can far exceed the value of lost property, as businesses may take months to recover — or never do.

The Swiss Re report did not include other costs of dealing with climate change and its resulting extreme weather events, such as the costs to government agencies. A recent report from the Pew Charitable Trusts found that the Department of the Interior and the U.S. Forest Service have nearly doubled their combined spending on wildfire management over the last 10 years.