How Much Is Berkshire Hathaway Worth?

Berkshire Hathaway Inc. is a multinational conglomerate headed by investment icon Warren Buffett. The company owns more than 60 businesses, including well-known brands such as Geico auto insurance, battery manufacturer Duracell, Kraft Heinz and Dairy Queen. With so many household names under its ownership, the company can be attractive to various levels of investors.

But name recognition isn’t the only thing that attracts investors to Berkshire Hathaway stock. Save for a few blips, the share price has climbed steadily since December 1984 to become the most expensive stock in the world, thanks in large part to its wildly profitable investment portfolio. Solid management also factors in. Despite a decline in third-quarter 2021 earnings resulting from fluctuations in its investment holdings, Berkshire Hathaway recorded double-digit profits and amassed a record cash pile of $149.2 billion, CNBC reported. That’s after the company spent $7.6 billion repurchasing shares, leaving just 1,493,097 shares outstanding, according to its third-quarter earnings release.

Here are some figures to help you assess the strength of Berkshire Hathaway stock so you have the information you need before you start investing.

About Berkshire Hathaway | |

|---|---|

Headquarters | Omaha, Neb. |

Year Founded | 1955 |

CEO Warren Buffett’s Net Worth | $102.8B |

What Berkshire Hathaway Is Worth | |

|---|---|

Share Price, 52-Week Range | $333,150-$445,000 |

2020 Revenue | $286.26B |

2020 Profit | $42.52B |

GOBankingRates’ Evaluation of Berkshire Hathaway’s Net Worth | $796.24B |

Information on 52-week range is accurate as of Nov. 17, 2021. | |

Berkshire Hathaway’s Market Cap: $632.269B

Market capitalization considers all of a company’s outstanding shares of stock in order to gauge its worth. The higher the cap, the more value investors find with the company. Berkshire Hathaway’s current market cap is $632.269 billion.

Berkshire Hathaway stock has ranged in price from $333,150-$445,000 over the last 52 weeks. Part of the reason the share price is so high compared with other stocks is that the company has never split its stock. A stock split means a corporation increases its number of shares outstanding by dividing them, which in turn lowers the new units’ price. Stock splits don’t alter the overall value of the shares an investor owns; rather, they’re designed to attract new investors with more affordable share prices.

Berkshire Hathaway’s Net Worth: $796.24B

Even though market cap gives you a sense of what the market values a company at, it’s based entirely on market sentiment. Share prices change on a near-constant basis, which offers a less stable view of what the company is worth. GOBankingRates uses a company’s last three years of profit and revenue, along with its liabilities and assets, to calculate its net worth.

Based on Berkshire Hathaway’s revenue and profits from the last three years and its assets and liabilities, the company is worth over $796.24 billion.

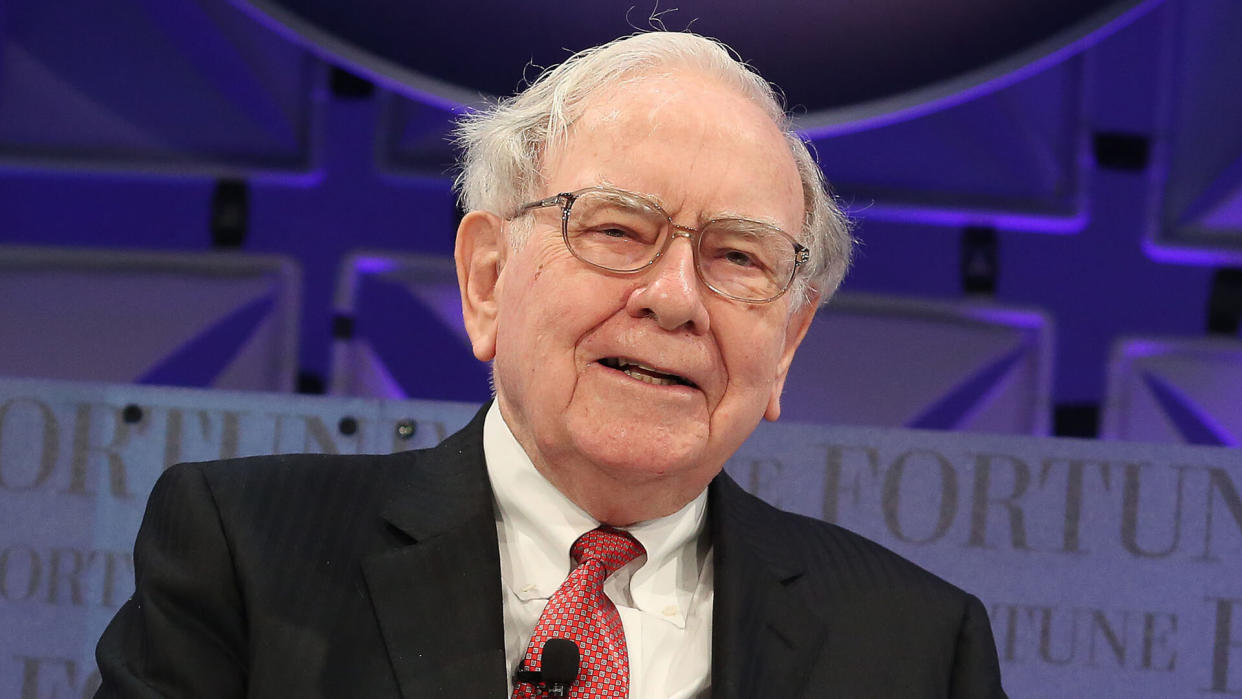

Berkshire Hathaway CEO Warren Buffett

Berkshire Hathaway CEO Warren Buffett is famous in the business world for his investment acumen and advice. He displayed an entrepreneurial spirit in his youth, peddling goods like soda and candy in his neighborhood. He made his first stock purchase at age 11, and at age 14 he filed his first tax return, which totaled $35.

The Oracle of Omaha has committed to giving 99% of his fortune to charity. As of June 2021, he had given away $41 billion, including $4.1 billion worth of Berkshire Hathaway shares that went to charitable foundations, CNBC reported. He has also requested more billionaires give away their wealth and has said he will only leave his children a fraction of his fortune.

Daria Uhlig contributed to the reporting for this article.

Data is accurate as of Nov. 17, 2021, and subject to change. Information on Warren Buffett’s net worth was sourced from Forbes’ Real-Time Billionaires data.

Methodology: The GOBankingRates Evaluation assesses a company’s net worth based on the company’s total assets, total liabilities, and revenue and net income from the last three years. Base value is established by subtracting total liabilities from total assets from the company’s last full fiscal year. Income value is established by taking the average of the revenue from the last three full fiscal years, plus 10 times the average of the net profits from the last three full fiscal years, and then calculating the average of those two figures. The final GOBankingRates Evaluation number is the sum of the base value and the income value.

This article originally appeared on GOBankingRates.com: How Much Is Berkshire Hathaway Worth?