How Much Will a $400,000 Mortgage Cost Me?

The monthly payments on a $400,000 mortgage could range from about $2,300 to more than $3,700, depending on the loan’s interest rate, term, and other factors. But hopeful homebuyers would be wise to consider how much that mortgage could cost over time as well as what the monthly payments might be. Read on for a breakdown of what some of your home-buying costs might be, and how they could affect the total cost of a $400,000 mortgage.

What Will a $400,000 Mortgage Cost?

There are several different costs you may run into when taking out a mortgage. Most of the time, they can be divided into three main categories.

Closing Costs

Closing costs are expenses you’ll pay upfront when you get a loan. They can include things like loan processing fees, third-party services such as appraisals and title insurance, and government fees and taxes. You also may decide to pay mortgage points (also called discount points) upfront on your loan to lower the interest rate. Closing costs can vary significantly from one loan type and lender to the next, but they generally range from 3% to 6% of the mortgage amount.

Monthly Payments

Monthly mortgage payments, which are paid over the life of your loan, typically include two main parts:

Principal: This portion of your mortgage payment goes directly toward paying back the amount you borrowed.

Interest: This is the fee the lender will charge you for borrowing money. The amount of interest you pay each month will be calculated by multiplying your interest rate by your remaining loan balance.

Escrow

Some homebuyers may also have a third amount, called escrow, included in their closing costs and/or monthly payments. Lenders often collect and hold money in an escrow account so they can be sure critical bills like homeowners insurance and property taxes are paid on time. (Curious about the most budget-friendly places to buy? Check out this list of the most affordable cities in each state.)

What Would the Payment Be on a $400,000 Mortgage?

We’ll keep things simple and eliminate the costs associated with an escrow account to calculate what the payment on a $400,000 mortgage’s monthly payments might be.

Let’s say you wanted to purchase a home for $500,000, and you had $100,000 for a down payment. If your lender offered you a 7% annual percentage rate (APR) on a 15-year loan for $400,000, you could expect your monthly payment — principal and interest — to be about $3,595. If you had a 30-year loan with a 7% APR, your payment could be about $2,661.

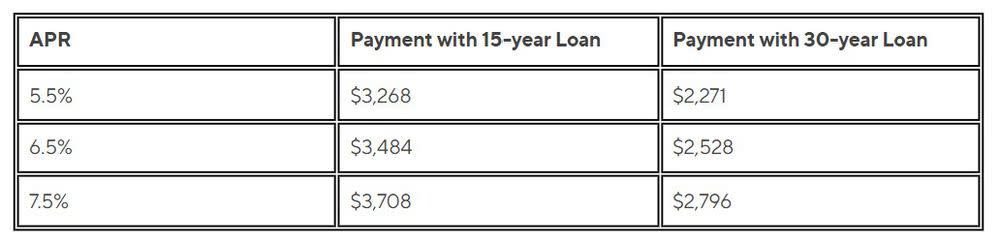

Here are some more examples that show the difference between a 15-year loan vs. a 30-year loan, using SoFi’s Mortgage Calculator:

Where Can You Get a $400,000 Mortgage?

Homebuyers may have a few different options when deciding where to go for a mortgage, including online banks and lenders, and traditional banks and credit unions. Because the rates and terms lenders offer may vary, it can be a good idea to shop around for a mortgage that’s the right fit for your individual needs.

Before you start looking for quotes, though, you may want to sit down and review the different types of mortgages you can qualify for. How would a 15-, 20-, or 30-year mortgage affect your monthly payments? Are you looking for a fixed or adjustable mortgage rate? Would you be better off with a conventional mortgage or a government-backed loan? (Some loans may have more flexible requirements for down payment amounts or a borrower’s credit score.)

Once you start comparison shopping, you can note the pros and cons of various offers and narrow down your choices. You also may want to read some online reviews of the lenders you’re considering.

How Much Interest Will You Pay on a $400,000 Mortgage?

The interest rate your lender offers can make a big difference to the overall cost of your mortgage. So can the mortgage term you choose.

On a $400,000 mortgage at a 7% APR, for example, your total interest costs could range from $247,156 to $558,036, depending on the length of the loan you choose (15 vs. 30 years).

Spreading out your mortgage payments over a longer term can lower your monthly payment, but you can expect to pay more for the loan overall. Your financial circumstances at the time you take out your loan may dictate which is a priority for you. (If you go for a longer loan, and your situation changes, you may decide to refinance your home mortgage to a shorter term down the road.)

How Does Amortization Work on a $400,000 Mortgage?

Though your payment will remain the same every month (if you have a fixed-rate loan), the amount you’ll pay toward interest vs. principal will change over the life of your home loan. In the first years, the majority of your payment will go toward interest. But as your balance goes down, more of your payment will go toward principal.

Your lender can provide you with a mortgage amortization schedule that shows you how the proportions will change as you make payments on your loan.

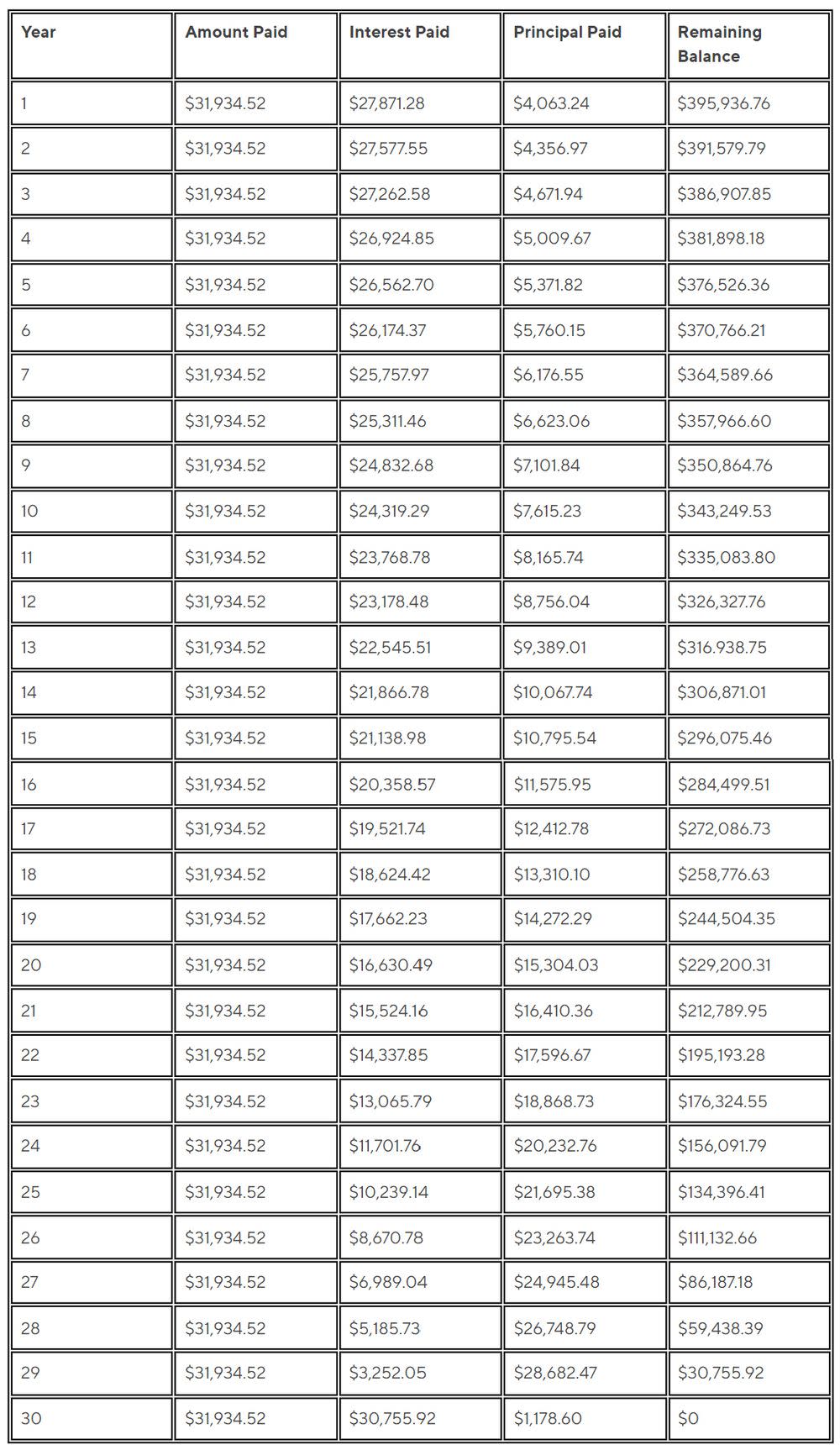

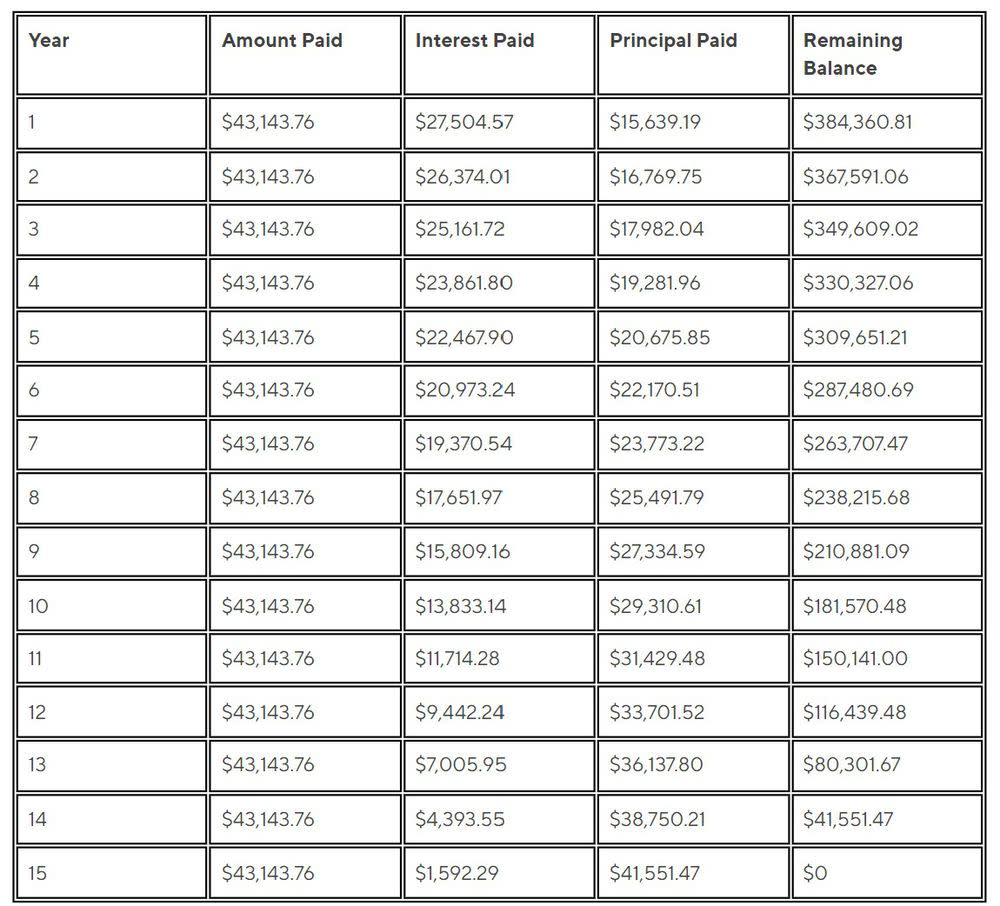

Here’s what the amortization schedules for a $400,000 mortgage with 30- and 15-year terms might look like. (Keep in mind that your payments may include other costs besides principal and interest.)

Amortization Schedule, 30-Year Loan at 7% APR

Amortization Schedule, 15-Year Loan at 7% APR

How to Get a $400,000 Mortgage

If you’re feeling intimidated by the whole home-buying process, breaking it down into some manageable steps may make things a little less overwhelming.

First, Determine What You Can Afford

Reviewing your income, debts, monthly spending, and how much you’ve saved for a down payment can be a good place to start. This will help you decide how much of a down payment you can handle and how much house you can afford.

Compare Different Loans and Lenders

Once you know what you can afford, you can start looking for the loan type, interest rate, loan term, and lender that meet your needs.

Consider Getting Preapproved

If you’ve decided on a loan and lender, it can be a good idea to go through the preapproval process. Getting a letter from your lender that says you’re preapproved for a certain loan amount lets sellers know you’re a serious buyer. (And it can come in handy if you get into a bidding war for your dream home.)

Get Ready to Go House Hunting

When you have your loan lined up, you can look for and potentially make an offer on a house. And since you already know how much you can afford, you can target homes in that range.

Submit a Full Mortgage Application

Once your offer is accepted and you’re ready to move forward, your lender will ask you to complete a more formal loan application and provide additional financial information and documentation.

Prepare for Closing

While you’re waiting for a final loan approval and a closing date, you can shop for homeowners insurance, get a home inspection, and make sure you have all the money you need for your down payment and closing costs.

Take Ownership of Your New Home

At the closing you can sign all the necessary paperwork, hand over the funds needed to make the purchase, and — congratulations! — get the keys to your new home.

The Takeaway

Researching the different costs you might have to pay if you plan to take out a $400,000 mortgage can help you stick to your budget and avoid unpleasant surprises.

The choices you make about the type of loan you get, the interest rate, loan term, and other costs, will all play part in how much you pay every month — and over the length of the loan. So it can be a good idea to run the numbers before you decide on a particular lender or loan.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 Opens A New Window.(Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

+Lock and Look program: Terms and conditions apply. Applies to conventional purchase loans only. Rate will lock for 91 calendar days at the time of preapproval. An executed purchase contract is required within 60 days of your initial rate lock. If current market pricing improves by 0.25 percentage points or more from the original locked rate, you may request your loan officer to review your loan application to determine if you qualify for a one-time float down. SoFi reserves the right to change or terminate this offer at any time with or without notice to you.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

More from MediaFeed:

These States Had The Highest Foreclosure Rates in March

In the ever-evolving landscape of real estate, the U.S. foreclosure market often unveils key trends that will shape the future of home ownership. According to property data provider ATTOM , the number of housing units with foreclosure filings in March was 32,878, a drop of less than 1% from the previous month and a 10% decline from the previous year. Rob Barber, CEO of ATTOM, highlights that this ongoing “persistently hot” housing market is likely due to sizable homeowner equity.

Foreclosure starts increased nationwide by 2%, with notable spikes in states like New Hampshire, Illinois, and Florida. Moreover, while there was a 7% increase in bank repossessions from the previous quarter, there’s a notable 20% decline compared to a year ago, indicating some stabilization in the REO (Real Estate Owned) sector. The average time to foreclose showed a slight increase from the previous quarter, but continues a downward trend observed since mid-2020, with states like Louisiana, Hawaii, and New York having longer foreclosure timelines, contrasting with states like Montana, Virginia, and Texas, which boast shorter timelines. Borrowers should stay up to date on their mortgage payments and work closely with their lenders to explore options for assistance if needed.

Read on for the foreclosure rates in March 2024 – plus the five counties, or county equivalents, with the highest rates within those states.

As previously noted, foreclosure rates saw a negligible drop compared to last month and to last year. Read on for the March foreclosure rates for all 50 states — plus the District of Columbia — beginning with the state that had the lowest rate of foreclosure filings per housing unit.

Related: The safest cities in the US

DepositPhotos.com

Ranking in population between Vermont and Alaska, the country’s second and third least populous states, Washington, D.C. observed 167 foreclosures in March, up about 17% from the previous month. With a total of 350,372 housing units, the foreclosure rate of the nation’s capital was one in every 2,098 households, putting it above the state of Illinois (#1).

In 49th place for population, the Green Mountain State ranked 50th for its foreclosure rate in March. Of the state’s 335,138 housing units, 11 homes went into foreclosure at a rate of one in every 30,467 households. Only four counties in the state saw foreclosures. They were (from highest to lowest): Rutland, Windsor, Washington, and Chittenden.

Listed as 44th in population, the Treasure State rated 49th again for its foreclosure rate this month. With 24 foreclosures out of 517,430 housing units, Montana’s foreclosure rate was one in every 21,560 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Wheatland, Chouteau, Deer Lodge, Richland, and Carbon.

The Mount Rushmore State nabbed the 48th spot once more for its foreclosure rate in March. Having 393,150 total housing units, the fifth-least populous state had a foreclosure rate of one in every 17,870 households with 22 foreclosures. The counties with the most foreclosures per housing unit were (from highest to lowest): Aurora, Codington, Minnehaha, Brown, and Meade.

Ranked 39th in population, the Mountain State claimed the 47th spot for the second month in a row. It has a total of 859,142 housing units, of which 58 went into foreclosure. This means that the foreclosure rate was one in every 14,813 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hancock, Tyler, Fayette, Berkeley, and Cabell.

The 27th most populous state ranked 46th for highest foreclosure rate in March. Of the Pacific Wonderland’s 1,818,599 homes, 124 went into foreclosure, making for a foreclosure rate of one in every 14,666 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Jefferson, Clatsop, Douglas, Clackamas, and Coos.

The Sunflower State ranked 45th for highest foreclosure rate this month. With 1,278,548 homes and a total of 100 housing units going into foreclosure, the 35th most populous state’s foreclosure rate was one in every 12,785 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Morton, Clark, Logan, Kearny, and Bourbon.

The eighth-least populous state placed 44th for highest foreclosure rate in March. A total of 38 homes went into foreclosure out of 483,053 total housing units, making the foreclosure rate for the Ocean State one in every 12,712 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Kent, Bristol, Washington, Providence, and Newport.

The 36th most populous state claimed the 43rd spot for highest foreclosure rate this month. Of the Land of Enchantment’s 943,149 homes, 82 went into foreclosure, making for a foreclosure rate of one in every 11,502 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Chaves, Eddy, Socorro, Lincoln, and Sandoval.

Ranked 34th in population, the Magnolia State experienced 121 foreclosures out of 1,324,992 total housing units. This puts the foreclosure rate at one in every 10,950 homes and into the 42nd spot this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Grenada, Simpson, Union, Copiah, and Lee.

Sorted as 13th in population, the Evergreen State ranked 41st for its foreclosure rate in March. Of its 3,216,243 housing units, 323 went into foreclosure, making the state’s foreclosure rate one in every 9,957 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Pacific, Lewis, Pierce, Cowlitz, and Grays Harbor.

Recommended: Tips on Buying a Foreclosed Home

danlogan

The Granite State, and the 41st most populous state in the U.S., ranked 40th for highest foreclosure rate. New Hampshire saw 66 of its 640,335 homes go into foreclosure, making for a foreclosure rate of one in every 9,702 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Belknap, Coos, Sullivan, Merrimack, and Carroll.

With 326 foreclosures out of 2,734,511 total housing units, America’s Dairyland and the 20th most populous state secured the 39th spot with a foreclosure rate of one in every 8,388 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Juneau, Iron, Rusk, Taylor, and Trempealeau.

The country’s least populous state claimed the 38th spot for highest foreclosure rate this month. With 273,291 housing units, of which 33 went into foreclosure, the Equality State’s foreclosure rate was one in every 8,282 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Carbon, Sweetwater, Campbell, Sublette, and Big Horn.

The Peace Garden State’s foreclosure rate was one in every 8,275 homes. This puts the fourth-least populous state — with 372,376 housing units and 45 foreclosures — into 37th place. The counties with the most foreclosures per housing unit were (from highest to lowest): Pembina, Hettinger, Kidder, Grant, and Bottineau.

Coming in at 19th in population, the Show-Me State took the 36th spot for highest foreclosure rate this month. Of its 2,795,030 homes, 348 went into foreclosure, making for a foreclosure rate of one in every 8,032 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Caldwell, Mississippi, Laclede, Dunklin, and Barry.

With 455 homes going into foreclosure, the 12th most populous state ranked 35th for highest foreclosure rate in March. Having 3,625,285 total housing units, the Old Dominion saw a foreclosure rate of one in every 7,968 households. The counties and independent city with the most foreclosures per housing unit were (from highest to lowest): Franklin City, Lexington City, King And Queen, Dickenson, and Halifax.

The Last Frontier saw 40 foreclosures this month, making the foreclosure rate one in every 7,938 homes. This caused the third-least populous state, with a total of 317,529 housing units, to claim the 34th spot. The boroughs with the most foreclosures per housing unit were (from highest to lowest): Anchorage, Matanuska-Susitna, Kenai Peninsula, Juneau, and Fairbanks North Star.

Ranking 37th in population, the Cornhusker State placed 33rd in March with a foreclosure rate of one in every 7,640 homes. With a total of 848,023 housing units, the state had 111 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Garfield, Nemaha, Scotts Bluff, Webster, and Sherman.

The Paradise of the Pacific, and the 40th most populous state, came in 32nd for highest foreclosure rate. Of its 560,873 homes, 80 went into foreclosure, making for a foreclosure rate of one in every 7,011 households. Only four of the five counties in the state saw foreclosures. They were (from highest to lowest): Hawaii, Kauai, Honolulu, and Maui.

Ranked 16th in population, the Volunteer State endured 442 foreclosures out of its 3,050,850 housing units. This puts the foreclosure rate at one in every 6,902 households and in 31st place for the second month in a row. The counties with the most foreclosures per housing unit were (from highest to lowest): Lake, Hardeman, Houston, Meigs, and Hardin.

Recommended: What Is a Short Sale?

Swarmcatcher

Ranked 10th in population, the Wolverine State secured the 30th spot with a foreclosure rate of one in every 6,706 homes. With a total of 4,580,447 housing units, the state had 683 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Clare, Shiawassee, Gratiot, St. Joseph, and Jackson.

With a total of 1,999,202 housing units, the Bluegrass State saw 301 homes go into foreclosure, thus landing in 29th place in March. This puts the foreclosure rate for the 29th most populous state at one in every 6,642 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Powell, Greenup, Clinton, Bath, and Jefferson.

Ranked 38th in population, the Gem State received the 28th spot due to its 119 housing units that went into foreclosure this month. With 758,877 total housing units, the state’s foreclosure rate was one in every 6,377 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Custer, Bingham, Bonneville, Caribou, and Bonner.

Ranked 22nd for most populous state, the Land of 10,000 Lakes obtained the 27th spot for highest foreclosure rate in March. It has 2,493,956 housing units, of which 396 went into foreclosure, making the state’s foreclosure rate one in every 6,298 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Mille Lacs, Lac Qui Parle, McLeod, Redwood, and Isanti.

The 21st most populous state ranked 26th for highest foreclosure rate this month. Of the Centennial State’s 2,500,095 housing units, 401 went into foreclosure, making for a foreclosure rate of one in every 6,235 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Phillips, Logan, Pueblo, Morgan, and Elbert.

Jacob Boomsma / istockphoto

The Sooners State landed the 25th spot in March. With housing units totaling 1,751,802, the 28th most populous state saw 285 homes go into foreclosure at a rate of one in every 6,147 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Nowata, Caddo, Garfield, Custer, and Murray.

Sorted as 25th in population, the Pelican State placed 24th for highest foreclosure rate this month. Louisiana had a foreclosure rate of one in every 5,747 households, with 362 out of 2,080,371 homes going into foreclosure. The parishes with the most foreclosures per housing unit were (from highest to lowest): Richland, Terrebonne, Plaquemines, Iberville, and West Baton Rouge.

The ninth-most populous state claimed 23rd place for highest foreclosure rate. Out of 4,739,881 homes, 863 went into foreclosure. This puts the Tar Heel State’s foreclosure rate at one in every 5,492 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Perquimans, Gates, Anson, Northampton, and Vance.

Listed as 24th in population, the Yellowhammer State came in 22nd for highest foreclosure rate this month. Of its 2,296,920 homes, 428 went into foreclosure, making for a foreclosure rate of one in every 5,367 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hale, Calhoun, Mobile, Jefferson, and Walker.

Sorted as 14th in population, the Grand Canyon State withstood 596 foreclosures out of its total 3,097,768 housing units. This puts the foreclosure rate at one in every 5,198 homes and into the 21st spot in March. The counties with the most foreclosures per housing unit were (from highest to lowest): Graham, Navajo, Yuma, Pinal, and La Paz.

Recommended: 4 Signs You May Be Ready to Buy

Listed as the 33rd most populous state, the Land of Opportunity ranked 20th for highest foreclosure rate this month. The state contains 1,371,709 housing units, of which 264 went into foreclosure, making its latest foreclosure rate one in every 5,196 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Prairie, Arkansas, Desha, Hot Spring, and Union.

Ranked 42nd in population, the Pine Tree State placed 19th for highest foreclosure rate in March. With a total of 741,803 housing units, Maine saw 143 foreclosures for a foreclosure rate of one in every 5,187 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Aroostook, Androscoggin, Oxford, Waldo, and Penobscot.

Ranked eighth in population, the Peach State took the 18th spot for highest foreclosure rate this month. Of its 4,426,780 homes, 910 were foreclosed on. This puts the state’s foreclosure rate at one in every 4,865 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Lanier, Crawford, Henry, Haralson, and Johnson.

The Beehive State placed 17th for highest foreclosure rate in March. Of its 1,162,654 housing units, 245 homes went into foreclosure, making the 17th most populous state’s foreclosure rate one in every 4,746 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Emery, Tooele, Wasatch, Juab, and Washington.

The Keystone State had the 16th highest foreclosure rate for the second month in a row. The fifth-most populous state saw 1,266 homes out of 5,753,908 total housing units go into foreclosure, making the state’s foreclosure rate one in every 4,545 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Philadelphia, Delaware, Wayne, Fayette, and Bucks.

The Hawkeye State had the 15th highest foreclosure rate in March. With 325 out of 1,417,064 homes going into foreclosure, the 31st most populous state’s foreclosure rate was one in every 4,360 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Audubon, Keokuk, Monroe, Clinton, and Jasper.

The Lone Star State withstood 2,885 foreclosures this month. With a foreclosure rate of one in every 4,040 households, this puts the second-most populous state in the U.S., with a whopping 11,654,971 housing units, into 14th place. The counties with the most foreclosures per housing unit were (from highest to lowest): Liberty, Madison, Atascosa, Jones, and Kaufman.

With 2,144 out of a total 8,494,452 housing units going into foreclosure, the Empire State claimed the 13th spot in March. The fourth-most populous state’s foreclosure rate was one in every 3,962 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Orange, Greene, Suffolk, Nassau, and Rensselaer.

The 15th most populous state ranked 12th for highest foreclosure rate this month. Of the Bay State’s 2,999,314 housing units, 775 went into foreclosure, making for a foreclosure rate of one in every 3,870 homes. The counties with the most foreclosures per housing unit were (from highest to lowest): Hampden, Plymouth, Worcester, Berkshire, and Essex.

The country’s most populous state ranked 11th for highest foreclosure rate in March. Of its impressive 14,424,442 housing units, 3,975 went into foreclosure, making the Golden State’s foreclosure rate one in every 3,629 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Lake, Mendocino, Madera, Kern, and Shasta.

Recommended: Your 2023 Guide to All Things Home

mlauffen

Ranked 32nd in population, the Silver State took the 10th spot for highest foreclosure rate this month. With one in every 3,181 homes going into foreclosure, and a total of 1,288,357 housing units, the state had 405 foreclosure filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Lyon, White Pine, Clark, Lander, and Nye.

The Buckeye State placed ninth in March with a foreclosure rate of one in every 3,167 homes. With a sum of 5,251,209 housing units, the seventh-most populous state had a total of 1,658 filings. The counties with the most foreclosures per housing unit were (from highest to lowest): Knox, Cuyahoga, Shelby, Preble, and Defiance.

The 17th largest state by population, the Crossroads of America landed the eighth spot this month with a foreclosure rate of one in every 3,129 homes. Of its 2,931,710 housing units, 937 went into foreclosure. The counties with the most foreclosures per housing unit were (from highest to lowest): Scott, Perry, Clinton, Howard, and Sullivan.

Ranked 18th for most populous state, America in Miniature took seventh place for highest foreclosure rate in March. With a total of 2,531,075 housing units, of which 815 went into foreclosure, the state’s foreclosure rate was one in every 3,106 households. The counties and independent city with the most foreclosures per housing unit were (from highest to lowest): Kent, Dorchester, Prince George’s County, Baltimore City, and Calvert.

The sixth-least populous state in the country, the Small Wonder nabbed sixth place this month. With one in every 3,051 homes going into foreclosure and a total of 451,556 housing units, the state saw 148 foreclosures filed. Having only three counties in the state, the most foreclosures per housing unit were (from highest to lowest): Kent, New Castle, and Sussex.

The 23rd most populous state had the fifth highest foreclosure rate in March with one in every 2,867 homes going into foreclosure. Of the Palmetto State’s 2,362,253 housing units, 824 were foreclosed on this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Fairfield, Hampton, Dorchester, Darlington, and Spartanburg.

The third-most populous state in the country has a total of 9,915,957 housing units, of which 3,568 went into foreclosure. This puts the Sunshine State’s foreclosure rate at one in every 2,779 homes and into fourth place this month. The counties with the most foreclosures per housing unit were (from highest to lowest): Hernando, Citrus, Wakulla, Osceola, and Charlotte.

With a foreclosure rate of one in every 2,638 homes, the Garden State ranked third for highest foreclosure rate this month. The 11th most populous state contains 3,756,340 housing units, of which 1,424 went into foreclosure. The counties with the most foreclosures per housing unit were (from highest to lowest): Cumberland, Warren, Sussex, Salem, and Atlantic.

With 587 of its 1,531,332 homes going into foreclosure, the Constitution State had the second highest foreclosure rate at one in every 2,609 households. In this 29th most populous state, the counties that had the most foreclosures per housing unit were (from highest to lowest): Windham, New Haven, New London, Tolland, and Fairfield.

The Land of Lincoln had the highest foreclosure rate in all 50 states in March. Of its 5,427,357 homes, 2,130 went into foreclosure, making the sixth-most populous state’s foreclosure rate one in every 2,548 households. The counties with the most foreclosures per housing unit were (from highest to lowest): Gallatin, Jasper, Whiteside, Schuyler, and Massac.

Of all 50 states, California had the most foreclosure filings (3,975), and Vermont had the least (11). As for the states with the highest foreclosure rates, Illinois, Connecticut, and New Jersey took the top three spots, respectively.

Two regions – the Great Lakes and the Mideast – tied for having the largest presence among the 10 states that ranked the highest for foreclosure rates. The states in the Great Lakes region were (from highest to lowest): Illinois, Indiana, and Ohio. The states in the Mideast region were (from highest to lowest): New Jersey, Delaware, and Maryland.

Four regions – the Far West, Southeast, Plains, and New England – tied for having the largest presence among the 10 states that ranked the lowest for foreclosure rates. The states in the Far West region were (from highest to lowest): Washington and Oregon. The states in the Southeast region were (from highest to lowest): Mississippi and West Virginia. The states in the Plains region were (from highest to lowest): Kansas and South Dakota. Finally, the states in the New England region were (from highest to lowest): Rhode Island and Vermont.

Learn More:

This article originally appeared on SoFi.comand was syndicated by MediaFeed.org.

SoFi Loan Products

SoFi loans are originated by SoFi Lending Corp. or an affiliate (dba SoFi), a lender licensed by the Department of Financial Protection and Innovation under the California Financing Law, license # 6054612; NMLS # 1121636. For additional product-specific legal and licensing information, see our disclosures.

SoFi Home Loans

Terms, conditions, and state restrictions apply. SoFi Home Loans are not available in all states. See our criteria for more information.

External Websites: The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.