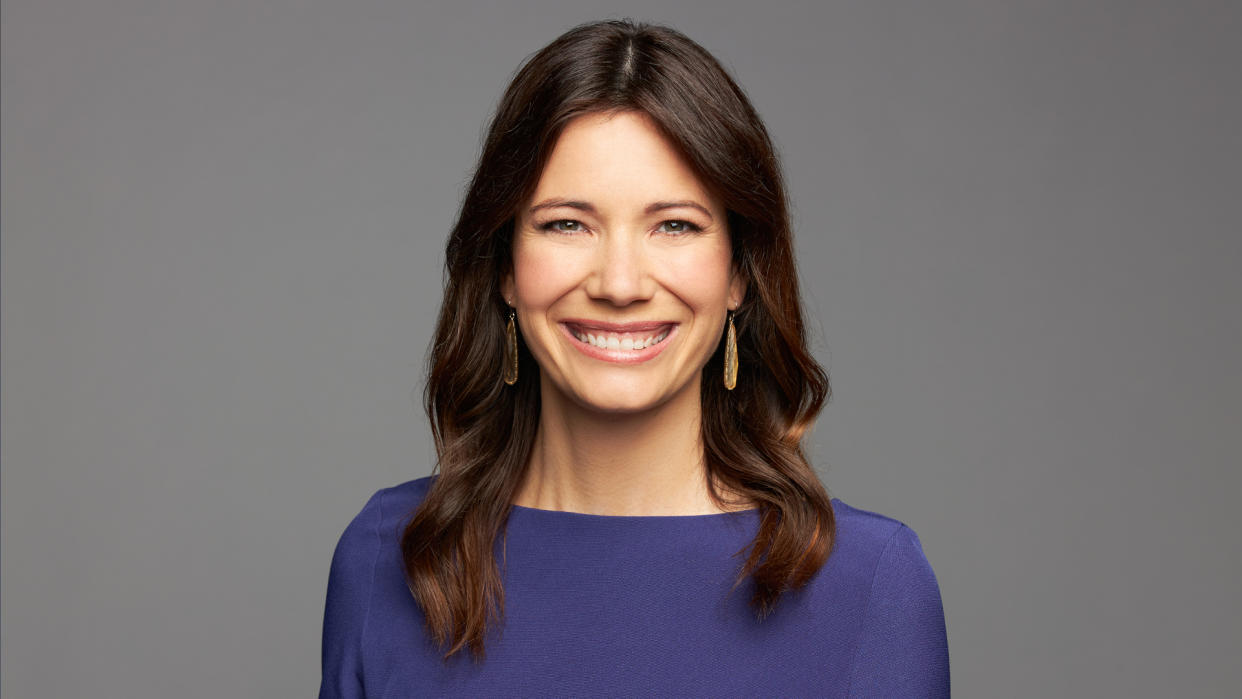

How Much Your Misunderstanding of Money Is Costing You, According to Rachel Cruze

No American can argue the incredible importance of money, and yet, we may not be inquisitive enough about how it all works on a psychological level. Having a tight grasp on the psychology of money — the study of our behavior with money — matters, as Rachel Cruze highlighted in a blog post on Ramsey Solutions. And that understanding is key to our financial success.

Read Next: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

Try This: 4 Genius Things All Wealthy People Do With Their Money

“Success with money isn’t about knowledge, IQ or how good you are at math,” Cruze wrote. “It’s about behavior, and everyone is prone to certain behaviors over others.”

Here’s how your misunderstanding of money could be costing you — and questions to ask yourself to identify your money mindset.

How We Think Affects How We Spend and Save

To not know about the psychology of money is to, in essence, not know about money. It’s a root of misunderstanding that can cost you.

To familiarize yourself with the psychology of money so that you can achieve and maintain financial well-being, consider your own behavioral tendencies with money.

“Everyone is different, and none of these tendencies are right or wrong,” Cruze wrote. “It’s just how you’re naturally wired.”

Cruze then laid out four things she asks readers to identify in their money mindset. Identifying and being aware of these can help you on your way to financial success.

Check Out: I’m a Financial Advisor: Here’s Why My Rich Clients Identify With the Middle Class

Are You a Spender or a Saver?

Are you a spender or a saver? This is important to know when understanding your relationship with money and wealth.

“Spenders can see so many creative possibilities when it comes to money,” Cruze wrote. “This is totally me! Whenever I have extra money, it burns a hole in my pocket, and I can’t wait to spend it.”

Savers don’t think that way.

“A saver’s first instinct is to not spend their money,” Cruze wrote. “They feel much better about having money tucked away. Savers are patient and willing to wait to make a purchase.”

Now, you may be thinking, “Well, duh, savers are doing it better.” But Cruze reasoned that either behavior has a dangerous extreme.

“As a spender, if you spend everything you make, you’re going to be broke,” Cruze wrote. “And savers, if you save everything you make, you’re going to miss out on a lot of fun experiences that bring joy to your life. This is pretty obvious when we think about it — but the point is that we need to think about it.”

Are You a Nerd or a Free Spirit?

Cruze said there are two types of budgeters: nerds and free spirits. Which one are you?

“Nerds thrive on crunching numbers,” Cruze wrote. “They genuinely look forward to organizing their budget. Weirdos. (Just kidding!) It gives them a sense of satisfaction to see where their money is going each month and to find ways to make it work even better. Everything has a nice, neat place, and they love it.”

Free spirits like to shake things up and make things exciting, perhaps even spontaneous.

“Free spirits are … Well, we’re the party!” Cruze said. “We don’t get too bogged down in the details, and that frees us up to enjoy life. If you’re a free spirit, just reading the word budget might make you break out in hives, but the shopping and entertainment categories are basically your love language. Free spirits like to live life to the fullest!”

The nerds and the free spirits could learn from one another to create the balance necessary for financial well-being.

“Nerds need the free spirits to inject some fun money into the budget for nonessential categories, like date nights, vacations and birthday parties,” Cruze wrote. “Free spirits need the nerds to help them make a realistic budget.”

Do You Think More About Safety or Status?

“Are you financially motivated by safety or by status?” Cruze asked. This could be a tougher question to explore.

“For this one, you may have to do some real soul-searching,” Cruze said. “People who value safety want the security that money can bring. They want to know they can withstand job loss, a medical emergency or even just a dip in income.”

This sounds smart, right? Well, it can get a little too extreme and push you into a place of fear, which could be a costly place since it can affect the efficiency of your decision making.

“If you’re a safety person, you need to watch out for living in fear,” Cruze said. “Fear can keep you from giving generously, investing in retirement, or even spending money on a new pair of shoes when the ones you wear every day have a hole in them and clearly need to be replaced.”

People who are motivated by status are thinking more about how their financial lifestyle compares to others’ lifestyles.

“If money is about status for someone, it’s how they measure success,” Cruze said. “The amount of money they have affects the type of home they live in, the activities they’re involved in, and their ability to go on that dream vacation.”

Cruze admitted that she leans toward status.

“On one hand, this just means I like nice things — and please hear me when I say there’s nothing wrong with having nice things if you can afford them,” Cruze said. “But knowing that I have that status tendency means I have to keep my spending in check. I need to remember that the stuff I own doesn’t define me as a person.”

What Was Your Upbringing Like?

Whether we like it or not, our families and our childhoods help shape our behavior with money — and could cause us to lose money.

“The way you heard your parents talk about money — or not talk about it — definitely influenced your attitude about it from an early age,” Cruze said. “This alone won’t define your money mindset, but it’s good to be aware of.”

More From GOBankingRates

I've Secretly Put Us in Serious Debt: How To Break the News to Your Spouse

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: How Much Your Misunderstanding of Money Is Costing You, According to Rachel Cruze